Table of Contents >> Show >> Hide

- Why People Change Life Insurance (and Why That’s Not Automatically Bad)

- The “Replacement Trap”: What You Can Lose When You Switch

- 1) You may restart the clock on important policy protections

- 2) You may be older (and insurance is not known for getting cheaper with age)

- 3) You may trigger surrender charges or lose accumulated value

- 4) You might lose benefits your current policy quietly includes

- 5) A new policy might not get approved the way you assume

- Before You Switch: The Non-Negotiable Checklist

- Smart Alternatives to Replacing Your Policy

- When Replacing Life Insurance Actually Makes Sense

- The Questions You Should Ask Before You Sign Anything

- Bottom Line: Change Life Insurance Slowly, Carefully, and On Purpose

- Real-World “Switch” Experiences: What People Often Learn the Hard Way (and How You Can Learn It the Easy Way)

- Experience 1: The “cheaper premium” that wasn’t cheaper

- Experience 2: The replacement that quietly reset the clock

- Experience 3: The cash-value surprise (also known as “Where did my money go?”)

- Experience 4: The health curveball during underwriting

- Experience 5: The smarter move that didn’t require replacement

Switching life insurance can feel like upgrading your phone plan: you see a shiny new offer, you’re told it’s “basically the same but cheaper,” and suddenly you’re one signature away from

accidentally deleting the financial safety net your family depends on. The problem? Life insurance isn’t a streaming subscription. You can’t just cancel it and hit “restart” without consequences.

This guide walks you through the real trade-offs of replacing or changing a life insurance policywithout doom, gloom, or sales-speak. You’ll learn when switching might actually make sense,

when it’s a terrible idea, and the questions you need answered before you sign anything.

Note: This is educational information, not legal or financial advice. For decisions involving coverage, taxes, or investments, talk with a licensed insurance professional and/or a qualified financial advisor.

Why People Change Life Insurance (and Why That’s Not Automatically Bad)

“Don’t replace your life insurance!” is a popular warning for a reasonbut it’s not a universal rule. Sometimes a change is smart. The goal is to make sure you’re switching for

your reasons, not because someone else is chasing a commission.

Common good reasons to consider a change

- Your needs changed: Marriage, divorce, new kids, new mortgage, business ownership, or caring for aging parents can change how much coverage you actually need.

- You’re paying for the wrong kind of policy: Many people buy permanent life insurance when a term policy would cover the goal for a fraction of the costor vice versa.

- Your health improved: If you’re healthier now than when you applied, you might qualify for better rates (not guaranteed, but possible).

- Your policy is underperforming: Some cash-value policies can struggle if assumptions don’t match reality, premiums aren’t adequate, or internal costs rise.

- You want different features: Conversion options, riders, no-lapse guarantees, living benefits, or a better fit for long-term planning.

But here’s the catch: you can have a perfectly valid reason to switch and still make a costly mistake if you don’t understand what you’re giving up.

The “Replacement Trap”: What You Can Lose When You Switch

Replacing life insurance (sometimes called “policy replacement”) means you’re swapping an existing policy for a new one. The new policy might be betterbut it can also reset key protections,

add fees, or expose you to new risks.

1) You may restart the clock on important policy protections

Many policies include a contestability period (often two years) where insurers can closely review claims and potentially deny a payout if there were material misstatements on the application.

Many policies also include a suicide exclusion period (often up to two years). Replacing or letting coverage lapse and restarting can bring these windows back.

Translation: you can turn a mature policy into a “new” policy that gets extra scrutiny during the early yearsexactly when your family least wants paperwork drama.

2) You may be older (and insurance is not known for getting cheaper with age)

Life insurance rates generally reflect age and health at the time you apply. Even if you’re still healthy, a new policy priced at today’s age can cost more than what you locked in years ago.

A “lower premium” pitch can be real, but you should compare apples to apples (same coverage amount, same duration, same type of policy, similar guarantees).

3) You may trigger surrender charges or lose accumulated value

If you have permanent life insurance (whole life, universal life, variable, or indexed universal life), you may have a cash value. But “cash value” isn’t always “cash you can grab without consequences.”

Many policies have surrender charges for early exits, plus possible fees or market value adjustments (especially with certain products).

If you surrender or replace too early, you may walk away with less than you expect. If you’ve borrowed against the policy, that loan can complicate things even more.

4) You might lose benefits your current policy quietly includes

Older policies can contain features that aren’t available (or aren’t as generous) today. Examples include certain guarantees, favorable loan provisions, or riders.

If you replace the policy, you’re not “upgrading” a phoneyou’re swapping a contract. Details matter.

5) A new policy might not get approved the way you assume

This is the big one. You can apply for a new policy and discover:

- You’re rated higher due to new medical findings (even minor ones).

- You’re declined entirely.

- The premium quoted in a casual conversation is not the premium you’re actually offered after underwriting.

If you canceled your existing policy first, that’s when life insurance gets really “exciting” in the worst possible way.

