Table of Contents >> Show >> Hide

- What is a prepaid card, exactly?

- The simple life cycle: load, spend, reload

- Prepaid vs. debit vs. credit: what’s the real difference?

- Fees: where prepaid cards can quietly get expensive

- Protections and safety: what happens if something goes wrong?

- Who should use a prepaid card?

- How to use a prepaid card like a pro

- Quick FAQs

- Real-World Experiences Using Prepaid Cards (The “Stuff You Only Learn After Tuesday” Section)

- Conclusion

A prepaid card is basically a spending container. You put money in, you spend money out. When it’s empty, it’s emptyno magical

“surprise debt” appears later like it can with a credit card. Think of it as a debit card’s cousin who refuses to overdraft on

principle and proudly says, “If it’s not loaded, it’s not happening.”

But prepaid cards aren’t all the same. Some are reloadable and meant for everyday use (often called “prepaid debit cards”).

Others are gift cards that are meant to be used up and tossed. And then there are payroll cards, government benefit cards, and

business prepaid cards with their own rules. In this guide, we’ll break down exactly how prepaid cards work, what happens behind

the scenes when you swipe or tap, what fees to watch, how protections work, and how to pick a good one without getting nickeled

and dimed into next Tuesday.

What is a prepaid card, exactly?

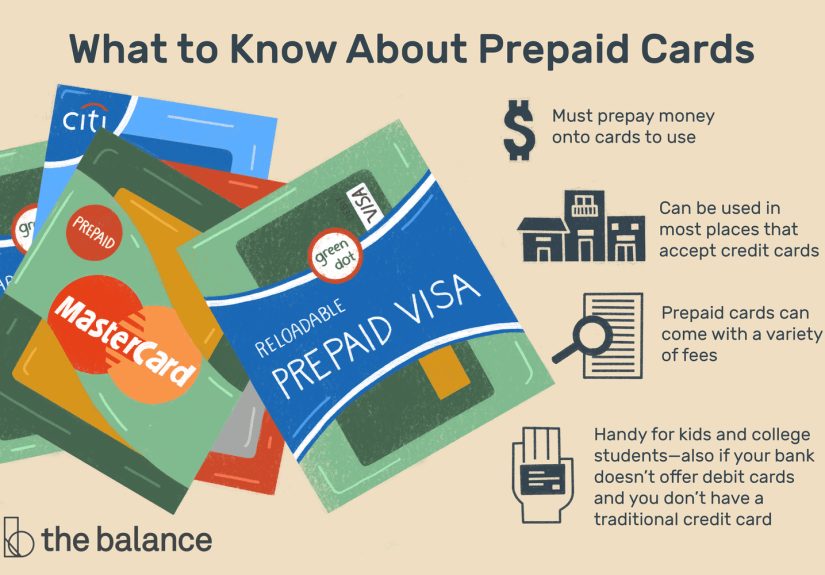

A prepaid card is a payment card that lets you spend money you’ve loaded onto it ahead of time. Most major prepaid cards run on

big payment networks (like Visa or Mastercard), so you can usually use them anywhere those networks are acceptedin stores, online,

and sometimes at ATMs.

Common types of prepaid cards

-

Reloadable prepaid cards (prepaid debit cards): Designed for repeat use. You can add money again and again via

direct deposit, bank transfer, cash reload, or other methods. -

Non-reloadable prepaid cards (gift cards): Often purchased for gifting. Many are “open-loop” (network-branded)

while others are store-specific. Protections can be limited if the card is unregistered or treated like cash. - Payroll cards: Employers can load wages onto these instead of using paper checks or direct deposit to a bank account.

- Government benefit cards: Used to distribute certain benefit payments (program rules vary).

- Prepaid business cards: Businesses may load funds for employees and set spending controls.

The simple life cycle: load, spend, reload

Step 1: You load funds onto the card

Loading money is what makes a prepaid card “prepaid.” Depending on the card, you might be able to add money through:

- Direct deposit: Paychecks, government payments, or other deposits sent electronically.

- Bank transfer: Moving money from a bank account to the prepaid account.

- Cash reload: Adding cash at certain retail locations or reload networks (often with a fee).

- Mobile deposit: Some cards offer features like depositing checks using your phone (availability varies).

- Transfers from another person: Some programs allow person-to-person transfers (rules and fees vary).

