Table of Contents >> Show >> Hide

- What “Best Case Scenario” Actually Means (No Crystal Ball Required)

- Bitcoin’s Best-Case Job Description: Digital Gold (Not a Sci-Fi Plot Twist)

- Why the Digital Gold Story Has Become More Plausible Over Time

- The Bull Case Doesn’t Require Bitcoin to Take Over the World

- Volatility and Drawdowns: The Entry Fee No One Puts on the Brochure

- Regulation, Taxes, and Custody: The Boring Stuff That Determines the Ending

- Portfolio Sizing: Where Common Sense Does Its Best Work

- How to Own Bitcoin Like a Responsible Adult

- What Would Confirm the Best Case Over the Next Decade?

- Conclusion: The Best Case Is Simple, Not Spectacular

- Experiences in the Real World: on What This Journey Feels Like

Every investing era has its “this changes everything” storyline. Railroads. Radio. Dot-coms. AI.

And for the last decade-plus, Bitcoin has been the headline hog that shows up to the party wearing sunglasses indoors.

Sometimes it looks brilliant. Sometimes it looks like it got kicked out of the party and is now yelling at a hedge on the sidewalk.

So let’s talk about the best case scenario for Bitcoin with a little wealth-of-common-sense energy:

fewer prophecies, more probabilities; fewer laser-eyes, more risk controls; fewer “it’s going to zero or infinity,”

more “what would have to be true for it to earn a durable place in portfolios?”

What “Best Case Scenario” Actually Means (No Crystal Ball Required)

“Best case” doesn’t mean “guaranteed.” It means “if the optimistic version of the story plays out, what does Bitcoin become?”

That framing matters because Bitcoin isn’t a traditional business. It doesn’t produce cash flows.

You can’t run a discounted cash flow model and pretend it’s a software company with a ticker symbol.

A more useful mental model is: Bitcoin is a network and a monetary asset with a hard-coded supply schedule.

If adoption grows and the network stays resilient, the asset can become more valuable.

If adoption stalls, regulation clamps down, better tech replaces it, or trust erodes, the story can weaken quickly.

This is why many thoughtful investors treat it like a “call option” on a future where Bitcoin is widely accepted as a store of value.

The common-sense question isn’t “What’s the price next month?” It’s “What’s the role?”

In the best case, Bitcoin earns a job title that’s surprisingly unsexy:

digital gold.

Not “replacing the dollar,” not “ending central banking,” not “solving world hunger.”

Just becoming a widely held, globally recognized store of value that lives natively on the internet.

Bitcoin’s Best-Case Job Description: Digital Gold (Not a Sci-Fi Plot Twist)

The “digital gold” idea is simple: gold has been used for centuries as a store of value because it’s scarce,

durable, and widely recognized. Bitcoin tries to mimic some of those propertiesscarcity and durabilityusing software,

while adding something gold can’t do: move across the world at internet speed without needing armored trucks.

Scarcity You Can Audit

Bitcoin’s scarcity isn’t a marketing sloganit’s embedded in its issuance rules. The supply is capped at 21 million coins,

and the network reduces the rate of new coin issuance roughly every four years through “halving” events.

Over time, that makes new supply harder to come by, which is part of why supporters describe Bitcoin as “digital scarcity.”

Scarcity alone doesn’t create value, but scarcity plus sustained demand can.

In plain English: if more people want a thing that cannot be easily produced, the price tends to go upsometimes calmly,

and sometimes like it’s on a trampoline.

Portability and Settlement: The Internet-Native Angle

Gold is hard to move and expensive to secure. Bitcoin is information secured by cryptography and a distributed network.

In the best case, that makes it useful as a globally portable store of value, especially where local currencies are unstable,

banking access is limited, or capital controls make traditional finance feel like a maze with locked doors.

This doesn’t require Bitcoin to become everyone’s daily spending currency. It can succeed as a store of value

even if it’s used more like a long-term savings vehicle than a payment method.

(If you’ve ever tried to buy a coffee during a high-fee moment and ended up paying the equivalent of a fancy sandwich

in network fees, you already understand why “store of value” is the cleaner narrative.)

