Table of Contents >> Show >> Hide

- How Credit Card Issuers Decide: The Big Picture

- Common Reasons a Credit Card Application Is Denied

- 1. Your Credit Score Is Too Low for That Card

- 2. You Have Little or No Credit History (a “Thin File”)

- 3. Your Income Isn’t High Enough (or Your Debt Is Too High)

- 4. High Credit Utilization (You’re Using Too Much of What You Have)

- 5. Late Payments, Collections, or Bankruptcies

- 6. Too Many Recent Credit Applications (Hard Inquiries)

- 7. Errors or Suspicious Items on Your Credit Report

- 8. You Don’t Meet the Issuer’s Internal Policies

- 9. Potential Fraud or Identity Mismatch

- What That Denial Letter Actually Tells You

- How to Improve Your Chances Next Time

- Real-World Experiences: What Denials Feel Like (and What People Learned)

- The Bottom Line

You click “submit,” imagine yourself swiping a shiny new rewards card, and then

boomyour credit card application is denied. Not exactly the victory

screen you were hoping for. The good news? A denial isn’t the end of your credit story,

and it’s rarely random. Issuers use a pretty predictable set of rules to decide who gets

approved and who doesn’t.

In this guide, we’ll break down the most common reasons a credit card application is

denied, what those reasons actually mean in plain English, and how you can improve

your odds next time. Think of it as translating “lender language” into normal human

languagewith a little humor to soften the blow.

How Credit Card Issuers Decide: The Big Picture

When you apply for a credit card in the United States, the issuer doesn’t just roll

dice in a back room. They look at a handful of key factors:

- Your credit scores and overall credit history

- Your income and debt-to-income ratio

- How much debt you’re already carrying and using

- Recent applications for credit (those “hard inquiries”)

- Internal rules and risk policies specific to that bank

- Potential red flags like fraud, identity issues, or credit report errors

Each card has its own approval criteria. A premium travel card that comes with a big

welcome bonus usually expects stronger credit than a starter or secured card. So a

denial doesn’t always mean you’re “bad with money”sometimes it just means you aimed

at the wrong tier of card for where your credit profile is right now.

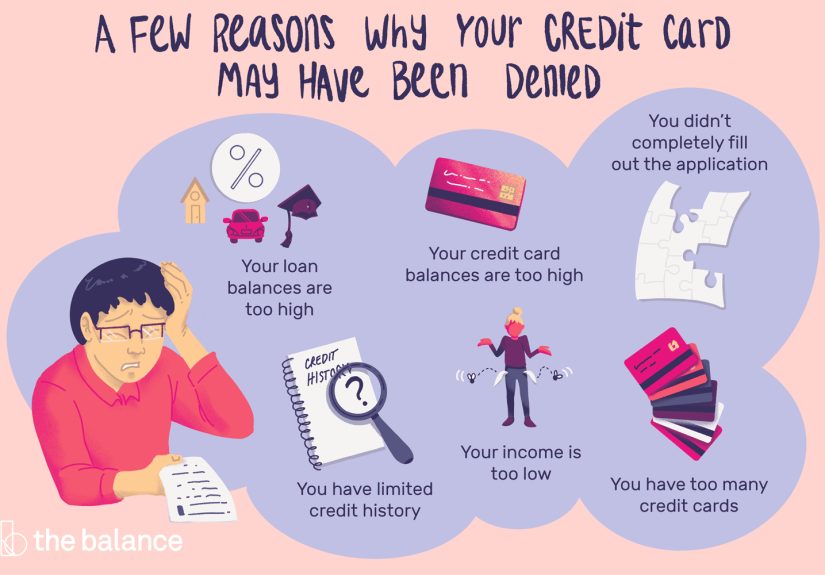

Common Reasons a Credit Card Application Is Denied

1. Your Credit Score Is Too Low for That Card

This is one of the most common reasons for denial. Many popular rewards cards

unofficially expect at least “good” creditoften a FICO® Score in the high 600s or

above. If your score is lower, the issuer may worry that you’re more likely to miss

payments or default.

Credit scores are largely built from five factors:

- Payment history (on-time vs. late or missed payments)

- Amounts owed (how much of your available credit you use)

- Length of credit history (how long you’ve had accounts)

- New credit (recent applications and accounts)

- Credit mix (cards, loans, etc.)

If you’ve had late payments, high balances, or accounts sent to collections, your

score may still be recoveringeven if you’ve been “good” recently. A denial can be

the issuer’s way of saying, “We’d like to see more stability first.”

2. You Have Little or No Credit History (a “Thin File”)

Ironically, you can also be denied because you haven’t borrowed much at all. If you’re

new to credit or you’ve only had one small account, the issuer doesn’t have enough

data to predict how you’ll handle a bigger line of credit. This is called having a

thin credit file.

In that case, a basic unsecured rewards card might be a stretch. Instead, you might

need to start with:

- A secured credit card (you put down a deposit as collateral)

- A beginner or “student” card

- Being added as an authorized user on a trusted person’s card

Use those starter options responsibly for 6–12 months, and your odds for better cards

later go way up.