Many reloadable prepaid cards also come with an app where you can see balances, set alerts, lock the card, and track purchases.

Some even provide account and routing numbers so you can receive deposits and pay bills electronically (details depend on the issuer).

Step 2: You spend (swipe, tap, insert, or type the number online)

Using a prepaid card feels a lot like using a debit card. At checkout you’ll typically:

- Tap (contactless), insert (chip), or swipe (mag stripe).

- Choose credit or debit at the terminal (wording varies by terminal).

- Enter a PIN for some transactions, or sign/approve for others.

Online, you’ll enter the card number, expiration date, and security code. For some online purchases, having a registered billing

address on file can help the transaction go through (especially for merchants that verify address details).

What happens behind the scenes: authorization, holds, and settlement

Here’s the “invisible” part that explains why your balance can feel like it’s playing hide-and-seek:

- Authorization: The merchant asks the card’s issuer, “Is there enough money available?” If yes, the issuer approves.

- Hold: The approved amount may be placed on hold, reducing your available balance immediately.

- Settlement: The final charge is posted when the merchant completes the transaction (sometimes later that day, sometimes later).

The hold is especially noticeable in certain places. Gas stations may authorize more than your final purchase amount (because they

don’t know your exact total until you’re done pumping). Hotels often place a deposit hold for incidentals. Restaurants may authorize

a bit extra to account for a tip. None of this means the merchant “stole” your moneyusually it’s a temporary hold that settles to

the final amount. It does mean prepaid card users should keep a buffer, especially for travel and “hold-heavy” merchants.

Why a prepaid card might get declined even when you “have money”

Declines aren’t always about your total balance. Common reasons include:

- Available balance is lower because of holds that haven’t cleared yet.

- Merchant category restrictions (some cards limit certain transaction types).

- Online verification issues if a billing address isn’t set up for the card.

- Transaction limits (daily spending limits or ATM limits).

- Merchant places a high pre-authorization (hotels, car rentals, pay-at-the-pump).

There’s also something called a partial authorization on some network-branded prepaid cards. In certain cases,

if your balance is lower than the purchase amount, the system may approve what’s available and you pay the rest another way.

Not every store supports this, but it’s a nice “less awkward at checkout” feature when it works.

Step 3: You reload (if it’s reloadable)

With a reloadable prepaid card, you can add funds again and keep using it. This is what makes prepaid cards useful for ongoing

budgeting, allowances, or as an alternative for people who don’t want (or can’t get) a traditional checking account.

Prepaid vs. debit vs. credit: what’s the real difference?

Prepaid card vs. debit card

A traditional debit card is tied to a checking account at a bank or credit union. A prepaid card is funded in advance and may not

be tied to a traditional checking account in the same way. Practically speaking, both can be used to pay at merchants, but debit

cards typically integrate more fully with bank services (checks, broader bill pay options, branch deposits, etc.).

Prepaid card vs. credit card

Credit cards let you borrow money from the issuer and pay it back later (with interest if you carry a balance). Prepaid cards don’t

involve borrowingno interest charges, but also no credit line. That makes prepaid cards simpler for budgeting, but less helpful if

you need to build credit history or use credit-specific perks.

Do prepaid cards build credit?

Most prepaid cards do not build credit because you’re not borrowing. Some niche programs may offer credit-building

features by reporting certain activity, but if your primary goal is credit-building, a secured credit card is usually the more direct

tool. For prepaid, think “spending and budgeting,” not “credit score glow-up.”

Fees: where prepaid cards can quietly get expensive

Prepaid cards can be low-cost… or they can slowly snack on your money like a hamster with a cheese budget. The difference is almost

always in the fee schedule.

Common prepaid card fees to watch for

- Monthly maintenance fee: Sometimes waived with direct deposit or a minimum balance.

- Activation or purchase fee: You might pay to buy the card initially.

- Reload fee: Adding cash at a retail location can cost extra.

- ATM withdrawal fee: Your card may charge, and the ATM owner may charge too.

- Balance inquiry fee: Some programs charge for certain balance checks.

- Inactivity fee: A fee if you don’t use the card for a certain period.

- Replacement fee: If you lose it and need a new one.

- Foreign transaction fee: For purchases in other currencies or outside the U.S.

How to choose a low-fee prepaid card

Instead of hunting for “the best prepaid card” like it’s a mythical unicorn, focus on fit:

- If you can set up direct deposit, look for a card that waives the monthly fee with deposits.

