Table of Contents >> Show >> Hide

- The 4 Core Ways Real Estate Makes You Money

- Choose Your “Common Sense” Lane: Active vs. Passive

- Run the Numbers Like a Slightly Paranoid Adult

- Leverage: The Cheat Code That Can Also Delete Your Save File

- Financing That Actually Makes Sense (Especially at the Start)

- Taxes: The Part Everyone Loves… Until It Gets Complicated

- Landlording Without Lawsuits: Common-Sense Compliance

- Finding Deals: The Boring Stuff That Makes You Rich

- Flipping: How People Make Money Fast (and Sometimes Lose It Faster)

- REITs: Real Estate Exposure Without the Midnight Plumbing

- A Wealth of Common Sense: 12 Rules That Travel Well

- Experiences From Real Investors: What Actually Happens After You Buy (500+ Words)

- Conclusion

Real estate is one of the few wealth-building tools that can pay you in multiple ways at the same time:

monthly cash flow, long-term appreciation, a loan that gets smaller while your asset (hopefully) gets bigger,

and tax rules that can feel like a secret level in a video game (with extra fine print and a few boss fights).

But “making money in real estate” isn’t a single strategy. It’s a menu. Some options are hands-on (think: toilets

staging a surprise water park). Others are hands-off (think: buying REIT shares like you’re ordering real estate

on a drive-thru menu). The common-sense part is choosing a lane that fits your time, temperament, and risk tolerance

then running the numbers like your future self is counting on you. Because… they are.

If you’re under 18, consider this a learning-and-planning playbook: real estate contracts are legally binding,

and in most cases you’ll need an adult to sign or co-sign. The upside? You can still build “real estate IQ” now:

analyze deals, learn markets, understand financing, and develop money habits that make the first purchase far less scary.

The 4 Core Ways Real Estate Makes You Money

1) Cash flow (income that shows up while you sleep)

Cash flow is what’s left after rent comes in and expenses go outmortgage, taxes, insurance, maintenance, repairs,

property management, HOA fees, utilities (sometimes), and vacancy. Positive cash flow means the property pays you.

Negative cash flow means you’ve adopted a building that eats money.

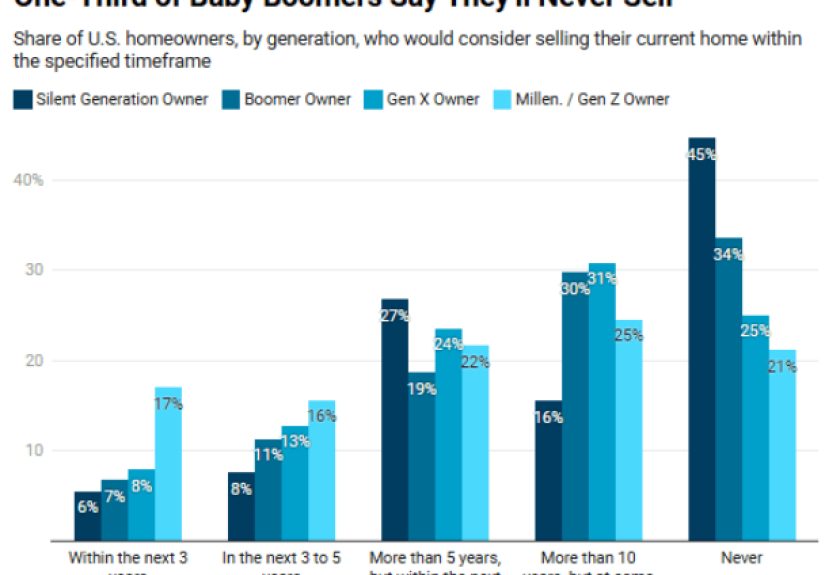

2) Appreciation (the property is worth more later)

Appreciation can come from broad market growth (your neighborhood gets hotter) and from inflation over time

(replacement costs rise). It can also be painfully uneven: some markets sprint, others nap.