Before You Switch: The Non-Negotiable Checklist

If you only read one section, make it this one. The safest way to change life insurance is to treat it like a controlled demolition: planned, documented, and not performed while standing under the building.

Step 1: Identify what you’re changingcoverage, type, or company

- Changing the amount: You may only need to increase or decrease coverage, not replace the policy.

- Changing term length: Sometimes you can extend protection by adding a second term policy instead of replacing the first.

- Changing from term to permanent: Conversion may be available (often without new medical underwriting) if your policy has a conversion feature.

- Changing permanent policy structure: This can involve fees, tax considerations, and long-term projections.

Step 2: Demand a side-by-side comparison in writing

Ask for a clear comparison that shows:

- Premiums (now and in the future)

- Death benefit details (level vs. increasing, guarantees, and conditions)

- Cash value assumptions and guaranteed values (for permanent policies)

- Fees and surrender charges (old policy and new policy)

- Riders and living benefits

- Any changes to contestability or exclusion periods

Step 3: Don’t cancel old coverage until new coverage is active

This is where people get burned. The safest process is typically:

- Apply for the new policy.

- Wait for underwriting and approval.

- Confirm the policy is in force (and you understand the first premium requirements).

- Only then consider canceling or reducing the old policyif it still makes sense.

Step 4: Watch for “twisting” and high-pressure replacement tactics

States regulate life insurance replacement for a reason: consumer harm has happened enough times to justify rules. If the pitch sounds like “Your policy is trash, sign here,” slow down.

A legitimate recommendation can handle questions, paperwork, and comparisons without getting offended.

Red flags include:

- Pressure to sign immediately “to lock in” an offer

- Vague answers about fees, guarantees, or what happens if you stop paying

- Claims that a policy is “free” or “self-funding” without showing conservative assumptions

- Encouraging you to cancel before the new policy is approved

Smart Alternatives to Replacing Your Policy

A lot of “replacement” conversations should actually be “adjustment” conversations. These options can solve problems without rebooting your coverage.

Option A: Keep the policy and buy a second one (layering)

If you need more coverage (new baby, bigger mortgage), you might keep the old policy and add a new term policy for the extra amount. This preserves the value of the older coverage and adds flexibility.

Option B: Convert term to permanent (if you need lifelong coverage)

Many term policies allow conversion to permanent insurance within certain timeframes. Conversion can help if your health has changed and you want to avoid new underwriting.

It’s not always cheapbut it’s often simpler and more predictable than starting over from scratch.

Option C: Reduce the face amount instead of canceling

If premiums feel heavy, sometimes you can reduce coverage, adjust riders, or restructure payments. It’s like putting your policy on a sensible budget instead of throwing it into the void.

Option D: Consider a tax-aware move for cash-value policies (1035 exchange)

If you’re moving from one qualifying cash-value life insurance policy to anotheror to certain annuity productsthere may be a way to transfer value without immediately triggering taxes

on gains, using a Section 1035 exchange. These transactions have strict rules (ownership and insured continuity matter, and the transfer is typically done directly between insurers).

This is an area where professional guidance is worth the money, because a sloppy transfer can turn “tax-aware” into “tax surprise.”

When Replacing Life Insurance Actually Makes Sense

Despite all the warnings, there are legitimate scenarios where replacement can be the best moveespecially when the switch is carefully planned and documented.

Scenario 1: Your term policy is expiring and you still need coverage

If your term is ending and you still have dependents, debt, or income that needs replacing, you may need new coverage. Start shopping early so you’re not forced into a bad decision at the last minute.

Scenario 2: You bought the wrong type of policy for the job

If you only needed income replacement for 20 years but bought an expensive permanent policy you can’t sustain, a well-planned shift could helpespecially if you can preserve value or minimize penalties.

Scenario 3: Your health improved enough to justify new underwriting

If you had a rough health period years ago and your health is now significantly improved, getting quotes can be reasonable. The key word is quotesnot cancellations.

Scenario 4: You discovered your policy is at risk of lapse later

Some permanent policies depend on funding levels and internal costs. If current illustrations show an increasing risk of lapse, you may need to adjust premiums, restructure the policy, or consider replacing it.

But replacement should be evaluated using conservative assumptions and clear disclosures.

The Questions You Should Ask Before You Sign Anything

Bring these questions to any agent, broker, or advisor recommending a life insurance change. If they can’t answer clearly, that’s an answer too.

Policy replacement questions

- What problem does this change solve, specifically?

- What am I giving up by replacing my current policy?

- Will contestability or exclusion periods restart?

- Are there surrender charges, and how long do they last?

- What are the guaranteed values vs. projected values?

- How does the new policy perform under conservative assumptions?

- What happens if I miss a payment or need to reduce premiums later?

- Are there fees, commissions, or incentives connected to this recommendation?

If the product has investments (variable life / variable universal life)

- What are the underlying investment costs and risks?

- What are the surrender periods and charges?

- What is the worst-case scenario if markets underperform?

