Table of Contents >> Show >> Hide

- First: What Are FounderLine and SaaStr, and Why Does This Video Matter?

- The Video’s Big Theme: Traction Isn’t a Feeling

- Product-Market Fit: The Traction Multiplier (and the Great Pretender)

- Good vs. Great: The Gap Is Usually Retention

- Can You Build a Great SaaS Company Outside the Bay Area?

- The Playbook Behind the Talk: Repeatable GTM Beats Heroic Founder Hustle

- How to Watch “SaaStr on FounderLine” Like a Workshop

- A 2026 Add-On: What’s Changed Since the Video (and What Hasn’t)

- Field Notes: of Founder Experiences After Watching “SaaStr on FounderLine (Video)”

- Conclusion

Some startup videos age like milk. This one ages like a good hot sauce: it’s still spicy, it still goes with

everything, and it still makes you question your life choices (in a productive way).

SaaStr on FounderLine (Video) captures a 60-minute-plus conversation about “All Things SaaS,”

with the kind of founder-and-investor Q&A that doesn’t waste time on fluffy buzzwords. The topics are the

ones founders keep re-learning the hard way: what counts as traction, whether you really need to be in

the Bay Area to build something big, and what separates “good” from “great” in a subscription business.

This article breaks down the key themes of the video, then upgrades them with modern SaaS benchmarks and

practical examplesso you can watch the episode like it’s a workshop, not background noise while you

reorganize your Notion templates for the 14th time.

First: What Are FounderLine and SaaStr, and Why Does This Video Matter?

FounderLine is a live weekly webcast format built around founder questions. That structure is

why the conversation works: it’s not a polished keynoteit’s real founders asking the real “wait… but how do I…?”

questions.

SaaStr (founded by Jason Lemkin) is one of the most well-known SaaS communities and content hubs,

focused on the messy middle between “we have a product” and “we have repeatable growth.” The FounderLine episode

is valuable because it sits right at that inflection point. It’s essentially a guided tour through the mental

models founders need before they scale sales, raise a bigger round, or convince themselves that vanity metrics

are “early traction.”

The Video’s Big Theme: Traction Isn’t a Feeling

Founders love the word “traction” because it sounds like progress without requiring proof. But in SaaS, traction

is not a vibe. It’s evidenceideally the kind that repeats next month without heroic effort from the CEO.

A Simple Traction Ladder (Use the Rung You’re Actually On)

One reason traction conversations get heated is that founders compare different stages like they’re the same sport.

They’re not. A seed-stage company and a Series A-stage company can both be “growing,” but the evidence investors

expect is different.

-

Problem traction: Prospects talk about the pain without you coaching them. Discovery calls sound

like therapy sessions (for your customer), not a product demo script. -

Solution traction: People use the product in a way that indicates real valuerepeat usage,

time-to-value is shrinking, and you’re seeing consistent activation. -

Revenue traction: Customers pay real money, renew, and (ideally) expand. Discounts aren’t doing

the heavy lifting. -

Go-to-market traction: The pipeline refills, deals move through stages in a predictable way,

and one rep can repeat what the founder did without requiring founder telepathy.

“Counts as Traction” Depends on Your Motion (SMB vs. Mid-Market vs. Enterprise)

In SaaS, the same metric can mean totally different things depending on who you sell to.

Example: If you sell a $99/month self-serve product, “traction” might look like a clean conversion

funnel, fast payback on acquisition, and low logo churn. If you sell $50k–$250k ACV enterprise contracts, traction

might look like a handful of lighthouse customers, strong renewals, expanding usage inside accounts, and a sales

cycle that doesn’t require ritual sacrifices.

The point isn’t to obsess over one universal metric. The point is to pick the right proof for your stage

and motionand stop hiding behind numbers that make you feel better but don’t make the business better.

Product-Market Fit: The Traction Multiplier (and the Great Pretender)

Many founders claim product-market fit when what they really have is “a few customers who are being polite.”

Real PMF shows up in behavior: demand validation, retention, organic pull, and improving unit economics.

A helpful mental model is to treat PMF as the moment your growth starts straining your systems

and the business still makes economic sense. It’s not “we built something customers want.” It’s “customers

keep showing up, keep paying, and keep staying.”

Practical PMF Signals (That Don’t Require Mind Reading)

- Retention improves by cohort as onboarding, product, and positioning get sharper.

- Sales cycles shorten because the value is obvious earlier.

- Expansion becomes normal (more seats, more modules, higher usage-based spend).

- Referral and inbound increase because customers talk about you unprompted.

- CAC vs. LTV math stops being tragic and starts being repeatable.

If you want a brutally honest check: ask whether adding more sales and marketing spend would scale growth

or just pour water into a leaky bucket. Which brings us to the next big idea.

Good vs. Great: The Gap Is Usually Retention

The difference between a good SaaS company and a great one is often visible in a single family of metrics:

retention and expansion. In modern SaaS language, that’s where Net Revenue Retention (NRR) enters

the chat.