Why the Digital Gold Story Has Become More Plausible Over Time

Early Bitcoin felt like it lived in a parallel universewallets, keys, exchanges that might vanish,

and enough jargon to make a tax accountant quietly weep.

But one reason the “best case” looks more realistic today is that the surrounding financial infrastructure has matured.

Bitcoin became easier to access, easier to hold within traditional systems, andimportantlyharder for institutions to ignore.

Wall Street Rails: Futures, Benchmarks, and Familiar Plumbing

Regulated products helped normalize price discovery and risk management. Bitcoin futures launched on major derivatives markets,

and institutional investors gained ways to hedge exposure rather than purely “buy and pray.”

That doesn’t remove risk, but it adds structure.

Spot Bitcoin ETFs: The “I’d Like Exposure Without a PhD in Wallets” Era

A watershed moment for mainstream access was the approval of U.S.-listed spot Bitcoin exchange-traded products in January 2024.

For many investors, this was the difference between “interesting idea” and “practical implementation.”

Instead of managing private keys (and losing them in a tragic laundry incident), they could buy Bitcoin exposure in a brokerage account.

In the best case scenario, ETFs don’t change what Bitcoin isthey change who can own it comfortably.

Financial professionals can integrate it into rebalancing policies. Retirement accounts can access it more easily.

Compliance teams can stop treating it like an unexploded firework.

The tradeoff is philosophical as much as practical: you gain convenience and reduce self-custody risk,

but you reintroduce intermediaries. The original Bitcoin pitch was “be your own bank.”

The ETF pitch is “please, for the love of spreadsheets, let someone else handle the custody and reporting.”

Both are rational, depending on what kind of investor you are.

The Bull Case Doesn’t Require Bitcoin to Take Over the World

One of the most helpful “common sense” upgrades you can make to the Bitcoin conversation is removing the all-or-nothing thinking.

Bitcoin doesn’t need to replace fiat currencies globally to succeed. It doesn’t need every government to adopt it.

It doesn’t need to become the default unit of account for groceries, rent, and therapy bills.

The best case is more modest and more believable: Bitcoin becomes a widely accepted store of value and a portfolio diversifier

for people who can tolerate volatility. Think “a digital asset that sits somewhere between gold and venture-like optionality.”

It can be imperfect and still valuablejust like most things humans keep around for a long time.

In that world, Bitcoin’s role is similar to how many people treat gold:

not because it produces income, but because it represents an alternative monetary asset with global recognition.

Some investors will hold it as insurance. Some will hold it as a long-duration bet on adoption. Some will avoid it entirely.

And yes, some will keep yelling at each other on the internet as if that’s a productive use of consciousness.

Volatility and Drawdowns: The Entry Fee No One Puts on the Brochure

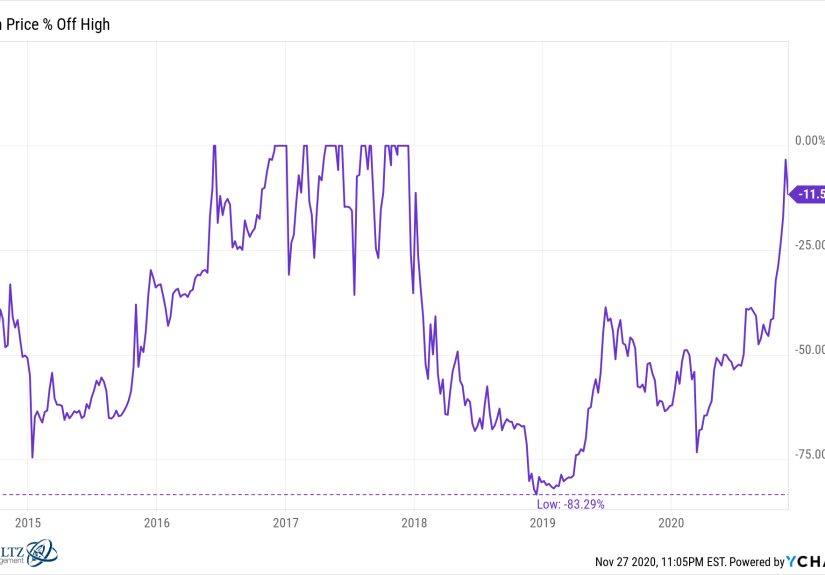

The best case scenario has a brutal footnote: even if Bitcoin becomes digital gold, it may still experience massive drawdowns.