- Am I comfortable managing an investment-based insurance product for years?

Bottom Line: Change Life Insurance Slowly, Carefully, and On Purpose

Changing life insurance can be a good moveif it’s driven by clear needs, evaluated with realistic numbers, and executed with safeguards. The fastest way to regret a replacement is to

cancel first, assume underwriting will go your way, and rely on optimistic projections that only work in a perfect world.

So before you switch, do the boring work: side-by-side comparisons, written disclosures, conservative assumptions, and a plan that keeps coverage in force throughout the transition.

Your future self (and your beneficiaries) will thank you.

Real-World “Switch” Experiences: What People Often Learn the Hard Way (and How You Can Learn It the Easy Way)

Below are real-world style scenariosbased on common situations people run into when changing life insurance. No names, no drama… okay, minimal drama. The goal is to make the risks feel

concrete, because “read the fine print” is great advice until you’re staring at the fine print with a headache.

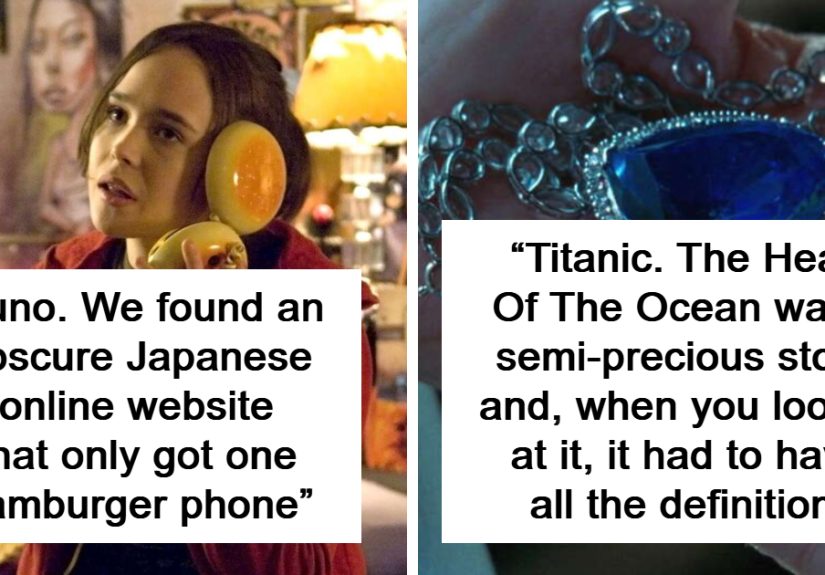

Experience 1: The “cheaper premium” that wasn’t cheaper

A parent in their early 40s had a 20-year term policy they bought in their early 30s. An agent offered a “better” policy with a lower monthly premium. The pitch sounded perfectuntil the comparison

got specific. The new policy was cheaper for the first couple of years, but the premium wasn’t level for the entire term. It stepped up later. A lot.

The lesson: always confirm whether premiums are truly level, how long the rate is guaranteed, and what happens at renewal. A “low starting premium” can be a teaser, not a bargain.

Experience 2: The replacement that quietly reset the clock

Someone replaced an older policy they’d had for years. They didn’t think much about policy timing, because they were focused on features. But the new policy came with early-year windows that can

trigger extra scrutiny (like contestability provisions) if a claim occurs soon after issue. Nothing went wrongbut the family realized later that they had unknowingly traded a seasoned contract for a brand-new one.

The lesson: even if you’re healthy and honest, you don’t want your beneficiaries dealing with avoidable hurdles. Ask directly what “resets” when a policy is replaced.

Experience 3: The cash-value surprise (also known as “Where did my money go?”)

A policyholder with permanent life insurance assumed their cash value was basically a savings account. When they explored surrendering to switch policies, they discovered a surrender charge schedule

that reduced what they’d receive if they left early. They also learned that outstanding policy loans can reduce the net value and may create tax complications if a policy is surrendered with a loan balance.

The lesson: cash value is real, but the “walk-away value” depends on timing, fees, loans, and policy design. Before changing anything, request an in-force illustration and a clear breakdown of surrender value today.

Experience 4: The health curveball during underwriting

A person who felt “basically the same” as five years ago applied for a replacement policy expecting similar rates. Underwriting uncovered updated lab results and medical notes that led to a higher

rating class than anticipated. The premium came back higherenough to erase the entire advantage of switching. Fortunately, they hadn’t canceled their old policy yet.

The lesson: never assume underwriting will cooperate. Apply first, wait for approval, and keep your current coverage in force until you’re certain the new plan works.

Experience 5: The smarter move that didn’t require replacement

A family wanted more coverage as their mortgage grew. Instead of replacing the existing policy, they layered: they kept the older term policy (with a great locked-in rate) and added a smaller second term policy

sized specifically to the new debt. The result: more coverage, flexible expiration dates, and no need to touch the original policy.

The lesson: “change” doesn’t always mean “replace.” Sometimes the best life insurance strategy is boringand boring is good when your goal is protection.