Common sense says you shouldn’t depend on appreciation to make a deal worktreat it like dessert, not dinner.

3) Forced appreciation (you create value)

This is the “make it nicer, make it earn more” path: add a bedroom, modernize a kitchen, improve curb appeal,

or upgrade systems that reduce future headaches. When improvements increase net operating income (NOI),

the property can become worth more even if the overall market is flat.

4) Loan paydown (tenants help pay your mortgage)

Each month, part of the mortgage payment reduces the loan balance. Over time, tenants can help you build equity.

It’s not glamorous, but it’s powerfullike compound interest wearing work boots.

Choose Your “Common Sense” Lane: Active vs. Passive

Active real estate (you work for the return)

- Buy-and-hold rentals: Single-family homes, condos (with HOA rules), small multifamily (duplex/triplex/fourplex).

- House hacking: Live in one unit (or rent rooms) and let rent offset your payment.

- Fix-and-flip: Buy distressed, renovate fast, sell. Higher potential reward, higher “surprise invoice” risk.

- Short-term rentals: Can outperform long-term rent, but pricing, regulations, and seasonality matter.

- Private lending / hard money (advanced): You lend to investors. Returns can be attractive, but underwriting matters a lot.

Passive real estate (you outsource the work)

- Public REITs: Real estate exposure via the stock market.

- REIT funds/ETFs: Diversified baskets of REITs.

- Private real estate funds / syndications: Potentially higher returns, but less liquidity and more due diligence.

The best lane is the one you can stick with long enough to get good at it. The “perfect” strategy you abandon after

three months is just a hobby with paperwork.

Run the Numbers Like a Slightly Paranoid Adult

Real estate rewards optimism… and punishes magical thinking. Before you buy anything, build a simple model that assumes:

things break, tenants move, and the world occasionally gets weird.

The 3 returns you should understand (without needing a finance degree)

- Cap rate: NOI ÷ purchase price. (NOI = rent minus operating expenses, before mortgage.)

- Cash-on-cash return: Annual cash flow ÷ cash invested (down payment + closing costs + initial repairs).

- Total return: Cash flow + appreciation + principal paydown (minus big surprises).

A simple example (numbers rounded for sanity)

Let’s say you buy a small duplex for $350,000. You put down 25% ($87,500).

Closing costs and initial repairs total $12,500. Your total cash in the deal: $100,000.

Rent is $1,600 per unit = $3,200/month ($38,400/year).

You budget operating expenses (taxes, insurance, maintenance, reserves, vacancy, maybe management) at 40% of rent.

That’s $15,360/year. So your NOI is about $23,040/year.

If the mortgage and interest cost you $18,000/year (varies by rate/loan), your pre-tax cash flow is about

$5,040/yearor 5.0% cash-on-cash on $100,000 invested.

Not life-changing in year one, but you also get principal paydown, potential rent growth, and long-term value creation.

The common-sense test: Does the deal still look OK if your vacancy is worse, repairs cost more, and rent grows slower?

If the deal only works in the “everything goes perfectly” universe, it’s not investingit’s wishcasting.

Leverage: The Cheat Code That Can Also Delete Your Save File

Mortgages are a superpower because they let you control a large asset with a smaller amount of cash. If a $350,000 property

rises 3% in value, that’s $10,500 of appreciation. If you invested $100,000 total cash, that’s a meaningful percentage gain.

The catch: leverage magnifies losses too. If rents fall, expenses rise, or you have a major vacancy, the mortgage payment

does not care about your feelings.

Common-sense leverage rules

- Keep reserves: Many experienced landlords keep 3–6 months of expenses set aside (more for older buildings).

- Budget closing costs: Buyers often pay thousands upfront for fees, services, and escrow itemscommonly a few percent of the loan.

- Stress test: Assume at least one “bad month” every year (vacancy, repair, or both).

Financing That Actually Makes Sense (Especially at the Start)

Owner-occupied advantages (the “beginner-friendly” route)

One of the most practical ways to start is to live in the property (house hack) and rent out extra rooms

or the other unit(s). Many loan programs are more favorable for primary residences than investment properties.