- If you need cash access, check the ATM network and out-of-network charges.

- If you reload with cash, compare reload locations and reload fees.

- Look for clear, upfront disclosures and an app that shows available balance (including holds).

A good rule: if the fee schedule reads like a restaurant menu where everything costs extraincluding the air you breathekeep shopping.

Protections and safety: what happens if something goes wrong?

Registering matters more than people think

Many prepaid cards work better (and are safer) when registered. Registration often means linking your name and information to the

account so the issuer can identify you. Practical benefits can include:

- Better ability to replace funds if the card is lost or stolen (depending on the program).

- Access to features like direct deposit and higher limits (varies by issuer).

- Improved verification for online purchases (billing address, identity checks).

Error resolution and unauthorized transactions

Consumer protections can apply to certain prepaid accounts, including rules around how issuers handle errors and unauthorized

transfers. In plain English: if something suspicious happens, you generally want to report it quickly, keep documentation, and follow

the issuer’s dispute process. Timing matterswaiting weeks to report a problem is like waiting weeks to tell a lifeguard you’re

drowning. Not ideal.

If your prepaid card is network-branded (Visa/Mastercard), it may also be eligible for network policies related to unauthorized

transactions. These policies can have conditions and exceptionsespecially for anonymous or unregistered prepaid/gift cardsso always

check your card’s specific terms.

Is the money on a prepaid card FDIC-insured?

Sometimes, yesbut not automatically. FDIC insurance generally protects deposits if an FDIC-insured bank fails, and whether

your prepaid funds qualify can depend on how the program is structured and whether you’ve registered the card so you can be identified.

Translation: if FDIC coverage matters to you, read the issuer’s disclosures and register the card.

Scams: the part where gift cards ruin everyone’s day

Prepaid gift cards in particular are popular with scammers because they can function like cash once the code is stolen. Common

problems include tampered packaging in stores and scams where someone pressures you to pay a “bill” with gift cards (spoiler:

legitimate organizations don’t demand gift card payments).

Smart habits:

- Inspect packaging before buying a gift card (avoid anything that looks peeled, scratched, or resealed).

- Keep the receipt and register the card if the program allows it.

- Never pay a stranger (or a “boss,” “IRS agent,” or “tech support”) with gift cards.

- Use account alerts and freeze/lock features if your card app offers them.

Who should use a prepaid card?

Great use cases

- Budgeting: Load a set amount for groceries, entertainment, or subscriptions.

- Teen and college spending: A controlled way to learn spending habits without a credit line.

- Online shopping safety: Use a prepaid card with limited funds for one-off purchases.

- Alternative to checking: For people who are unbanked or prefer not to use a traditional bank account.

- Travel spending bucket: A dedicated card for travel spending (keep extra buffer for holds).

When to skip it

- If the card’s fees are high and you can access a low-fee checking account instead.

- If you frequently rent cars or book hotels and don’t want to manage authorization holds.

- If your main goal is building credit history (a secured credit card is often better).

How to use a prepaid card like a pro

Setup checklist

- Read the fee schedule before buying or activating.

- Register the card (if it’s reloadable and registration is available).

- Set your PIN and enable security alerts (text/email/push notifications).

- Load funds strategically (direct deposit or bank transfer can be cheaper than cash reloads).

- Keep a buffer for tips, gas, hotels, and other authorization holds.

- Track “available balance” (not just “current balance”) to avoid surprise declines.

Example: a simple budget system with a prepaid card

Let’s say you’re trying to stop your “small treats” from becoming a “why is my account empty?” situation.

You could load $120/week onto a prepaid card and use it only for restaurants and takeout. When it’s gone, it’s gone.

The card becomes a friendly boundary that doesn’t judge youunlike your budgeting spreadsheet, which absolutely judges you.

Quick FAQs

Can you overdraft a prepaid card?

Typically, prepaid cards don’t let you spend more than what’s loaded. Some programs may offer optional overdraft or credit features,

but those are separate and come with their own rules and costs. If avoiding overdraft is your goal, prepaid can be a good fitjust

make sure you understand the terms.

Can I use a prepaid card internationally?

Many network-branded prepaid cards can be used anywhere the network is accepted, but foreign transaction fees and ATM fees can apply.

