Table of Contents >> Show >> Hide

- Key Things to Consider Before You Send Money

- Option 1: Online Money Transfer Services

- Option 2: Traditional Bank Transfers

- Option 3: Japan-Based Remittance Services (Seven Bank, SBI Remit, METS, etc.)

- Option 4: Cash-to-Cash Transfers (Western Union, MoneyGram, etc.)

- Option 5: E-Wallets and Fintech Apps

- What’s the Cheapest Way to Send Money from Japan to the Philippines?

- Step-by-Step: Sending Money Online from Japan to the Philippines

- Safety Tips and Common Mistakes to Avoid

- Real-World Experiences: What It’s Like Sending Money from Japan to the Philippines

- Final Thoughts

If you’re working, studying, or living in Japan and sending money back home to the Philippines, you already know one truth: every yen counts.

Between transfer fees, exchange rates, and random “service charges,” it can feel like everyone is taking a tiny bite out of your hard-earned cash

before it reaches your family. The good news? You have a lot of optionsand once you understand how they work, you can keep more pesos in your

loved ones’ pockets instead of in your bank’s profit column.

This guide breaks down the best ways to send money from Japan to the Philippines, what to look out for, and how to avoid common

mistakes. We’ll walk through bank transfers, online money transfer services like Wise and Remitly, Japan-only remittance services, cash pickup

options, and e-wallets such as GCash, so you can choose the method that fits your life, your budget, and your family’s needs.

Key Things to Consider Before You Send Money

1. Exchange Rate vs. Fees (The Real Cost)

When comparing the best ways to send money from Japan to the Philippines, don’t just look at the upfront transfer fee.

You also need to pay attention to the exchange rate from JPY to PHP.

Many traditional banks and remittance counters advertise “low fees” but quietly add a margin on the exchange ratethat’s basically a hidden fee

built into the rate. Meanwhile, some digital providers use or closely track the mid-market rate (the true rate you see on Google) and

charge a transparent fee instead. Independent comparison sites and U.S. personal finance outlets consistently find that banks tend to be

the most expensive overall once you combine fees and exchange-rate markups, while specialist transfer services are usually cheaper for

international remittances.

2. Speed and Delivery Options

How fast does the money need to arrive? Your answer will narrow down your choices:

- Instant to a few minutes: Cash pickup or some e-wallet and bank transfers via remittance apps.

- Same day to next day: Most online money transfer services from Japan to the Philippines.

- 1–3 business days: Traditional bank wires, especially if intermediaries are involved.

You’ll also want to decide how your family prefers to receive money:

- Bank deposit (BDO, BPI, Metrobank, Landbank, etc.)

- Cash pickup at partners like BDO branches, M Lhuillier, Cebuana Lhuillier, Palawan, and others

- E-wallets like GCash, Maya, or Coins.ph

3. Limits, Documentation, and Rules

Japan regulates remittance services, and most providers have limits per transfer, per day, and per year.

Some Japanese banks and remittance services cap typical personal transfers around the 1,000,000-yen range per transaction or per day,

and may have yearly limits unless you provide extra documentation such as proof of income or purpose of remittance.

You’ll usually need:

- Your residence card or passport

- MyNumber information in some cases

- Recipient’s full name and address

- Recipient’s bank details or e-wallet details

- Sometimes, the purpose of remittance (e.g., family support, tuition)

Option 1: Online Money Transfer Services

Online money transfer services are often the sweet spot between price, speed, and convenience.

Popular global players that operate from Japan include:

- Wise – known for using the mid-market exchange rate and low, transparent fees.

- Remitly – offers “Express” and “Economy” options, often with promos for first-time users.

- WorldRemit, Xe, OFX, and similar services – provide bank deposits, cash pickup, and sometimes e-wallet deposits.

