Table of Contents >> Show >> Hide

- Understanding Investment Cycles (Without Needing a PhD)

- What Is Diversification, Really?

- How Diversification Smooths the Ride Through Market Cycles

- Different Ways to Diversify (Beyond Just “Stocks and Bonds”)

- The Quiet Hero: Rebalancing

- Common Myths and Mistakes About Diversification

- A Wealth of Common Sense Approach

- Real-World Experiences: How Diversification Helps Investors Stay the Course

If you’ve ever checked your portfolio on a bad market day and felt your stomach try to escape through your shoes, congratulationsyou’ve experienced an investment cycle up close. Markets rise, fall, and occasionally throw a full-blown tantrum. The question isn’t whether these cycles will happen (they will); it’s whether your portfolio is built to survive them without you losing your cool or your long-term plan.

That’s where diversification comes in. At its core, diversification is a very practical way of saying, “Let’s not bet the entire farm on one horse, no matter how fast it looks right now.” It’s a simple idea with a big payoff: by spreading your money across different kinds of investments, you can smooth out the bumps of market cycles and give yourself a better chance of staying invested long enough to benefit from long-term growth.

In this article, we’ll unpack how diversification works, why it helps during market booms and busts, and how a “wealth of common sense” approach can keep you focused on the big picture instead of panicking over every headline. This is education, not personal financial advicethink of it as a friendly guide to help you understand the logic behind a calmer, more resilient portfolio.

Understanding Investment Cycles (Without Needing a PhD)

Investment cycles are the recurring patterns of growth, slowdown, decline, and recovery that markets go through over time. Stocks don’t move in a straight line. They surge in good times, slide during recessions or crises, and meander in between. Bond yields rise and fall as interest rates change. Real estate prices can boom in one decade and stagnate in the next.

These cycles are driven by many forceseconomic growth, inflation, interest rates, corporate profits, investor sentiment, and even geopolitical news. But from an individual investor’s perspective, you can simplify it: some periods are kind to your portfolio, and some are downright rude.

The problem arises when someone builds their portfolio around just one part of the cycle. For example, if you only look at a bull market and decide, “Stocks can only go up,” you might go 100% into equities. When the next downturn hits, that same portfolio can fall sharply, and the emotional stress may push you to sell at exactly the wrong time. A more diversified approach doesn’t stop downturns, but it can soften their impact so you’re not tempted to abandon your plan.

What Is Diversification, Really?

Diversification means spreading your investments across different assets, sectors, and sometimes regions so that no single bet can sink the entire ship. A diversified portfolio often includes a mix of:

- Stocks (equities) for long-term growth

- Bonds for income and stability

- Cash or cash equivalents for liquidity and short-term needs

- Possibly other assets like real estate, commodities, or alternatives, depending on the investor

Different asset classes tend to behave differently across market environments. Historically, stocks have offered higher long-term returns but with sharper ups and downs. High-quality bonds, on the other hand, usually move less dramatically and may even rise when stocks fall, especially in risk-off environments. By combining these in a single portfolio, you’re not eliminating risk, but you’re reshaping it.

Think of diversification like building a team. You wouldn’t field a basketball team of only centers or only point guards. You want players who excel in different situationsfast breaks, defense, shooting, rebounding. A portfolio works the same way across economic “seasons.”

How Diversification Smooths the Ride Through Market Cycles

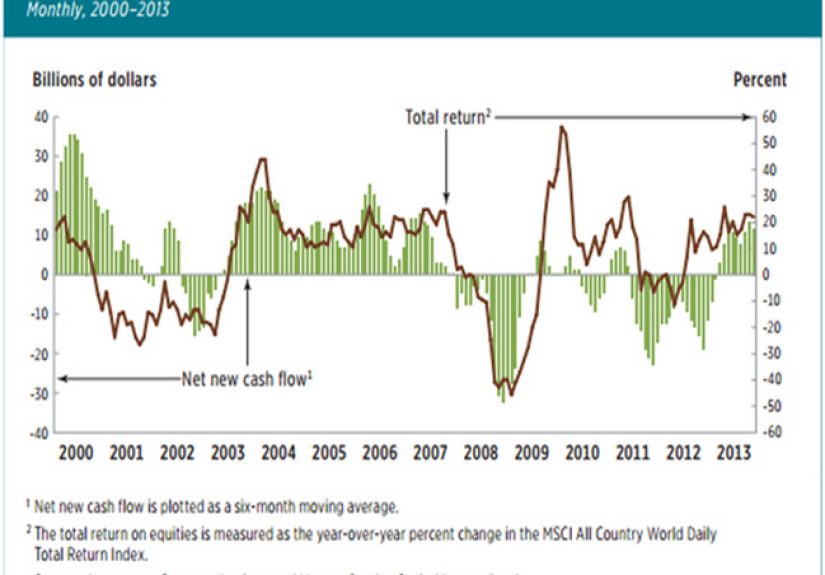

One of the clearest ways to see diversification at work is to compare a 100% stock portfolio with a blended portfoliosay, 60% stocks and 40% bondsover time. Historical research shows that while a pure stock portfolio may win in some long bull markets, a diversified mix often delivers more consistent returns with smaller drawdowns, especially across rolling 20- or 25-year periods.

