Table of Contents >> Show >> Hide

- Why Life Insurance Matters Even If You Don’t Earn a Paycheck

- The 9 Biggest Reasons Stay-at-Home Parents Need Life Insurance

- 1. Your “Unpaid” Job Would Be Very Expensive to Replace

- 2. It Keeps the Family Home and Household Bills on Track

- 3. It Buys the Working Partner Time to Grieve, Not Just Grind

- 4. It Protects Your Kids’ Routines and Emotional Stability

- 5. It Helps Replace Future Income You Planned to Earn

- 6. It Supports Long-Term Goals Like College and Big Dreams

- 7. It Can Ease the Burden on Extended Family

- 8. It’s Often Much More Affordable Than People Think

- 9. It Brings Peace of Mind and a Sense of Equality

- How Much Life Insurance Should a Stay-at-Home Parent Consider?

- What Type of Policy Usually Makes Sense?

- Practical Steps to Get Started

- Experiences and Scenarios: How Life Insurance Changes the Story

- Final Thoughts: Your Role MattersProtect It

If you’re a stay-at-home parent, you’ve probably heard some version of, “Why would you need life insurance? You don’t even bring home a paycheck.”

Translation: “I have never tried to do childcare, laundry, cooking, cleaning, organizing, appointment-scheduling, school-email-reading, and emotion-coaching in the same day.”

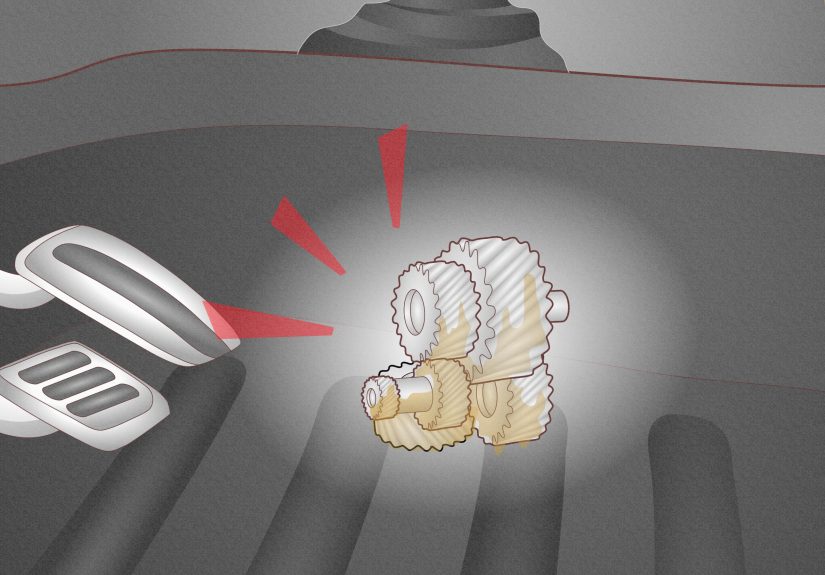

The truth is, stay-at-home parents are the engine that keeps the family machine running. And if that engine suddenly isn’t there, the financial impact can be enormous.

That’s exactly why life insurance isn’t just for the partner with the W-2 income. It’s a key part of protecting your kids, your home, and your spouse’s future.

Why Life Insurance Matters Even If You Don’t Earn a Paycheck

Life insurance is often described as “income replacement.” But for stay-at-home parents, it’s better to think of it as “work replacement.”

Research has shown that if you paid for everything a stay-at-home parent doeschildcare, driving, cooking, housecleaning, tutoring, scheduling, and moreit would cost thousands of dollars per month to outsource those tasks. In some analyses, that unpaid labor is valued at well over $4,000–$5,000 a month depending on where you live and how many kids you have.

That’s not just a “nice to have” contribution. It’s the difference between your partner being able to keep their job and sanity… or having to cut back hours, change careers,

or lean heavily on family and paid help if the worst were to happen.