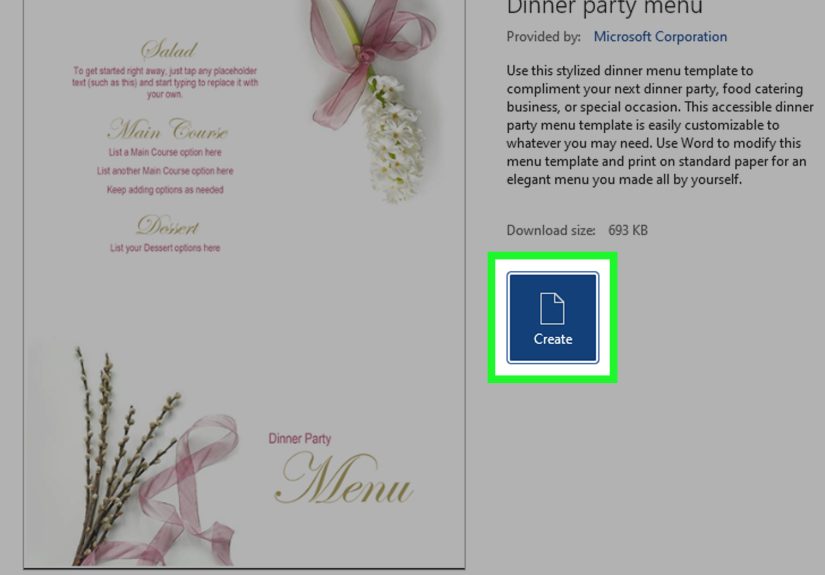

How These Services Work

The flow is pretty simple:

- Download the app or visit the website.

- Create an account and verify your identity.

- Enter how much JPY you’re sending and choose the payout method (bank, cash pickup, or wallet).

- See the exchange rate and total fees upfront.

- Pay using bank transfer, convenience-store payment, or card (depending on the provider).

- Track the transfer from your phone and notify your recipient.

Pros

- Lower total cost: Many are significantly cheaper than traditional banks.

- Transparent pricing: You can see exactly how many pesos your recipient will get before you confirm.

- Convenience: Available 24/7 from your phone, often with in-app tracking.

- Flexible delivery: Bank deposit, cash pickup, or e-wallet transfers in the Philippines.

Cons

- Verification hoops: First-time sign-up may require extra documents or video verification.

- Funding limitations: Some services may not support every Japanese bank or card type.

- Rate fluctuations: If you lock in a rate, you usually need to complete payment within a set time window.

For many people, an online service (especially one that uses close-to-mid-market rates) ends up being the

best way to send money from Japan to the Philippines when you’re focused on keeping fees low but still want fast delivery.

Option 2: Traditional Bank Transfers

You can send money directly from your Japanese banksuch as SMBC, MUFG, Resona, or othersto a Philippine bank account.

This typically involves an international wire transfer from your Japanese account to your recipient’s account in the Philippines.

How It Works

You’ll need to provide:

- Recipient’s full name and address

- Recipient bank name, branch, and address

- Recipient account number

- SWIFT/BIC code for the Philippine bank

Once you submit the wire via online banking or at a branch, the funds travel through one or more intermediary banks before reaching the Philippines.

Pros

- Familiar and trusted: You’re using your main bank, which feels safer for many people.

- Good for larger amounts: Wires are often used for tuition, property payments, or large family support transfers.

Cons

- Higher overall cost: Banks tend to charge higher fixed transfer fees plus less-favorable exchange rates.

- Slower: It can take 1–3 business days or longer, especially with multiple intermediary banks.

- Less transparency: You might not see the exact exchange rate or all intermediary fees upfront.

Some Japanese institutions are also changing their international services. For example, Japan Post Bank has ended certain

over-the-counter international remittance services and moved toward new structures, so it’s important to check your bank’s

current policies and options before assuming you can send money the way you always have.

Option 3: Japan-Based Remittance Services (Seven Bank, SBI Remit, METS, etc.)

Japan has several remittance companies specifically designed to serve foreign workers sending money home. These services often

partner with major Philippine institutions and payout networks.

Seven Bank’s Philippine Services

Seven Bank offers an international remittance service with a dedicated tie-up to BDO Unibank in the Philippines. You can:

- Send money from Japan via app or Seven Bank ATMs.

- Deliver funds to BDO bank accounts, cash pickup locations, or GCash e-wallets.

- Access tens of thousands of pickup points through partners like BDO, M Lhuillier, and Cebuana Lhuillier.

Fees are tiered based on the amount you’re sending, and transfer limits usually apply per transaction and per period.

SBI Remit and Other Specialists

SBI Remit and similar companies operate as dedicated remittance providers with:

- Flat or tiered fees for the Philippines corridor

- Options for bank deposits, cash pickup, and sometimes wallets

- Remittance limits (often around 1,000,000 yen per transaction)

These services can be very competitive compared with traditional banks and are popular among OFWs and long-term residents.

