Table of Contents >> Show >> Hide

- The Quick Snapshot: What You’re Really Choosing

- Money Talk: Purchase Price vs. “Total Cost of Ownership”

- Maintenance & Repairs: Predictability vs. Character (and Copper Pipes)

- Energy Efficiency & Comfort: Bills, Drafts, and the “Why Is This Room 12 Degrees Colder?” Problem

- Location & Lifestyle: The Neighborhood Factor Is a Big Deal

- Safety & Health Considerations: What to Know Before You Fall in Love

- Inspections, Contingencies, and Negotiation: The Power Moves

- Warranties vs. Renovation Flexibility: Different Kinds of Control

- Which One Fits You? A Simple Decision Framework

- Specific Examples: What the Tradeoffs Look Like in Real Life

- Common Mistakes to Avoid (No Matter Which You Choose)

- Conclusion: The Best Home Is the One That Fits Your Life

- Experiences Buyers Commonly Share (500+ Words of Real-World Flavor)

- 1) “The new home felt easy… until we priced out the ‘not included’ list.”

- 2) “Our older home had charm, and also a surprising number of opinions.”

- 3) “We thought the warranty would handle everything. It handled… some things.”

- 4) “The inspection saved useither by negotiating, or by letting us walk.”

- 5) “Our final decision wasn’t about ageit was about our schedule and stress tolerance.”

Buying a home is a little like adopting a pet. A brand-new puppy (new construction) is adorable, shiny, and comes

with that “new house smell.” An older rescue (an existing/older home) may have quirks, history, and a mysterious

stain you’ll swear wasn’t there at the showing. Either way: you’re committing to love it, feed it money, and take it

to regular checkups.

So which is smarter: buying a new home or buying an older home? The honest answer is:

it depends on what you value mostpredictability vs. character, modern efficiency vs. prime location, turnkey vs.

“I can totally learn how to grout tile from a 9-minute video.”

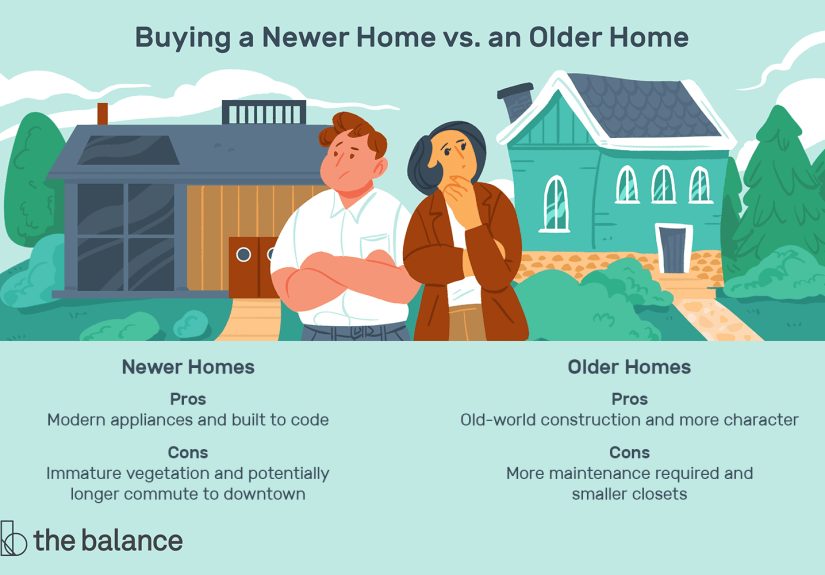

The Quick Snapshot: What You’re Really Choosing

-

New homes tend to offer modern layouts, newer systems, better baseline energy performance, and

builder warrantiesbut they may cost more upfront and often sit farther from established amenities. -

Older homes often bring mature neighborhoods, bigger lots, unique architecture, and renovation

potentialyet they can come with hidden repair costs and older materials/systems that need updating.

Think of it as a trade: less uncertainty now vs. more control (and potential surprises) later.

Money Talk: Purchase Price vs. “Total Cost of Ownership”

Upfront cost: sticker price isn’t the whole story

New construction often carries a premiumpartly because everything is new, partly because buyers like “new,” and

partly because builders price in upgraded finishes, warranties, and demand. Existing homes can offer more price

variety (including “needs love” bargains), but the discount can evaporate if the house requires immediate big-ticket

repairs.