The 9 Biggest Reasons Stay-at-Home Parents Need Life Insurance

1. Your “Unpaid” Job Would Be Very Expensive to Replace

Let’s start with the obvious: kids are adorable, but they’re also expensive. If a stay-at-home parent dies, the surviving spouse will probably need to pay for:

- Full-time or part-time childcare

- Transportation to school, daycare, and activities

- Housecleaning and laundry help

- Meal prep or takeout (because grief + cooking is a tough combo)

- Organizing schedules, appointments, and school logistics

Depending on your location, full-time childcare alone can easily cost more than a mortgage payment. Add housekeeping, extra convenience food, and transportation, and you’re talking tens of thousands of dollars per year. A life insurance payout creates a pool of money your partner can use to hire help and keep life as stable as possible for the kids.

2. It Keeps the Family Home and Household Bills on Track

Even if the working partner earns enough to “cover everything on paper,” real life after a loss doesn’t go according to spreadsheet. They may need to:

- Cut back hours or take time off work

- Pay extra for childcare with odd hours or backup coverage

- Cover therapy bills for themselves and the kids

- Take unpaid leave to attend to legal and practical matters

A life insurance policy for the stay-at-home parent gives the family breathing room so the surviving spouse doesn’t have to choose between paying the mortgage and paying for someone to watch the kids. It can help cover:

- Mortgage or rent

- Utilities and essential household bills

- Groceries and everyday living costs

- Existing debts like car loans or credit cards

Keeping a roof over everyone’s head and the lights on is a huge part of financial securityand that’s what life insurance is designed to protect.

3. It Buys the Working Partner Time to Grieve, Not Just Grind

Grief doesn’t care about PTO limits.

Without life insurance, the surviving spouse may have to rush back to work almost immediately, even while juggling new caregiving logistics alone. With a decent life insurance payout, they have the option to:

- Take a leave of absence or temporarily reduce their hours

- Slow down career moves without derailing long-term goals

- Be more present for the kids during a traumatic time

Money can’t fix grief, but it can give your partner the space to process it without being in constant financial panic mode.

4. It Protects Your Kids’ Routines and Emotional Stability

When kids lose a parent, one of the healthiest things for them is stabilityfamiliar schools, neighborhoods, routines, and faces. A sudden forced move, a change of schools, or a drastic shift in lifestyle can compound their emotional stress.

Life insurance for a stay-at-home parent can help:

- Keep kids in the same school or daycare

- Maintain their regular sports, clubs, and activities

- Pay for extra emotional support, like counseling

- Avoid major, immediate lifestyle changes

You can’t control everything your kids might face in life, but you can give them financial protection that supports their emotional well-being.

5. It Helps Replace Future Income You Planned to Earn

Many stay-at-home parents don’t plan to be out of the workforce forever. They may intend to return to work once the kids are in school full time or after certain family milestones. In that case, your future income is part of your family’s financial planeven if it hasn’t started yet.

A well-designed life insurance policy can reflect not only the cost of your current unpaid work, but also the income you were likely to earn later. That might include:

- New income from going back to your previous career

- Income from retraining or starting a business

- Extra savings or retirement contributions you would have made

If you’re a stay-at-home parent now but not forever, that future value mattersand life insurance recognizes it.

6. It Supports Long-Term Goals Like College and Big Dreams

Most parents have long-term hopes for their kids: college, trade school, launching a business, traveling, or at least not moving into your basement forever.

Life insurance can help protect those big dreams. A portion of the death benefit could be earmarked for:

- College tuition, room, and board

- Vocational or technical training

- Future milestones like first-car savings, study-abroad programs, or starting a business

Even if the primary earner has coverage, adding a policy for the stay-at-home parent can increase the total safety net for long-term goalsespecially if they were planning to contribute future earnings toward education or savings.

7. It Can Ease the Burden on Extended Family

Without adequate life insurance, the financial fallout often spills onto grandparents, aunts, uncles, and close friends. They might:

- Help cover childcare or after-school care

- Pitch in for school expenses, clothing, or medical bills

- Become part-time or even full-time caregivers

While family support is invaluable, most people don’t want their loved ones to be financially strained because of their absence. A life insurance policy for the stay-at-home parent helps ensure that support can be about love and timenot money and stress.