Metrobank Easy Transfer Service (METS)

Some Philippine banks have special arrangements in Japan. For example, a service like Metrobank’s Easy Transfer Service (METS)

allows customers with certain Japanese-bank accounts to remit funds to the Philippines with relatively simple procedures and

quick crediting times. This can be handy if your family in the Philippines is already using Metrobank.

Pros and Cons of Japan-Based Remittance Services

Pros:

- Designed specifically for foreign workers and families.

- Strong relationships with Philippine banks and cash pickup networks.

- Reasonable fees and fairly fast transfers.

Cons:

- Limits per transaction/day/year can be strict without extra documentation.

- Some services require registering in person or via mail.

- Fees and exchange rates can still vary widelycomparison is important.

Option 4: Cash-to-Cash Transfers (Western Union, MoneyGram, etc.)

If your family doesn’t use banks or e-wallets, or they live in areas where those aren’t convenient, cash pickup

is a lifesaver. Global providers like Western Union and MoneyGram allow you to:

- Pay in Japan via bank, card, or sometimes cash at an agent location.

- Have your recipient pick up pesos in cash at thousands of locations across the Philippines.

When Cash Pickup Makes Sense

Cash pickup is especially useful when:

- Your recipient doesn’t have a bank account or prefers cash.

- There’s an emergency and they need money immediately.

- Your family lives near remittance centers or pawnshops that act as payout partners.

What to Watch Out For

Cash transfers can be more expensive due to:

- Higher transfer fees for cash-funded or cash-payout transactions.

- Less-favorable exchange rates compared with online-only transfers.

Still, the speed and reach of these networks make them one of the most reliable ways to send money in urgent situations.

Option 5: E-Wallets and Fintech Apps

In the Philippines, GCash, Maya, and Coins.ph are extremely popular. Many international remittance services (including

those based in Japan) now allow you to send money directly to these wallets.

Why E-Wallets Are Attractive

- Speed: Transfers often arrive within minutes.

- Convenience: Recipients can pay bills, buy load, shop online, or cash out at partner outlets.

- Security: Reduces the need to carry large amounts of cash.

Potential Downsides

- E-wallet cash-out fees on the Philippine side can eat into the amount received.

- Wallet limits may restrict how much can be stored or withdrawn per day.

If your family members are already heavy e-wallet users, combining a digital remittance provider in Japan with wallet payout

in the Philippines can be one of the smoothest ways to send money regularly.

What’s the Cheapest Way to Send Money from Japan to the Philippines?

There’s no one-size-fits-all winner, but online money transfer services and Japan-based remittance specialists

are usually cheaper overall than traditional banks and many cash-based services.

Here’s how to hunt for the cheapest method for your situation:

-

Compare at least three providers. Use comparison tools or manually check a few apps to see:

- The exchange rate (JPY ➜ PHP)

- The transfer fee

- The estimated peso amount your recipient will receive

-

Consider your funding method. Bank transfers or balance payments are often cheaper than credit cards,

which can trigger extra cash-advance fees and worse rates. -

Watch out for promotions. New-customer bonuses, fee-free transfers, or improved first-time exchange rates can

be usefulbut don’t rely on promo pricing forever. -

Look at total cost, not just “0 fee.” A “no-fee” bank transfer with a bad rate can still cost more than a modest

fee with a fair exchange rate.

For regular remittances (monthly or biweekly), it often pays to settle on one or two providers that consistently offer good rates

and use them every time, instead of randomly switching without checking.

Step-by-Step: Sending Money Online from Japan to the Philippines

While details differ slightly by provider, the basic journey looks like this:

-

Sign up and verify your identity.

Provide your legal name, address, and ID (residence card, passport, etc.). Many services also ask for your employment information. -

Add a recipient.

Enter your family member’s full legal name (matching their ID), bank or wallet details, and sometimes their address or phone number. -

Enter the amount in yen.

The app will show the fee, exchange rate, and the final amount in pesos. -

Choose how you’ll pay.

Bank transfer, convenience-store payment, or card, depending on the provider and your preference. -

Confirm and send.

Double-check everythingespecially recipient informationand confirm the transfer. -

Track and inform your family.

Most services give you a tracking number or real-time status updates. Send a screenshot or message so your family knows when to expect the funds.

Safety Tips and Common Mistakes to Avoid

Don’t Let Scammers Ride on Your Remittance

Always send money through licensed, reputable providers. Be suspicious if someone:

- Asks you to send money to “unlock” a prize or prize money.

- Wants you to remit to a stranger’s account for a “job opportunity.”

- Pushes you to move money quickly without any receipts or records.

