Table of Contents >> Show >> Hide

- Why Homebuyers Are Racing To Lock In Mortgage Rates

- How Mortgage Rate Locks Actually Work (Without the Jargon)

- The Psychology Behind “Lock It Now Before It Gets Worse”

- Smart Strategies for Buyers in a Volatile Rate Market

- Risks Buyers Should Watch Out For

- Real-World Experiences: What Buyers Learn When Racing the Clock

- Bottom Line: Race Smart, Not Scared

If you feel like every conversation about buying a house now starts with, “So, what are rates doing today?”, you’re not imagining it. In a world where a single headline can move mortgage rates by a quarter of a percentage point, homebuyers are doing something very human: they’re racing to lock in a rate before it gets worse.

The good news? Rates are no longer at the brutal peaks we saw when 30-year fixed mortgages pushed past 7%. The bad news? They’re still high enough to hurt, and nobody has a crystal ball. That’s why buyers are refreshing mortgage apps like they’re checking the weather and calling their loan officers the minute they see even a tiny dip.

This article breaks down why homebuyers are in such a hurry to lock, how rate locks actually work, what this “race” means for the housing market, and how to be smart (not panicked) when you decide to lock your own mortgage rate.

Why Homebuyers Are Racing To Lock In Mortgage Rates

A snapshot of today’s mortgage rate reality

For context, the average 30-year fixed mortgage rate in late 2025 is sitting in the low-6% range. A year ago it was higher; a couple of years ago, it was often over 7%. Go back to the pandemic years and rates in the 2%–3% range were very real. That whiplash alone explains a lot of the current anxiety.

Even small changes in rates matter. On a $400,000 loan, the difference between 6.2% and 6.7% can be more than a hundred dollars a month in payment. Over 30 years, that’s tens of thousands of dollars. To a buyer who’s stretching to afford the monthly payment, that gap is the difference between “let’s write an offer” and “let’s renew the lease.”

So when buyers see headlines hinting at inflation surprises, Federal Reserve meeting drama, or bond yields spiking, they get nervous. When they see even a glimmer of downward movement, the phones light up: “Can we lock my rate now?”

The ghost of 7%+ still haunts the market

Rates over 7% in 2023 and 2024 weren’t just numbers on a chart; they froze a big chunk of the housing market. Many would-be buyers simply walked away, and many sellers decided not to list at all. Affordability hit a multi-decade low, and sales dropped to their weakest level since the mid-1990s.

That recent history is burned into everyone’s memory. Even though rates in the low-6% range are lower than those peaks, buyers are thinking, “If things go sideways again, we could be right back above 7%.” That fear makes today’s rate feel not just like a price, but a deadline.

How Mortgage Rate Locks Actually Work (Without the Jargon)

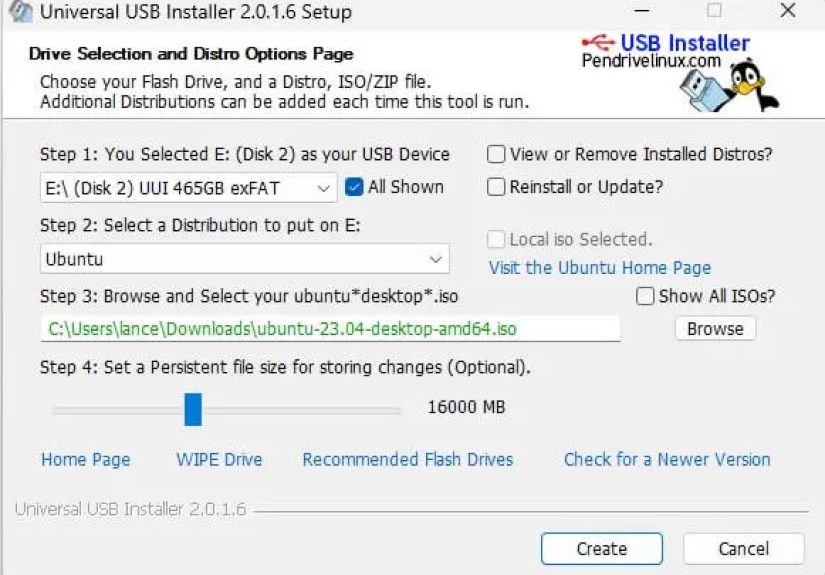

What is a rate lock?

A mortgage rate lock is simply an agreement between you and your lender: they promise to honor a specific interest rate and terms for a set period of time, usually while your loan is being processed. In return, you promise to keep moving forward with that lender and loan.

Think of it like reserving concert tickets. You’re saying, “Hold this price for me while I grab my wallet and finalize everything.” The lender is taking on the risk that rates move against them in the meantime.

Typical lock periods and what they mean

Most lenders offer lock periods like:

- 30-day lock: Common if you’re close to closing, with appraisal and underwriting nearly done.