NRR in Plain English

NRR measures how much revenue you keep and grow from existing customers after accounting for downgrades and churn.

If NRR is over 100%, you can grow even before adding brand-new customersbecause your current customers expand.

Many operators also track Gross Revenue Retention (GRR), which excludes expansion and focuses

on how well you hold onto what you already sold. GRR is the “are customers quietly leaving?” metric. NRR is the

“are customers staying and buying more?” metric. Great companies tend to care about both, because expansion

doesn’t fully compensate for a business that leaks trust.

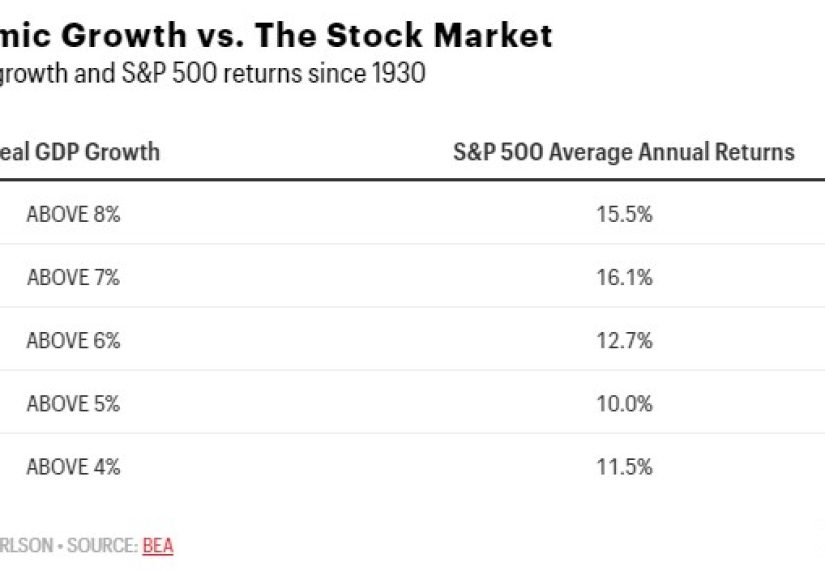

Benchmarks That Give You a Reality Check

Benchmarks vary by segment, but a useful shorthand is:

NRR ~100% is good, 110% is better, and 120%+ is best-in-class

for many SaaS categories. The exact “great” number depends on your customer type and pricing model, but the logic

holds: greatness shows up when customers stick and grow.

If you’re not there yet, don’t panicuse it as a diagnosis tool:

- Low GRR: You’re losing customers (often onboarding, product fit, or expectation-setting).

- OK GRR but low NRR: Customers stay but don’t expand (packaging, pricing, value ladder).

- High NRR but shaky GRR: Expansion may be masking churn (watch logo retention carefully).

Can You Build a Great SaaS Company Outside the Bay Area?

This question is evergreenand it’s also emotionally loaded. Founders worry that geography decides destiny:

fewer investors nearby, fewer “startup people,” fewer coffee meetings with someone who says “let’s jam.”

The more practical way to frame it is: Where do your customers live, where does talent live, and where does

your company run best? SaaS is software delivered over the internet. Customers often don’t care whether

your HQ is in San Francisco or Boise. They care whether your product solves the problem and whether your team shows

up with competence and urgency.

Why “Not the Bay” Can Be a Feature, Not a Bug

- Closer to the customer: If your buyers are in healthcare, manufacturing, logistics, education,

or finance, being near industry hubs can beat being near trendy startup brunch. - Talent arbitrage: You can hire experienced operators who prefer stability, lower cost-of-living,

or simply don’t want to live inside a $7 latte economy. - Focus: Fewer distractions can mean more buildingand in early stage, building wins.

The real constraint is rarely geography. It’s whether you can consistently create customer value, prove it in metrics,

and tell the story clearly enough that capital and talent want to join.

The Playbook Behind the Talk: Repeatable GTM Beats Heroic Founder Hustle

Founder-led sales is often necessary at the beginning. But the goal is not to become the world’s most exhausted

closer. The goal is to create a go-to-market engine that works when you’re not personally running every demo.

Sales + Marketing Alignment: The Pipeline Doesn’t Fix Itself

In early SaaS, marketing can’t be “brand vibes” and sales can’t be “I’ll figure it out.” Alignment matters because

it determines whether leads turn into revenue or turn into a spreadsheet of sadness. The best teams define stages,

define SLAs, and agree on what a qualified lead actually isbefore the pipeline gets big enough to hide dysfunction.

Unit Economics: The Math That Keeps Founders Honest

It’s tempting to chase growth without asking whether it’s sustainable. But investors and operators increasingly

look at unit economics as a sanity check.

A classic lens is LTV:CAC (lifetime value vs. customer acquisition cost). It’s not a magic number,

but it forces clarity: are you buying customers profitably, and can you repeat it? Many investors use rough

benchmarks (like 3x over a multi-year window) to gauge whether the engine is healthy.