If it sounds too good to be true (“Send a small fee now, get a huge amount later”), it’s almost certainly a scam.

Avoid These Common Money-Transfer Mistakes

- Typing errors: A single wrong number in the account can delay or misdirect your transfer.

- Ignoring exchange-rate margins: Don’t just look at the “fee”look at how good (or bad) the rate is.

- Sending at the last minute: Emergency transfers often cost more. For regular support, schedule transfers early.

- Exceeding limits: Learn your provider’s daily and yearly caps so you’re not blocked when you need to send.

Real-World Experiences: What It’s Like Sending Money from Japan to the Philippines

Guides and comparison charts are helpful, but lived experiences add another layer. Here are some common scenarios and lessons people

discover once they start sending money regularly from Japan to the Philippines.

“My First Remittance from Japan Was More Stressful Than My Job Interview”

Many people sending money for the first time describe the same feelings: confusion, mild panic, and about 14 open browser tabs.

You’re trying to figure out which service is trustworthy, which one is cheapest, what “mid-market rate” means, and why every provider

seems to use slightly different terminology for the same thing.

One common pattern: people often start with a big-name brand like a global remittance or bank because it feels familiar.

Later, when they compare the actual pesos received versus what an online specialist could’ve provided, they realize they’ve been

overpaying. This moment usually leads to a weekend deep-dive into comparison tools, apps, and online reviewsand then a switch to

a more cost-effective service for future transfers.

Learning the “Fees + Rate” Equation the Hard Way

A classic mistake is focusing only on the visible fee. Imagine this:

- Service A charges a higher transfer fee but gives a great exchange rate.

- Service B advertises “0 fee!” but quietly uses a weak exchange rate.

On paper, Service B looks cheaper. In reality, your family in the Philippines ends up with fewer pesos in their account. After this happens

once or twiceusually when someone notices the numbers don’t match what they expectedpeople start comparing the final received amount

instead of just the fee.

Over a year of monthly transfers, this difference can add up to several thousand pesos. That’s grocery money, tuition, or utility bills.

Once you see those numbers side by side, it becomes much easier to justify switching providers.

Timing Transfers Around Paydays and Exchange Rates

Another experience common among long-term workers in Japan is learning to time transfers. Some people send immediately on payday,

others wait a day or two to see if the JPY–PHP rate improves slightly. While nobody can predict currency markets perfectly, many apps let you:

- Set rate alerts so you’re notified when the rate hits a certain level.

- Lock in a rate for a short window while you complete your transfer.

Over time, even small improvements in the ratesay, an extra 0.2 or 0.3 pesos per yencan make a noticeable difference, especially if you send

money every month.

Building a Routine That Works for Your Family

People also figure out what works best for their family’s rhythm. For example:

- Some send a large amount once a month, which can be cheaper per transfer and easier to track in a budget.

-

Others prefer smaller, more frequent transfers (weekly or biweekly) so their family isn’t tempted to spend everything at onceand so

emergencies feel less stressful when they pop up on random Tuesdays. - Families that use e-wallets may like being able to pay bills directly from the app, reducing the need for cash and multiple trips to remittance centers.

Over time, you’ll figure out a system that balances cost, convenience, and your family’s habits. The key is to treat remittances like any other

part of your financial plan: something you can optimize instead of just “hoping for the best.”

Small Habits That Save Money in the Long Run

Experienced senders from Japan to the Philippines often develop a few money-smart habits:

- Always screenshot the details before confirming, so you have proof of the rate, fee, and expected amount in pesos.

- Keep a simple log (even just in a notes app) of how much you sent, what service you used, and how many pesos arrived.

- Review your strategy every few monthsnew providers or promos might make it worth switching.

- Educate your family about how remittance fees work so everyone understands why you chose a particular method.

These habits don’t take much time, but they help ensure that more of your hard work in Japan turns into real support in the Philippinesand less

into invisible bank margins.

Final Thoughts

The best ways to send money from Japan to the Philippines depend on your priorities: lowest cost, fastest delivery, easiest for your

family to receive, or all of the above. For many people, online money transfer services and Japan-based remittance specialists offer the best

balance of fair exchange rates, reasonable fees, and convenience. Traditional banks and cash-to-cash services still play important roles,

especially for large transfers or emergencies.

The main takeaway? Don’t treat remittances as something you “just do.” Treat them like any other financial decisioncompare, plan, and review.

A little effort now can mean thousands more pesos in your family’s hands over the years.