- 45-day lock: A popular default for many purchases, enough time for inspections, appraisal, and paperwork.

- 60-day or longer lock: Helpful for new construction or more complex transactions, but often more expensive.

The longer your rate is locked, the more risk the lender is taking that the market moves. That’s why long locks can come with slightly higher rates or additional fees.

Extensions, float-downs, and fine print

If your closing is delayed, you may be able to extend your lock. That’s good news, but it’s usually not free. Expect a fee or a small adjustment to the rate. Some lenders also offer a “float-down” option, which lets you lower your rate once if market rates drop significantly during your lock period.

These features can be valuable in a volatile market, but they’re not automatic. Ask your lender up front:

- How long is the standard lock?

- What do extensions cost?

- Is a float-down option available, and when can it be used?

Reading that fine print now can save you from an expensive surprise later.

Pros and cons of locking early

Pros:

- You protect yourself if rates jump before closing.

- You gain peace of mind and can plan your budget more confidently.

- You avoid “payment shock” at the last minute.

Cons:

- If rates fall, you’re stuck unless you have a float-down or choose to start over with a new lender.

- Locking too early on a long, complicated transaction can mean paying extra for extensions.

- Some buyers become obsessed with trying to “time the bottom,” which can cause decision paralysis.

The key is balancing protection from rising rates with flexibility if rates drift down.

The Psychology Behind “Lock It Now Before It Gets Worse”

Fear of missing out on a “good enough” rate

Humans aren’t wired to optimize perfectly; we’re wired to avoid regret. In a mortgage context, that often means buyers would rather lock a rate that’s “good enough” today than risk missing it while hoping for the mythical perfect rate tomorrow.

There’s also something called “anchoring”: if you heard your friend complain about getting 7.25% last year, then 6.25% suddenly looks attractive. If your parents refinanced at 3%, every modern rate looks terrible. Your internal comparison point shapes how urgent that lock decision feels.

Lock-in effect: why current homeowners aren’t moving

Many existing homeowners refinanced into ultra-low sub-4% rates in 2020–2021. If they sell now, they don’t just lose their house; they lose that cheap mortgage and have to replace it with something in the 6% range. That “mortgage rate lock-in” effect makes them think twice about listing.

Fewer people listing their homes means fewer options for buyers. And when something attractive hits the market, competition is fierce. That, in turn, makes buyers more desperate to lock in a decent rate before someone else gets the same house and maybe a better deal on financing.

Smart Strategies for Buyers in a Volatile Rate Market

Step 1: Become “lock-ready” before you shop

The fastest way to feel less panicked about rates is to control what you can. That means:

- Boost your credit score: Pay down card balances, avoid new debt, and fix errors on your report. Even a modest score bump can improve your rate tier.

- Increase your down payment if possible: A bigger down payment can unlock better rates and lower mortgage insurance costs.

- Get full pre-approval, not just pre-qualification: A fully underwritten pre-approval tells you exactly what you can afford and lets you lock faster when you find the right house.

When you’re lock-ready, you’re not scrambling to gather tax returns while rates move. You can act decisively when the numbers make sense.

Step 2: Don’t day-trade your mortgage rate

Yes, mortgage rates move in response to the bond market, inflation data, and Federal Reserve signals. No, that does not mean you need to become a full-time bond trader to buy a house.

A healthier approach:

- Watch general trends rather than every tiny blip.

- Ask your lender or broker how rates typically move around key economic reports.

- Set a target payment range that fits your budget and lock when a rate comfortably keeps you inside that number.

If the payment works, the house is right, and your life circumstances line up, that’s usually a better signal than trying to guess what next month’s inflation print will do.

Step 3: Consider points, buydowns, and adjustable-rate options

When rates are elevated, more buyers look at tools to shrink the monthly payment, at least early on:

- Discount points: You pay more upfront at closing to “buy down” your interest rate for the life of the loan. This can be smart if you’re confident you’ll stay in the home for several years.

- Temporary buydowns (e.g., 2-1 buydown): Your rate is reduced for the first one or two years, then steps up to the full rate. Often, sellers or builders help fund these.

- Adjustable-rate mortgages (ARMs): These offer a lower initial rate for a fixed period (e.g., 5, 7, or 10 years) before adjusting. They can make sense if you know you won’t keep the loan long termbut they’re not for everyone.

Each option has downsides. If you move or refinance earlier than planned, you might not recoup the cost of points. If rates don’t fall later, that ARM adjustment can sting. This is a great time to run scenarios with a trusted loan officer or financial planner instead of guessing.

Risks Buyers Should Watch Out For

Locking too soon on the wrong house

In the rush to secure a decent rate, some buyers make a more fundamental mistake: locking on a property they’re not actually in love with. They feel pressured to “take something” before rates change again and end up compromising more than they wanted on location, size, or condition.