The costs people forget to budget for

-

New home “extras”: window coverings, fencing, backyard landscaping, gutters (sometimes!), and

upgrades that were “only $4,500 more” (repeated twelve times). -

Older home “stabilizers”: electrical updates, plumbing repairs, roof replacement, HVAC end-of-life,

foundation drainage work, and the classic: “We didn’t know that was load-bearing.” -

Ongoing costs: utilities, maintenance, insurance, HOA fees (common in many new communities),

and commuting costs if location shifts your daily routine.

A practical way to compare is to create a 5-year “real cost” estimate: mortgage + taxes + insurance + expected

maintenance + utilities + commute changes + planned upgrades. It’s not perfect, but it’s a lot more honest than

comparing list prices like they’re apples-to-apples.

Maintenance & Repairs: Predictability vs. Character (and Copper Pipes)

New homes: fewer early surprises, but not zero surprises

New homes typically delay major maintenance because the roof, HVAC, water heater, and appliances are new. Many

builders also include warranties that cover workmanship early on and major structural issues for longer periods.

That can reduce your short-term repair anxietyat least until the warranty fine print meets reality.

Important note: “New” doesn’t automatically mean “perfect.” New builds can still have issuesgrading/drainage

problems, rushed finishes, or installation mistakes. The difference is you’re more likely to be dealing with warranty

processes than negotiating with a previous owner who swears the leak is “seasonal.”

Older homes: you’re buying history (and sometimes yesterday’s shortcuts)

Older homes vary wildly. A well-maintained 1970s split-level can be a sturdy, sensible buy. A neglected 1920s

bungalow can be an expensive romance. The biggest advantage of an older home is that time has already “tested”

itsettling has happened, the neighborhood has matured, and you can often see how the house behaves after decades

of real life.

The biggest downside is that some systems and materials have a lifespan. A home might be charming, but charm does

not heat water. Your inspection should focus on the “big five”: roof, foundation/drainage, electrical, plumbing, and

HVACplus any signs of moisture intrusion, pests, and poor past renovations.

Energy Efficiency & Comfort: Bills, Drafts, and the “Why Is This Room 12 Degrees Colder?” Problem

New homes: built for modern performance

New homes are generally tighter and better insulated than older homes, with higher-performance windows, more modern

HVAC equipment, and fewer air leaks (assuming quality construction and good installation). Many buyers notice the

comfort difference right away: fewer drafts, more consistent temperatures, and less outside noise.

If you want a shortcut for comparing performance, look for third-party efficiency programs (for example, homes that

meet recognized energy-performance standards). Regardless of the label, ask for specifics: insulation levels, window

specs, HVAC sizing, ventilation approach, and whether the home was tested for air leakage.

Older homes: can be upgraded, but you’re retrofitting

Older homes can be made efficientsometimes very efficientbut it usually takes planned improvements: air sealing,

insulation upgrades, duct sealing, better windows (or storm windows), and smart HVAC updates. The good news is you

can often prioritize changes based on payback and comfort.

One caution: “Old house breathable” is not the same thing as “healthy indoor air.” If you tighten an older home,

consider ventilation and moisture control so you don’t accidentally create a fancy new hobby called “indoor mold

cultivation.”

Location & Lifestyle: The Neighborhood Factor Is a Big Deal

Older homes often win on walkability and established amenities

Many older homes sit in established neighborhoodscloser to historic downtowns, mature trees, older parks, and

developed infrastructure. You may find shorter commutes, more character, and the kind of neighborhood vibe that

cannot be installed during Phase 2 of a master plan.

New homes often win on community features and modern planning

New developments frequently include amenities like trails, community pools, playgrounds, and newer schools (though

school quality varies by district and changes over time). You may also see more consistent property styles and newer

utilities. The tradeoff is that new communities can be farther from job centers or older commercial areas.

Ask yourself: do you want “coffee shop in walking distance,” or “two-car garage and a mudroom that can swallow

backpacks whole”? There’s no wrong answerjust different daily realities.

Safety & Health Considerations: What to Know Before You Fall in Love

Older homes and lead-based paint disclosures

If you’re considering a home built before 1978, lead-based paint is a real topic. Lead paint isn’t automatically

dangerous if it’s intact, but deteriorating paint and lead dust can be hazardousespecially for young children.

Federal rules require disclosures and provide buyers an opportunity to evaluate risk before purchase. If you have

kids (or plan to), it’s worth taking this seriously and budgeting for safe remediation if needed.