During strong stock markets, the diversified portfolio may trail slightly because the bonds aren’t soaring the way equities are. But during severe downturns, bonds can act as a cushion. Instead of falling in lockstep with stocks, they may hold their value or even gain, reducing the overall decline of the portfolio. The result is a smoother return pathfewer huge peaks and fewer gut-wrenching valleys.

This smoothing effect matters for two big reasons:

- Behavior: It’s easier to stay invested with a portfolio that drops 20% than one that drops 50%.

- Math: Recovering from smaller losses requires less future gain. A 50% loss needs a 100% gain to break even; a 20% loss needs only 25%.

Over full market cycles, diversification helps you avoid being overly dependent on the timing of your start date. Two investors who begin investing just a few years apart can have very different experiences if one begins right before a bubble and the other after a crash. A diversified portfolio doesn’t make timing irrelevant, but it makes the outcome less extreme.

Different Ways to Diversify (Beyond Just “Stocks and Bonds”)

The classic stock-and-bond mix is a great starting point, but diversification can go deeper than that. Here are several layers where investors commonly diversify:

1. Across Asset Classes

A basic diversified portfolio might include:

- Domestic stocks for growth tied to the home economy

- International stocks to benefit from different economic cycles and currency movements

- Investment-grade bonds for income and stability

- Short-term cash or cash-like holdings to handle emergencies and short-term goals

Some investors also add real estate investment trusts (REITs), commodities, or other “alternative” assets that may respond differently to inflation or interest rate changes.

2. Within Asset Classes

Diversification isn’t just “stocks vs. bonds.” Within the stock portion, for example, investors often spread exposure across:

- Large-, mid-, and small-cap companies

- Different sectors like technology, healthcare, industrials, and consumer goods

- Growth and value styles

This helps avoid a “hidden concentration problem”being overly dependent on a handful of big names or a single hot sector. Recent concerns about index concentration have reminded investors that owning “the market” doesn’t always mean you’re truly diversified if most of your returns come from a small cluster of mega-cap stocks.

3. Across Regions and Economies

Economic cycles don’t hit every country at the same time. While one region is slowing, another might be recovering. International diversification can help you avoid tying your entire financial future to the fate of a single country or currency.

That doesn’t mean global investing is risk-freeforeign markets have their own volatilitybut it adds another layer of independence between your investments. The more your portfolio includes assets that don’t move in perfect sync, the better diversification can smooth its trajectory over time.

The Quiet Hero: Rebalancing

Diversification is a great start, but it’s not a “set it and forget it forever” strategy. Over time, market moves cause your asset mix to drift. If stocks outperform for several years, a 60/40 portfolio might quietly become 70/30 or 80/20. That higher stock weight means higher riskpossibly more than you intended.

Rebalancing is the process of periodically nudging your portfolio back to its target mix. That might mean selling some of the assets that have done well and buying more of the ones that lagged. Emotionally, this can feel oddyou’re trimming winners and adding to the less lovedbut mathematically it’s a disciplined way to “buy low and sell high.”

Regular rebalancing helps:

- Keep your risk level aligned with your long-term plan

- Prevent a single asset class from dominating your portfolio

- Reinforce a systematic, rules-based approach instead of gut-driven decisions

Many investors use calendar-based rebalancing (for example, once or twice a year) or threshold-based rebalancing (when an asset class drifts more than a set percentage from its target). Either way, rebalancing is how diversification stays intentional instead of drifting by accident.

Common Myths and Mistakes About Diversification

“If I Diversify, I’ll Never Get Big Gains.”

Diversification does not guarantee you’ll always top the charts. There will always be years when a concentrated beton one sector, one country, or one stockblows past a diversified portfolio. But the point of diversification isn’t to win every short-term race; it’s to stay in the game for decades.

A useful way to think about it: diversification accepts that you won’t always own the single best performer, but you’re also far less likely to own only the worst performer at the worst possible time.

“I Own Lots of Funds, So I Must Be Diversified.”

Holding many funds isn’t the same as being diversified. If several of those funds focus on the same sector, region, or style, you might just be layering fees on top of a concentrated bet. True diversification is about exposurewhat you actually own under the hoodnot just how many tickers appear on your statement.