Gold has endured long stretches of disappointment. Bitcoin has endured drawdowns that make normal investors question

every life choice that led them to press the “buy” button.

If Bitcoin’s destiny is to behave like a store of value for a new generation, that generation may have to get comfortable

with the idea that “store of value” does not mean “line goes up smoothly.” It means “this thing has survived many cycles,

and people keep coming back to it.”

Why It’s So Wild (and Why That Might ChangeSlowly)

Bitcoin is still relatively young compared to traditional stores of value.

In the optimistic scenario, volatility trends down over time as ownership broadens, liquidity improves,

and the market becomes harder to push around.

But “down over time” does not mean “down next week.”

This is an asset class that can produce heartburn in 4K resolution.

Regulation, Taxes, and Custody: The Boring Stuff That Determines the Ending

The best case scenario doesn’t happen in a vacuum. It requires rule clarity and safe ownership pathways.

In the U.S., crypto exists across a patchwork of regulatory categories, and that uncertainty has been a recurring overhang.

Still, the direction of travel has been toward more defined frameworks and more investor educationespecially around risks.

Custody Risk Is Real (and Usually Self-Inflicted)

Bitcoin’s self-custody model is empowering, but it’s also unforgiving.

Lose your private keys and you may lose access permanently. Use a sketchy platform and you add counterparty risk.

Fall for a scam and you learn the ancient investing lesson: when someone promises “guaranteed returns,” they are guaranteeing

somethingit’s just not your profit.

In the best case, more investors hold Bitcoin through robust custodians and regulated wrappers,

reducing the frequency of catastrophic losses caused by hacks, fraud, and “I wrote my seed phrase on a sticky note and now it’s gone.”

Taxes: The Part Everyone Forgets Until April

In the U.S., the IRS treats virtual currency as property for federal tax purposes, which means transactions can have tax consequences.

In real life, this is one reason many investors prefer holding through products and platforms that simplify reporting.

Best case scenario? Ownership becomes easier, but tax compliance remains about as fun as doing leg day.

Portfolio Sizing: Where Common Sense Does Its Best Work

If Bitcoin has a role in a diversified portfolio, the most defensible version of that role is usually:

small allocation, long time horizon, disciplined process.

Not because small allocations are magically safe, but because Bitcoin’s volatility can dominate a portfolio if the position is too large.

Many research frameworks that discuss Bitcoin in portfolios land in the low single digits for allocation sizing for typical investors.

The logic is asymmetric: in an optimistic adoption scenario, a small position can contribute meaningfully to returns;

in a failure scenario, a small position is less likely to permanently derail financial plans.

A Practical Example: The “Sleep-At-Night” Allocation

Imagine two investors with identical portfolios, except one adds a small Bitcoin allocation.

If Bitcoin performs exceptionally well, that allocation may noticeably boost outcomes.

If Bitcoin performs terribly, the investor can still reach long-term goals because the rest of the portfolio did the heavy lifting.

The best case scenario is not “Bitcoin makes you rich.” The best case scenario is “Bitcoin works, and you owned enough to matter,

but not so much that you panic-sold at the bottom of a 60% drawdown because your brain decided it prefers peace.”

How to Own Bitcoin Like a Responsible Adult

If you want the “common sense” approach, try this checklist:

- Define the thesis: store of value, adoption bet, or diversificationpick one.

- Choose the vehicle: ETF for simplicity, self-custody for sovereignty, or a mix for redundancy.

- Size it small: start with an allocation you can hold through ugly drawdowns.

- Use a process: dollar-cost averaging can reduce the pressure to time entries.

- Rebalance: take some off the table after big runs; add modestly after big drops if your thesis is intact.

- Avoid leverage: Bitcoin already behaves like it drank three energy drinks. Don’t give it a fourth.