Radon: not a “new vs. old” issuean “any home” issue

Elevated radon levels can occur in any type of homenew or olddepending on geography and construction details.

Testing is straightforward, and mitigation is typically possible if levels are high. If you’re comparing homes, don’t

assume the newer one is automatically lower risk here.

Older materials and systems

In older homes, inspectors may flag things like outdated wiring methods, older plumbing materials, or insulation

and building components that require special handling during renovations. None of this is an automatic dealbreaker,

but it’s a strong reason to do thorough inspections and plan upgrades thoughtfully.

Inspections, Contingencies, and Negotiation: The Power Moves

Yes, even new homes should be inspected

A professional inspection isn’t just for older homes. For new construction, consider inspections at key stages

(pre-drywall and final) if possible, or at least a thorough final inspection before closing. The goal is to catch

issues while the builder can still correct themand while your leverage is strongest.

Older homes: inspection is your flashlight in a haunted attic

For an older home, the inspection helps you understand what you’re buying and how soon you’ll be repairing it. Use

the report to separate “normal wear” from “this needs attention now.” If major issues appear, your options typically

include negotiating repairs, negotiating credits/price, or walking away (depending on your contract and market

conditions).

Pro tip: prioritize negotiating on safety, structural, moisture, and major system concerns. Sellers are less likely

to replace a perfectly functioning-but-ugly countertop just because your Pinterest board has feelings.

Warranties vs. Renovation Flexibility: Different Kinds of Control

New homes: warranty comfort (with homework required)

Builder warranties commonly cover workmanship early on, systems for a bit longer, and major structural issues for

longer periods. But “covered” is not the same as “easy.” Ask how claims work, what documentation you need, and how

disputes are handled. Also ask what maintenance tasks are required to keep coverage valid (yes, that includes

things like drainage and grading rules).

Older homes: renovation freedom (with a reality check)

If you love the idea of customizing, older homes can be a dream. You can add value with smart improvements: updated

kitchens and baths, better insulation, improved layout flow, or adding living space. Some buyers also explore

renovation-focused financing that allows improvements as part of the mortgage processuseful if the home is solid

but dated.

Renovation reality check: always assume projects will cost more and take longer than your most optimistic estimate.

This isn’t negativity. This is math wearing a hard hat.

Which One Fits You? A Simple Decision Framework

New construction might be your best match if…

- You want a modern floor plan and newer systems with fewer immediate repairs.

- You prefer predictable maintenance in the first few years.

- You like community amenities and don’t mind newer landscaping or ongoing construction nearby.

- You want energy efficiency and comfort right away.

- You’re okay with HOA rules and a neighborhood still “coming online.”

An older/existing home might be your best match if…

- You care most about location, established neighborhoods, and mature trees.

- You love unique architecture and don’t need everything to be “open concept.”

- You’re comfortable budgeting for upgrades and prioritizing repairs.

- You want renovation potential and a chance to build equity through improvements.

- You’re willing to investigate more (inspection, disclosures, specialized evaluations when needed).

The “third option” many buyers forget: a newer resale home

Homes that are roughly 5–15 years old can offer a sweet spot: modern-ish layouts and systems, established yards,

and fewer “brand-new neighborhood” unknowns. You may also get real utility bill history and a clearer picture of

how the home performs through seasons.

Specific Examples: What the Tradeoffs Look Like in Real Life

Example 1: The 2026 new-build townhome

You get: low-maintenance exterior, modern kitchen, newer HVAC, better baseline insulation, and often a builder

warranty. You trade: HOA rules, smaller yard, closer neighbors, and potentially a longer commute. Your first-year

surprise expense may be blinds, a washer/dryer upgrade, and landscaping the “backyard” that currently looks like a

spreadsheet.

Example 2: The 1958 ranch in an established neighborhood

You get: a larger lot, mature trees, and a neighborhood where everything you need is already built. You trade: a

higher chance the electrical panel needs updating, the attic insulation is thin, and the bathrooms are “vintage” in

the way that makes you politely avoid eye contact with the tile.

Example 3: The 1924 craftsman with “original charm”

You get: incredible character, built-ins, and curb appeal that makes strangers compliment your porch. You trade:

ongoing maintenance, higher likelihood of specialized repairs, and renovation constraints if you want to preserve

historic features. It can be totally worth itif you budget like an adult and inspect like a detective.