8. It’s Often Much More Affordable Than People Think

One of the biggest misconceptions about life insurance is that it’s wildly expensive. In reality, a healthy, non-smoking adult in their 20s, 30s, or early 40s can often get a substantial term life policy (think hundreds of thousands of dollars in coverage) for the cost of a few streaming subscriptions per month, depending on their health and specific insurer.

Term life insurancecoverage that lasts for a fixed period such as 10, 20, or 30 yearsis usually the go-to option for families with young children. It’s designed to cover the years when your kids are most financially dependent, and premiums are typically much lower than for permanent policies.

Your actual cost will depend on factors like age, health history, lifestyle, and coverage amount, so it’s important to get personalized quotes. But in many cases, protecting your family costs significantly less than people expect.

9. It Brings Peace of Mind and a Sense of Equality

Many stay-at-home parents quietly worry, “If something happened to me, would my family be okay?” Life insurance is a way to answer that with a more confident “yes.”

It also sends an important message inside the relationship: both parents’ roles are financially significant. Insuring both partnerswhether or not they earn incomeacknowledges that the stay-at-home parent’s work is essential and deserves protection.

That peace of mind isn’t just financial; it’s emotional validation that what you do every day truly matters.

How Much Life Insurance Should a Stay-at-Home Parent Consider?

There’s no one-size-fits-all number, but several common guidelines can help you think about coverage:

- Replacement-cost approach: Estimate how much it would cost per year to replace your work (childcare, housekeeping, transportation, etc.), then multiply by the number of years you’d want that support available. For example, if replacement costs are $30,000 per year and you want coverage for 10–15 years, you might be looking at $300,000–$450,000 in coverage.

- Income-matching approach: Some insurers allow coverage up to the amount of the breadwinning partner’s income or policy size for a stay-at-home spouse. This is another way to keep overall protection balanced.

- General ranges: Many financial professionals suggest coverage for stay-at-home parents in the few-hundred-thousand-dollar range, adjusted for the family’s location, number of children, and long-term goals.

Ultimately, you’ll want to discuss your specific situation with a licensed insurance professional or financial planner. They can help you weigh:

- How long your kids will be financially dependent

- Existing savings and employer benefits

- Your mortgage, debts, and long-term goals

- What support systems (family, community) are realistically available

Think of your coverage amount as a tool: not to make anyone “wealthy,” but to keep your family out of crisis.

What Type of Policy Usually Makes Sense?

Term Life Insurance: Simple and Budget-Friendly

For most stay-at-home parents, term life insurance is the most practical choice. Here’s why:

- It covers a specific time frameoften 10, 20, or 30 yearswhen kids are most dependent.

- It typically offers the highest death benefit for the lowest premium.

- It’s straightforward: if you die during the term, your beneficiaries receive the death benefit.

A common approach is to choose a term that lasts until your youngest child is financially independent (for example, into their early- to mid-20s), and then build additional savings and retirement funds for later life.

Permanent Life Insurance: When You Might Need Lifetime Coverage

Some families consider permanent life insurance (such as whole or universal life), which:

- Provides coverage for your entire life as long as premiums are paid

- Builds cash value that can grow over time

It’s generally more expensive than term coverage, so it’s usually best for more specific needssuch as long-term care for dependents with disabilities or estate-planning goals. For most young families, term life is often the starting point, and permanent coverage may be layered in later if needed.

Joint vs. Separate Policies

Some insurers offer joint policies that cover both parents, but many experts recommend separate policies for each adult instead. Separate policies:

- Provide a death benefit for each parent’s passing

- Offer more flexibility if your circumstances change (divorce, career shifts, etc.)

The key takeaway: the stay-at-home parent should have their own policy, not just rely on coverage tied to the working partner’s job.

Practical Steps to Get Started

- Write down everything you do in a week. Include childcare hours, driving, cooking, cleaning, organizing, and emotional/administrative work for the household.

- Put rough price tags on those tasks. Look up local childcare rates, housekeeping costs, and other services to estimate a realistic replacement cost.

- Decide how long you’d want coverage. Often this means until your youngest child is out of the house or financially independent.

- Use those numbers to ballpark a coverage amount. This could be a few hundred thousand dollars or more, depending on your family’s needs.