- Stay scam-resistant: if it sounds too good to be true, it’s probably a “donation” to someone else’s lifestyle.

What Would Confirm the Best Case Over the Next Decade?

The best case scenario becomes more believable if you see:

- Broader ownership through regulated channels without constant blowups.

- Lower volatility over long periods as liquidity deepens (even if it stays spicy).

- More durable narratives: Bitcoin remains a store-of-value contender across multiple macro regimes.

- Resilience under stress: the network keeps operating through market and geopolitical turbulence.

- Real utility in weak-currency environments where saving and transacting is otherwise fragile.

Notice what’s not on the list: “Everyone uses Bitcoin to buy tacos.” Tacos are great, but the investment case doesn’t need tacos.

The investment case needs longevity, trust, and a growing base of holders who treat Bitcoin as a long-term asset, not a lottery ticket.

Conclusion: The Best Case Is Simple, Not Spectacular

The best case scenario for Bitcoin is not a utopia. It’s a category win.

Bitcoin becomes the internet’s most credible store-of-value asset: a digital form of scarcity that people recognize globally,

that institutions can access through familiar wrappers, and that individuals can hold directly if they choose.

Even in the best case, Bitcoin remains volatile, controversial, and occasionally exhausting.

But “digital gold” doesn’t need unanimous approvalgold never had that either.

It just needs enough believers, enough liquidity, enough infrastructure, and enough time.

That’s the common-sense version of optimism: not certainty, but a scenario worth understanding.

Experiences in the Real World: on What This Journey Feels Like

One of the most consistent “Bitcoin experiences” isn’t about priceit’s about psychology. The first time someone buys Bitcoin,

it’s rarely a calm, spreadsheet-driven event. It’s usually triggered by a headline, a podcast, a friend’s group chat,

or the haunting realization that you’ve spent more time researching a new phone than you have researching how money works.

You start small because you’re curious, but you also feel like you’re walking into a room where everyone speaks in acronyms.

Then comes the whiplash. Bitcoin teaches new investors what volatility really means. A 10% move is not a “big day,”

it’s a Tuesday with extra caffeine. The first drawdown feels personallike the market singled you out specifically.

Some people panic-sell and swear it off forever. Others hold through it and discover an uncomfortable truth:

the pain of watching your position drop is often sharper than the joy of watching it rise.

That’s not a Bitcoin thing. That’s a human thing.

Over time, many investors shift from trying to be clever to trying to be consistent. They stop searching for “the perfect entry”

and start using a simple schedule: a small purchase weekly or monthly, funded like any other savings habit.

This doesn’t guarantee profits, but it changes the emotional tone.

You stop treating Bitcoin like a live grenade and more like a long-term experiment you can afford to run.

In that mindset, the best case scenario isn’t “I timed the bottom.” It’s “I kept a process when I didn’t feel confident.”

Another common experience is the custody fork in the road. Some people love the independence of self-custody:

the idea that their savings aren’t tied to a bank’s hours or a platform’s solvency.

Others realize quickly that “be your own bank” also means “be your own IT department,” and they prefer the guardrails of regulated products.

The arrival of spot Bitcoin ETFs intensified this divide. For plenty of investors, the ETF is the first time Bitcoin felt

like a normal allocation rather than a side quest with a user manual.

And then there’s the maturity moment: when your allocation grows because the price rose, not because you added more.

That’s when rebalancing becomes a surprisingly powerful emotional tool. Trimming after a big run can feel like “selling too early,”

but it can also feel like reclaiming controlturning paper gains into a plan. Adding modestly after a big drop can feel scary,

but it can also be the difference between a narrative-driven gamble and a disciplined strategy.

In the end, the best Bitcoin experience isn’t constant excitement. It’s confidence that you can hold a small, thoughtful position

without letting it hijack your life.

![Root Samsung Galaxy Player 4.0 & 5.0 With One Click [How To]](https://2quotes.net/wp-content/uploads/2026/02/root-samsung-galaxy-player-4-0-5-0-with-one-click-how-to-KoV1f0d6-thumb.jpg)