3. Your Income Isn’t High Enough (or Your Debt Is Too High)

Issuers don’t just care how much you earn; they care how much of it is already spoken

for. That’s where your debt-to-income ratio (DTI) comes in. DTI

compares your monthly debt payments (credit cards, loans, etc.) to your monthly gross

income.

As a simple example, if you earn $4,000 before taxes and pay $1,200 per month toward

debt, your DTI is 30%. Generally, the lower the ratio, the more comfortable lenders

feel. If you’re carrying auto loans, student loans, personal loans, and multiple card

balances, a new card can start to look risky from their perspective.

You might be denied if:

- Your reported income is relatively low for the credit line you’re requesting.

- Your existing monthly payments already eat up a big chunk of your income.

- You recently took on new debt (like a car or personal loan).

4. High Credit Utilization (You’re Using Too Much of What You Have)

Credit utilization is the percentage of your available revolving

credit you’re currently using. If you have $10,000 in total credit limits and

$5,000 in balances, you’re at 50% utilization.

Many experts suggest staying under about 30% overall, and lower is even better. If

your utilization is highsay, 70–90% or moreissuers may worry that:

- You’re leaning on credit to cover everyday expenses.

- You might be one unexpected bill away from missing payments.

In that scenario, they may decide that adding another line of credit increases their

risk instead of helping you.

5. Late Payments, Collections, or Bankruptcies

Payment history is one of the strongest predictors of future behavior. Late payments,

charge-offs, accounts in collections, or past bankruptcies can all trigger denials,

especially with more premium cards.

Even if your score looks okay now, these negative marks can remain on your credit

reports for years. A lender may see them and think, “We’ll pass for now,” particularly

if the negative events are recent. As they age and you build a clean track record,

they hurt you less.

6. Too Many Recent Credit Applications (Hard Inquiries)

Every time you apply for most credit cards, the issuer pulls your credit reports with

a hard inquiry. A small number of hard inquiries is normal. But if

issuers see a bunch of applications in a short period, it can look like you’re

desperate for credit or actively churning cards just for bonuses.

Some banks even have internal rules (for example, limiting the number of new accounts

you can have in 24 months) that can lead to automatic denialseven with good scores.

So if you’ve been on an application spree, that alone might explain the “no.”

7. Errors or Suspicious Items on Your Credit Report

Sometimes your application is finebut your credit report is not. Errors can include:

- Accounts that don’t belong to you

- Incorrect balances or limits

- Duplicate accounts

- Outdated negative information that should have fallen off

In more serious cases, fraud or identity theft can result in accounts and inquiries

you never authorized. If an issuer sees confusing or inconsistent data, they may

simply choose the safer option and deny the application.

Checking your credit reports regularly and disputing errors with the credit bureaus

can help prevent this kind of denialand protect you from actual fraud.

8. You Don’t Meet the Issuer’s Internal Policies

Not all reasons for denial show up as obvious red flags to you. Each issuer has

internal rules that can include things like:

- Minimum age and residency requirements

- Maximum number of that bank’s cards you can hold

- How recently you were approved for another card with them

- Existing relationship history (good or bad) with the bank

You might have solid credit and still be denied because you already have several

cards with the same bank or recently closed one after taking a big welcome bonus.

From their standpoint, policy is policyeven if it’s frustratingly opaque from yours.

9. Potential Fraud or Identity Mismatch

Issuers are extremely cautious about identity theft. If your application information

doesn’t match what they have on file, or if they detect unusual patterns (like a

brand-new address plus a flurry of new applications), they may decline as a

precaution.

Simple things like:

- Typos in your Social Security number or address

- A recently changed phone number

- Freezes or fraud alerts on your credit reports

can trigger extra verification or an outright denial. Often, calling the issuer,

verifying your identity, or unfreezing your credit temporarily can resolve this

for future applications.

What That Denial Letter Actually Tells You

If your credit card application is denied, you’re generally entitled to receive an

adverse action notice. That letter or email will outline the key

reasons the issuer used to make its decisionthings like “high balances on revolving

accounts” or “insufficient credit history.”

This notice is more than paperwork. It’s your roadmap. The reasons listed are

essentially a to-do list of what to work on if you want better odds next time. You

can also use the notice to request a free copy of the credit report the issuer used,

then review it for accuracy and areas to improve.

One important note: being denied doesn’t directly damage your credit score. The

application itself triggers the hard inquiry, which may cause a small,

temporary drop. But the actual “no” from the issuer doesn’t show up as a negative

mark on your credit reports.

How to Improve Your Chances Next Time

1. Match the Card to Your Current Credit Profile

Before applying again, take an honest look at your credit situation. If your scores

are fair or you’re rebuilding after past issues, aim for:

- Starter cash-back cards built for fair credit

- Secured credit cards that report to all three bureaus

- Cards specifically marketed to students or newcomers

Many issuers and comparison sites provide estimated score ranges for each card.

Use those as a guide so you’re not repeatedly applying for cards that are out of

reach for now.