Common Mistakes to Avoid (No Matter Which You Choose)

-

Skipping the inspection. Even in hot markets, find a way to reduce riskpre-inspections or

targeted evaluations can help. -

Falling in love before you do the math. Your heart can pick the house; your spreadsheet should

approve the relationship. -

Underestimating “small” projects. Paint, flooring, and landscaping add up fastespecially if

you’re paying for labor. -

Ignoring resale realities. Layout, location, school district trends, and neighborhood stability

matter when you sell, even if you swear this is your “forever home.” -

Not planning for maintenance. Every home needs upkeep. The only question is whether it’s baked

into your plan or shows up as a surprise guest.

Conclusion: The Best Home Is the One That Fits Your Life

Choosing between a new home and an older home isn’t about picking the “right” categoryit’s about choosing the set

of tradeoffs you can live with happily. New construction often rewards buyers who value efficiency, modern layouts,

and predictability. Older homes often reward buyers who value location, character, and the ability to customize over

time.

If you want a grounded way to decide, focus on three questions:

(1) What lifestyle do I want daily (commute, walkability, space)? (2) How much

uncertainty can I tolerate (repairs, timelines, warranties)? (3) What’s my realistic budget after

move-in (not just at closing)?

Answer those honestly, and the “new vs. old” debate gets a lot less dramaticmore like a useful strategy session,

and less like a group chat argument fueled by house-hunting adrenaline.

Experiences Buyers Commonly Share (500+ Words of Real-World Flavor)

Because the decision is emotional as well as financial, it helps to hear the kinds of experiences buyers frequently

describe when they compare new homes and older homes. These aren’t one-size-fits-all truthsmore like recurring

themes that show up again and again.

1) “The new home felt easy… until we priced out the ‘not included’ list.”

Many new-home buyers say the first few weeks feel blissfully uneventful: everything works, nothing leaks, and the

breaker panel doesn’t look like a museum exhibit. Then the practical add-ons arrive. Blinds for an entire house,

fencing for a yard, a fridge upgrade because the included one is… fine, and a patio because “we bought outdoor

furniture and realized we have nowhere to put it.” The takeaway: new homes can reduce repair stress early on, but

they often shift spending toward finishing touches and personalization.

2) “Our older home had charm, and also a surprising number of opinions.”

Buyers of older homes often talk about the joy of unique details: arched doorways, solid wood doors, built-ins,

original trim. They also talk about “opinions” the house haslike the upstairs bedroom that’s always warmer, the

bathroom fan that sounds like it’s training for a marathon, and the closet that seems designed for a world where

people owned exactly three shirts. Many buyers say the key to happiness is embracing a phased approach: handle the

safety and major system needs first, then tackle comfort and cosmetic updates over time. That pacing turns

overwhelm into progress.

3) “We thought the warranty would handle everything. It handled… some things.”

New-home buyers often appreciate having a clear path for fixes, especially during the first year. But a common

experience is learning that warranties have boundaries. Cosmetic items may have tight timelines, and some issues

require persistent documentation, follow-ups, and patience. The happiest buyers are usually the ones who treat the

warranty like a helpful toolnot a magic wand. They keep a simple log of concerns, take photos, attend walk-throughs

with a checklist, and address small problems early before they become big ones.

4) “The inspection saved useither by negotiating, or by letting us walk.”

Across both new and older homes, buyers routinely say inspections changed the outcome. Sometimes the inspection

reveals a manageable list that becomes a negotiation point. Other times it reveals a dealbreakeractive moisture,

major structural movement, or systems at end-of-life that weren’t priced into the purchase. Even buyers who adore a

house often say the best feeling is clarity: knowing what you’re signing up for and what the first few years are

likely to look like. That’s true whether you’re buying a 2026 build or a 1966 classic.

5) “Our final decision wasn’t about ageit was about our schedule and stress tolerance.”

One of the most consistent “experience lessons” is that the right choice depends on your bandwidth. Buyers with

demanding jobs, small kids, or limited time often lean new because they want fewer immediate projects. Buyers who

enjoy DIY (or at least don’t fear it), have flexible timelines, or want a prime location often lean oldereven

knowing it might require updates. The best outcomes happen when buyers align the house with their real lives. If

you’re already maxed out, a fixer-upper can feel like adopting three puppies at once. If you’re excited by projects,

an older home can feel like an investment and a creative outlet, not a burden.

Bottom line from buyer experiences: pick the home that fits your daily life and your stress budget. Square footage

is great, but peace of mind is also a featureand it should be on your must-have list.