Also, travel merchants may place larger authorization holds. If you plan to travel, check the card’s fee schedule and consider keeping

a backup payment method.

Do prepaid cards work for subscriptions and free trials?

Sometimes yes, sometimes no. Some merchants require a card that can handle certain verification steps. Also, subscriptions can place

small verification charges or holds. If you’re using prepaid to control subscriptions, keep a small cushion so a $0.00 “verification”

doesn’t accidentally trigger a decline at the worst time.

Real-World Experiences Using Prepaid Cards (The “Stuff You Only Learn After Tuesday” Section)

The internet is full of perfect, sterile examples where every transaction posts instantly and nobody ever forgets a PIN. Real life is

messierand that’s where prepaid cards get interesting. Here are a few lived-experience style scenarios that show how prepaid cards

actually behave out in the wild.

1) The “I’m budgeting, not punishing myself” routine

A common win: using a reloadable prepaid card as a weekly spending lane. One person loads a fixed amount every Fridaysay $150 for

fun spending (coffee, lunch, random “I deserve this” purchases). It’s not about deprivation; it’s about clarity. When you pay with one

card for your flexible spending, you stop guessing where the money went. The app becomes a reality check, and the balance becomes a

natural “slow down” signal. The biggest lesson? Set alerts. A low-balance notification is way less embarrassing than the “declined”

beep at checkout while you pretend it’s the card reader’s fault.

2) The hotel hold that made someone swear off travel forever (briefly)

Another real-world moment: someone books a hotel using a prepaid card because it’s “already funded.” The front desk places an

authorization hold for incidentals. Suddenly the card’s available balance drops, and the traveler can’t pay for dinner because the card

looks tapped outeven though the actual stay cost hasn’t fully posted yet. The fix isn’t complicated: keep extra buffer funds (or use

a different payment method for lodging). But the emotional experience is very real: “Why is my money trapped in a hotel dungeon?”

Prepaid cards can work for travel, but only if you plan for holds and timing.

3) The teen allowance system that saved a lot of arguments

Parents often like prepaid cards for teens because they can load allowances without linking to a primary checking account. The “argument

reduction” comes from boundaries. Instead of debating every purchase, the conversation shifts to planning: “You’ve got $40 loaded this

week. If you want the $25 hoodie, that leaves $15 for everything else.” The card becomes a teaching tool that’s immediate and concrete.

One parent noted the best part wasn’t controlit was predictability. And yes, there was still one classic moment where a teen

tried to buy snacks at a gas station pump and learned what an authorization hold is. Budget education, delivered by the universe.

4) The freelancer who separated “business subscriptions” from “life money”

Freelancers and side-hustlers sometimes use prepaid cards to isolate recurring business expensessoftware tools, ad spend, domain

renewals, and those subscriptions you swear you’ll cancel next month. Loading a monthly amount creates a ceiling. If a vendor raises

a price or a forgotten subscription tries to renew, the transaction might fail instead of quietly draining the main account.

The pro tip from this experience: keep a small cushion and review transactions weekly. The goal is not to break your toolsit’s to

prevent surprise charges from breaking your budget.

5) The “online shopping safety” strategy

Some people use prepaid cards as a “risk buffer” for online purchases: load only what you plan to spend, then use that card online.

If a merchant gets compromised, the exposure is limited. This strategy works best when the prepaid card is registered and offers solid

account tools (alerts, transaction history, card lock). The lesson learned: it’s not a magic shield, but it can be a smart layer.

Also, keep receipts and screenshots for any disputesprepaid disputes can be straightforward when you have documentation, and painful

when you don’t.

In other words, prepaid cards are neither perfect nor pointless. They’re tools. If you understand the mechanicsloading methods,

authorization holds, fees, and protectionsyou can use them to budget better, separate spending, and reduce financial chaos. If you

ignore the fine print and treat the card like it’s “just a gift card with dreams,” you may end up donating money to fees and holds.

Use it intentionally, keep a buffer, register when it makes sense, and you’ll get the best of what prepaid cards can offer.

Conclusion

Prepaid cards work by letting you spend money you’ve already loadedno borrowing, no interest, and (usually) no overdraft. The key is

understanding how transactions and holds work, choosing a card with a fee structure that matches your habits, and using registration

and alerts to boost security. Used well, a prepaid card can be a practical budgeting tool, a safer online-spending option, or a simple

alternative to traditional banking for everyday purchases.