2. Lower Your Balances and Credit Utilization

Paying down existing credit card debt can pull several levers at once:

- It reduces your credit utilization ratio.

- It may improve your credit scores.

- It lowers your monthly obligations, improving your DTI.

Even dropping utilization from, say, 70% to 40% can make a noticeable difference.

If you can’t pay everything off at once, target the cards with the highest interest

rates first while still making minimum payments on others.

3. Give It Time Between Applications

If you’ve applied for multiple cards in a short span, easing off the gas is smart.

Space out applications by at least several months, especially if you were just

denied. This gives your score time to recover from hard inquiries and lets positive

habits (like on-time payments and lower balances) show up on your credit reports.

4. Build or Rebuild With the Right Tools

If thin or damaged credit is the issue, think of the next 6–12 months as a training

phase. You might:

- Use a secured card with a reasonable deposit.

- Set up autopay for at least the minimum on every account.

- Keep spending modestjust enough to show regular, responsible use.

Over time, those small, boring moves are what actually build credit strength.

There’s no magic “hack,” just consistent good behavior.

5. Check Your Credit Reports for Errors

Make it a habit to review your credit reports from the major bureaus. If you see

something that’s wronglike a duplicate account, an incorrect late payment, or an

account that isn’t yoursdispute it. Correcting errors can quickly improve your

overall profile and reduce the chance of being denied for reasons that aren’t

your fault.

Real-World Experiences: What Denials Feel Like (and What People Learned)

A denial notice can feel personal, but almost everyone who uses credit long enough

runs into one at some point. Here are some common “storylines” that play out in

real lifeand the lessons hiding inside them.

Story 1: “Great Income, Good Score… Still Denied?”

Imagine Alex, who earns a solid salary, always pays on time, and has a good credit

score. They apply for a premium travel card and get denied. After reading the

adverse action notice, Alex learns the bank didn’t like the fact that they had

opened several new cards in the last year and were using most of their available

credit.

The lesson: issuers look at your behavior right now, not just your income

or long-term track record. Taking on multiple new accounts and carrying big balances

at the same time can be enough to tip the scales toward “no”even if your score

looks fine on paper.

Story 2: “New to Credit and Hitting a Wall”

Then there’s Jordan, who just graduated, landed a first job, and decided it was

time for a rewards card. The application is denied with a reason code like

“insufficient credit history.” Jordan has never missed a paymentbecause there

were barely any accounts to begin with.

Frustrated, Jordan shifts strategy: opens a secured card with a modest deposit,

uses it for gas and groceries, and pays it off each month. After a year, that

one small account has created a solid payment history and improved the credit

profile. When Jordan applies againthis time for a mid-level cash-back cardthe

application is approved.

The lesson: sometimes you’re not doing anything “wrong.” You just need more

time and data on your record before issuers feel comfortable extending more

credit.

Story 3: “Something Feels Off”

Finally, picture Taylor, who has strong credit scores, low balances, and a stable

job. A denial feels totally out of left field. The adverse action notice mentions

“serious delinquencies,” which doesn’t match Taylor’s memory at all.

Curious (and a little alarmed), Taylor pulls all three credit reports and discovers

accounts opened in another state with late payments and collections. It turns out

Taylor is a victim of identity theft. After filing disputes, placing fraud alerts,

and working with the bureaus to clean up the reports, Taylor’s future applications

stand a much better chance.

The lesson: a confusing denial can be a warning sign, not just a rejection. If the

reason code doesn’t make sense, dig deeper. You might uncover errorsor fraudthat

need urgent attention.

Emotional Side Notes and Practical Takeaways

Beyond the numbers, credit denials come with feelings: embarrassment, frustration,

even a bit of shame. It’s easy to think, “I’m bad with money” or “I’ll never get

approved.” But in reality, lenders are making risk-based decisions using formulas

and policies. Your financial identity is not defined by one decision from one bank.

What separates people who bounce back from those who stay stuck isn’t luckit’s

how they respond:

- They read the denial notice carefully instead of ignoring it.

- They pull their credit reports and look for patterns or problems.

- They pick one or two improvement goals (like paying down a specific card or

avoiding new applications for six months) and stick to them. - They choose cards that match their current situation rather than the fanciest

card on the internet.

Over time, these realistic, boring moves are what turn “denied” into “approved.”

And if it makes you feel better, even people who know a lot about credit sometimes

get denied. The key is to treat each “no” as data, not as a permanent verdict.

The Bottom Line

A denied credit card application is frustrating, but it’s also feedback. The issuer

is telling you something about how your current credit profile looks from their

perspective. Common issues include low or limited credit history, high utilization,

too much existing debt, recent negative marks, or simply conflicting with the

bank’s internal rules.

Your job now is to use that information. Read the denial notice, check your credit

reports, and decide on a few practical stepslike lowering balances, giving it time

between applications, or starting with a more accessible card. With some patience

and a plan, “Denied” can turn into “Approved” sooner than you think.

And remember: this article is for general education, not personalized financial

advice. For big decisions or complex situations, consider talking with a qualified

financial professional or nonprofit credit counselor who can look at your full

picture.