- Get quotes from multiple insurers or an independent agent. They can help you compare options, terms, and riders (like disability or critical illness riders on the breadwinner’s policy).

- Review your policy regularly. As your kids grow, debts change, and life evolves, make sure your coverage still fits.

Experiences and Scenarios: How Life Insurance Changes the Story

To bring all of this down to earth, imagine three families. These are composite scenarios based on common real-life situations, not any one specific familybut they illustrate how life insurance for stay-at-home parents can make a huge difference.

Mia’s Story: A Modest Policy, a Massive Relief

Mia is a stay-at-home mom with two young kids. Her husband, Derek, works full time and earns a comfortable income. They’re not wealthy, but with careful budgeting, they manage their mortgage, daycare for their preschooler a few mornings a week, and some savings.

At the suggestion of a friend, they buy a 20-year term life policy for Mia with a $350,000 death benefit. The premium is low enough that it feels like just another utility bill.

A few years later, tragedy strikes. Mia dies unexpectedly from a medical complication. Derek is devastatedand terrified about raising two kids alone. But because they had that policy, Derek can:

- Take several months off work without worrying about missing mortgage payments

- Hire a nanny and a housecleaner a few days a week

- Pay for therapy for himself and the kids

- Keep the kids in their home, school, and neighborhood

The policy doesn’t erase their grief, but it keeps grief from turning into a financial emergency. That’s the real job of life insurance.

Jordan and Alex: When Only One Parent Is Insured

Jordan and Alex have a toddler and a baby. Alex stays home with the kids; Jordan works full time. They’re diligent about money and make sure Jordan has a big term life policy through an individual plan plus some coverage at work. But they skip insuring Alex because “there’s no income to replace.”

When Alex dies suddenly in a car accident, the family has no policy on the person who ran the household. Jordan’s income still comes in, but the reality hits quickly:

- Childcare for two young kids is nearly as much as their rent

- The house is constantly chaotic, so they pay for cleaning help when they can

- Jordan can’t realistically keep working late or traveling for work

Jordan ends up switching to a lower-paying job with fewer hours just to be available for the kids. Between the pay cut and the new childcare costs, money gets extremely tight. A policy on Alex wouldn’t have solved everything, but it could have provided a buffer to smooth that brutal transition.

Grandma Rosa: When Extended Family Becomes the Safety Net

In another family, a stay-at-home dad named Luis dies from a sudden illness, leaving behind his wife, Elena, and their three children. Elena works part time in retail and doesn’t have a lot of financial flexibility. There was no life insurance on Luis.

Without savings or a death benefit, they:

- Move in with Elena’s mother, Rosa, to share expenses

- Rely on family members for childcare so Elena can add shifts

- Put off car repairs and cut back on kids’ activities to make ends meet

Rosa loves helping, but she also ends up dipping into her own retirement savings to cover emergencies. The entire extended family feels the financial strain.

A reasonably sized life insurance policy for Luis wouldn’t have eliminated all hardshipbut it might have allowed Elena and the kids to stay in their home, maintain a more normal routine, and avoid placing so much pressure on Rosa’s limited retirement income.

These scenarios share a theme: the stay-at-home parent’s contribution is massive, and when it’s not protected, the ripple effects are huge. Life insurance doesn’t just protect “income”; it protects the invisible work that holds families together.

Final Thoughts: Your Role MattersProtect It

Stay-at-home parents are often the quiet MVPs of family life. You may not collect a paycheck, but your work absolutely has financial valueand emotional value that can’t be measured.

Life insurance is one of the most practical ways to honor that value. It:

- Helps replace the services you provide every day

- Supports your kids’ stability and long-term goals

- Gives your partner time and space to grieve

- Prevents extended family from being stretched too thin

- Provides peace of mind that your family will be protected if the unthinkable happens

If you’re a stay-at-home parent, you are not “extra.” You are essential. And essential things deserve to be protected.

The next step is simple: talk with a licensed insurance professional or financial advisor, run the numbers for your specific situation, and put a plan in place. You’ll probably sleep a little better knowing that, whatever happens, you did everything you could to safeguard your family’s future.

SEO META (JSON)