“Diversification Eliminates Risk.”

Unfortunately, no. Diversification can’t eliminate market risk, economic shocks, or periods when almost everything seems to fall at once. What it does is reduce the impact of any single investment or category imploding on your entire plan. It’s a shock absorber, not a force field.

A Wealth of Common Sense Approach

The phrase “a wealth of common sense” captures the spirit of good diversification. You don’t need complicated formulas or exotic strategies to build a resilient portfolio. You need:

- A clear understanding of your time horizon and risk tolerance

- A reasonable mix of growth-oriented and stabilizing assets

- Broad, low-cost exposure across markets instead of chasing fads

- A discipline to stay invested through cycles and rebalance when needed

Markets will always move through phases of excitement, disappointment, and recovery. Diversification doesn’t make those cycles disappear, but it helps turn wild roller-coaster swings into something closer to rolling hills. The ride is still long, but a lot easier to stay on.

And ultimately, that’s the real power of diversification: it helps align your portfolio with human behavior. Most people don’t want to live in a state of constant financial adrenaline. They want a plan that feels sturdy enough to carry them through booms, busts, and everything in between.

Real-World Experiences: How Diversification Helps Investors Stay the Course

Concepts are nice. But diversification really clicks when you see how it affects real-world investor behavior. Below are some composite, illustrative examples based on common situations many investors face over multiple market cycles.

The All-In Stock Investor vs. the Balanced Investor

Imagine two friends who start investing at the same time. Alex is convinced that stocks are the only way to grow wealth and puts 100% of their money into an aggressive stock portfolio. Jordan chooses a balanced mix of 60% stocks and 40% bonds.

During a strong bull market, Alex brags regularly. Their account balance jumps rapidly, and Jordan’s portfolio, while growing nicely, looks a bit slower. It’s tempting for Jordan to think, “Maybe I should ditch the bonds and go all in, too.”

Then a deep bear market hits. Alex’s stocks fall sharply. A portfolio that once felt like a rocket ship now feels like an elevator with the cables cut. Watching the balance plunge week after week, Alex can’t sleep, constantly checks the news, and eventually sells a big chunk of the portfolio near the bottom just to stop the emotional pain.

Jordan’s diversified portfolio also declinesthere’s no magic herebut the bonds help cushion the fall. The hit is still uncomfortable, but not devastating. Because the losses are more manageable, Jordan doesn’t feel cornered into a panic sale. In fact, during a scheduled rebalance, Jordan sells a bit of the bond allocation that held up and buys more stocks at depressed prices. When the market eventually recovers (as it historically has after major downturns), Jordan fully participates in the rebound, while Alex has to decide whenor ifto get back in after selling low.

Over a full cycle, Jordan’s calmer, more diversified approach often results in better realized results, not because the mix is perfect, but because it’s easier to stick with.

The Near-Retiree Who Adjusted the Mix in Time

Consider Maria, who is 60 and planning to retire within five years. For most of her career, she invested heavily in stocks, which helped her grow her retirement savings. As she approached retirement, she gradually shifted part of her portfolio into bonds and cash equivalents, creating a diversified mix that could handle both growth and income needs.

When a sharp market downturn hits a year before her planned retirement date, the stock side of her portfolio falls, but the bond portion holds up reasonably well. Instead of feeling forced to delay retirement or cut her lifestyle drastically, Maria uses her more stable fixed-income holdings to cover expenses and avoid selling stocks at steep discounts. Diversification doesn’t make the downturn pleasant, but it gives her optionsand emotional breathing room.

Without that diversification, a heavily stock-weighted portfolio close to retirement could have put her plans at serious risk, especially if she needed to withdraw money at the worst possible time. Her “common sense” decision to diversify as retirement approached helped smooth the cycle when it mattered most.

Learning to Embrace “Boring” Consistency

Many investors secretly crave excitement from marketsuntil the excitement shows up as a double-digit loss. Over time, people who embrace diversification often learn to love “boring” portfolios that quietly compound in the background while they live their lives.

A diversified portfolio might not give you the thrill of a single stock that doubles in a year, but it also reduces the chance of waking up to a disaster because that stock missed earnings or a hot sector suddenly cooled off. The trade-off is simple: a little less drama, a lot more durability.

The real experience of diversification isn’t about never losing moneyevery investor faces losses at some point. It’s about transforming those losses from existential threats into manageable setbacks, the kind that don’t derail your long-term plan. That’s the “wealth of common sense” at work: building a portfolio designed not just for maximum theoretical return, but for long-term survival through every twist of the investment cycle.

Disclaimer: This article is for educational purposes only and does not constitute personalized investment, tax, or financial advice. Always consider your own circumstances and, if needed, consult a qualified financial professional.