A better approach is to reverse the order: choose a home that genuinely fits your life first, then move quickly and strategically on the rate. A great rate on the wrong house still adds up to long-term frustration.

Underestimating closing delays and rate lock deadlines

Inspection issues, appraisal challenges, title problems, or builder delays can all push your closing date back. If your rate lock expires before you close, you may face fees to extend itor have to accept a higher market rate if conditions worsened.

Ask your agent and lender what a realistic timeline looks like for your specific transaction. On a new construction home with an uncertain completion date, a short lock can be risky unless the builder offers its own extended lock program.

Ignoring the refinancing option

One thing that gets lost in the panic is this: you’re not marrying your mortgage rate; you’re marrying the house. If your long-term numbers work at today’s rate and you plan to stay put, you can always plan to refinance later if rates come down.

Does that mean you should overextend yourself now? No. But it does mean you don’t have to chase perfection. A solid, affordable rate today with the option to refinance later will beat endlessly waiting for the absolute bottom that may never arrive.

Real-World Experiences: What Buyers Learn When Racing the Clock

Statistics and charts are useful, but the emotional reality of locking a mortgage rate really becomes clear when you listen to buyers themselves. Here are a few composite “stories” based on common experiences loan officers and real estate agents report.

Case 1: The couple who waited too long

Alex and Jordan started shopping when 30-year rates were about 6.1%. They felt that if they just waited another month or two, rates would surely slide under 6%. They saw a house they liked but decided to “hold off until after the next Fed meeting.”

The Fed came and went, inflation data surprised to the upside, bond yields spikedand within a couple of weeks, the rates they were being quoted jumped to around 6.6%. Their monthly payment estimate went up by more than $150, and that first house they liked? It sold to someone else who locked right away.

Lesson learned: perfect is the enemy of good. Alex and Jordan eventually bought a home later in the year, but they now say their new rule is simple: “If the payment fits our budget and we love the house, we lock.”

Case 2: The buyer who locked too early on new construction

Sophia was building a new home with an expected completion in four months. Her lender offered a long-term lock for a slightly higher rate and a fee. Fearing that rates would spike, she grabbed the long lock immediately.

Then the builder hit delaystwice. What started as a four-month timeline turned into seven. Sophia had to choose between paying extra to extend the lock again or letting it expire and taking the market rate.

To make things more awkward, by the time she was actually ready to close, market rates had drifted slightly lower than the expensive long lock she was paying to preserve. She ultimately let the lock go and opted for the new market rate, but the stress and extra costs stung.

Lesson learned: long locks can be useful, but only when your timeline is reasonably certain and the pricing makes sense compared to what you might realistically see in the market.

Case 3: The first-time buyer who focused on total payment

Marcus, a first-time buyer with student loans, took a different approach. Instead of obsessing over minor rate movements, he set a clear monthly payment ceiling, including estimated taxes, insurance, and HOA dues.

His lender quoted 6.4% at first, which pushed the payment a bit above his comfort zone. He worked on his credit, paid down a card, and saved a little more for closing costs. A few weeks later, after both his efforts and a small dip in market rates, he was able to lock at 6.2% with a modest seller credit.

The rate itself wasn’t dramatically different, but the monthly payment now fit his budget. Instead of waiting indefinitely for a fantasy 5% rate, he locked with confidence and left room in his budget for life’s other surprises.

Lesson learned: clarity beats prediction. Knowing your real payment comfort zone matters more than trying to guess whether rates will be 0.1% lower next month.

Case 4: The existing homeowner navigating lock-in and move-up plans

Then there’s the “locked-in” group: owners sitting on ultra-low 3% mortgages who’d love a bigger place but dread trading up to a 6% rate. Many ultimately decide to stay put and renovate instead, which is one reason home improvement spending remains strong.

But some families truly need to movemaybe for a new job, expanding family, or a major life change. One common strategy is to be brutally realistic about budget at the higher rate, then look for ways to offset the shock: a slightly smaller house, a different neighborhood, or negotiating seller credits to pay points.

Those who do move often come away with a more balanced perspective: yes, they miss the old low rate, but the new home better fits their life. And they remind themselves that refinancing later is on the table if rates trend down.

Lesson learned: sometimes the “race to lock in” is really a race to align your housing with your lifeeven if the new rate isn’t as pretty as the old one.

Bottom Line: Race Smart, Not Scared

Homebuyers are right to pay attention to mortgage rates. The difference between locking at 6.1% versus 6.7% is real money. But a rushed decision fueled only by fear can do more damage than a slightly higher rate ever will.

The smartest move in this environment is to control what you canyour credit, savings, and budgetthen act decisively when both the house and the payment make sense. Use rate locks as a tool to protect yourself, not as a trigger for panic.

If you treat the process like a marathon with a few fast sprints instead of one endless sprint from the moment you open a mortgage app, you’ll be much more likely to cross the finish line in the right home at a rate you can live with todayand improve on tomorrow if the market finally cooperates.