Another practical metric is CAC payback period: how long it takes to earn back what you spent to

acquire a customer. Faster payback generally means you can reinvest more aggressively without lighting runway on fire.

How to Watch “SaaStr on FounderLine” Like a Workshop

If you just watch the video straight through, you’ll get inspired… and then go back to Slack and forget half of it.

Try this instead: watch it in sections and turn the ideas into decisions.

Pause Point #1: Define Your Current Traction Proof

- What do we want traction to mean in the next 90 days?

- What evidence would convince a skeptical investor (or a skeptical future me)?

- Which metric are we currently using as a comfort blanket?

Pause Point #2: Measure the Leak Before You Pour More Water

- What is our churn (logo and revenue) by cohort?

- What is our NRR/GRR, and what are the drivers (onboarding, product gaps, pricing)?

- If we doubled acquisition spend, would we growor just churn faster?

Pause Point #3: Make GTM Repeatable

- Can a new rep repeat our best close without founder rescue?

- Are sales stages defined, and do deals move through them with predictable timing?

- Do marketing and sales agree on what “qualified” means?

A 2026 Add-On: What’s Changed Since the Video (and What Hasn’t)

A lot has changed in SaaSAI is everywhere, buyers are more cost-sensitive, and “efficient growth” has become a

boardroom love language. But the core truths from this FounderLine conversation still hold:

- Traction still needs proof. The format of proof changes by motion, not by hype cycle.

- Retention still drives durability. Greatness still looks like customers who stay and expand.

- GTM still needs repeatability. Founder heroics are a phase, not a business model.

- Geography still isn’t destiny. Customer value beats zip codes.

If anything, today’s environment rewards founders who can articulate these fundamentals with clarityand then run

the company like the fundamentals actually matter.

Field Notes: of Founder Experiences After Watching “SaaStr on FounderLine (Video)”

Here’s what many founders experience after watching this kind of conversationespecially if they watch it with a

notebook instead of a snack.

1) The “traction hangover.” The first reaction is often a weird mix of motivation and discomfort.

Motivation, because you finally hear someone define traction without poetry. Discomfort, because you realize your

current definition of traction is… “people said they liked the demo.” That hangover is useful. It pushes founders

to replace soft signals with hard ones: paid commitments, renewal behavior, usage that repeats, pipelines that refill.

2) The retention gut punch. Founders who are growing often discover a sneaky truth: growth can hide

churn for a while. You can be closing new customers every month and still be standing on a trapdoor if cohorts fade

quickly. When founders start tracking GRR/NRR consistently, it changes product decisions overnight. Suddenly,

onboarding is no longer “nice to have.” It’s the thing that decides whether customers stick long enough to expand.

Customer success stops being a “later” department and starts being a revenue driver.

3) The “we don’t need to move” relief. Founders outside major startup hubs often carry quiet anxiety

that they’re playing on hard mode. Watching a direct discussion about building great SaaS companies outside the Bay

Area can be clarifying: you don’t win by relocating your ZIP codeyou win by building a business with repeatable

value, clear positioning, and credible metrics. Many founders channel that relief into focus: fewer distractions,

tighter customer loops, and a stronger operator mindset.

4) The pipeline reality check. Early-stage teams often confuse activity with progress: lots of calls,

lots of “interest,” lots of “let’s circle back.” FounderLine-style Q&A tends to trigger a better habit: define

stages, define exit criteria, and measure conversion between stages. Founders begin to ask sharper questions:

Are we losing deals because of pricing, trust, missing features, or unclear ROI? Are we targeting the right buyer?

Are we building a repeatable motionor just surviving on founder charisma?

5) The “operator upgrade.” The biggest experience is subtle: founders shift from storytelling to

operating. Instead of pitching the dream, they build the scoreboard. They set weekly metrics reviews, implement

cohort retention tracking, and turn qualitative feedback into product priorities. They also get better at saying

“not yet” to premature scaling. Hiring ahead of traction is temptingbecause it feels like progress. But after you

internalize the difference between “good” and “great,” you start treating durability as the real milestone:

customers who stay, expand, and happily complain when you ship a bug because they actually use the product.

That’s the real value of watching SaaStr on FounderLine today. It doesn’t just teach conceptsit nudges

founders toward a more adult version of building: evidence over excitement, retention over vanity, and repeatability

over heroics.

Conclusion

SaaStr on FounderLine (Video) is a compact masterclass in SaaS fundamentals: traction that can be

proven, growth that doesn’t leak, and the mindset shift from founder hustle to repeatable execution. If you’re

pre-Series A, it can help you define what “real progress” looks like. If you’re post-Series A, it’s a useful mirror:

are you building something durable, or just moving fast?

Watch it for the insightsbut more importantly, use it to build your scoreboard. Because in SaaS, the scoreboard

eventually collects the truth… whether you track it or not.