Some government-backed programs allow low down payments for qualified borrowers on 1–4 unit homesprovided you live there.

Investment property financing (more cash, more rules)

Investment loans often require higher down payments, stronger cash reserves, and sometimes higher rates.

This can still be a great pathbut only if the deal can stand on its own without heroic rent assumptions.

Taxes: The Part Everyone Loves… Until It Gets Complicated

Real estate has unique tax features, but the common-sense approach is: learn the basics, then use a tax professional.

Here are the big concepts investors should understand before making decisions.

Depreciation (a “paper expense” that can reduce taxable income)

In many cases, residential rental buildings are depreciated over 27.5 years. Depreciation can reduce taxable rental income

even if the property is cash-flow positive. However, depreciation rules are technical, land value isn’t depreciated the same way,

and depreciation can affect taxes when you sell (depreciation recapture).

1031 exchanges (deferring taxes by swapping investment property)

A like-kind exchange under Section 1031 can allow you to defer capital gains tax when exchanging real property held for investment

or business use for other qualifying real property. There are strict timelines and documentation rules, and it’s not designed for quick flips.

Home sale exclusion (Section 121: primary residence rules)

If you sell your primary residence and meet certain requirements, you may be able to exclude up to $250,000 of gain

($500,000 for married couples filing jointly). This is one reason “live-in renovations” can be compellingwhen done legally and thoughtfully.

Passive activity limits and “at-risk” rules

Rental real estate often falls under passive activity rules, which can limit how losses offset other income depending on your situation.

These rules are very real, very specific, and very annoying to learn the hard way.

Landlording Without Lawsuits: Common-Sense Compliance

Real estate income is great. Legal problems are not. A few essentials:

Fair housing basics

Federal fair housing law prohibits discrimination in housing based on protected characteristics (including race, color, national origin,

religion, sex, familial status, and disability). Many states and cities add additional protections. Build a consistent screening process,

apply it the same way to everyone, and keep good records.

Lead-based paint disclosures (older homes)

If you rent or sell certain housing built before 1978, federal rules may require disclosures about known lead-based paint and lead hazards

and providing an informational pamphlet. Even if you’re not doing renovations, disclosure rules can still apply.

Lease, maintenance, and safety

Use a solid lease that matches your state’s requirements. Handle repairs promptly. Keep the property safe. In real estate,

“maintenance later” is how you accidentally invent “maintenance emergency.”

Finding Deals: The Boring Stuff That Makes You Rich

Start with a “buy box”

- Property type (single-family, duplex, small multifamily)

- Neighborhoods you understand (or can learn deeply)

- Price range you can actually finance

- Minimum cash flow target (or house-hack savings target)

Use conservative assumptions

Investors get into trouble by using optimistic rent estimates, ignoring operating expenses, and assuming “maintenance will be minimal.”

It won’t. Buildings are like pets: they’re lovable, expensive, and they will eventually need something at 2 a.m.

Value-add that makes sense (not HGTV fantasy math)

A smart renovation is one that increases rent and reduces future problems without turning your rental into the Taj Mahal on a starter-home street.

Paint, flooring, lighting, landscaping, and functional kitchens/baths often pay off. Luxury custom everything usually doesn’t.

Flipping: How People Make Money Fast (and Sometimes Lose It Faster)

Fix-and-flips can work, but they’re not “easy money.” The common-sense flip formula is:

- Buy right: Most profit is made at purchase. If you overpay, no backsplash can save you.

- Control scope: Don’t “improve” your way into bankruptcy. Focus on what buyers actually pay for in that neighborhood.

- Know holding costs: Interest, utilities, insurance, property taxes, permits, and time all cost money.

- Have a Plan B: If the market cools, can you rent it out and break even?

If you can’t answer “What if it doesn’t sell in 90 days?” without sweating, you may be flipping your emergency fund.

REITs: Real Estate Exposure Without the Midnight Plumbing

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate. Public REITs trade on stock exchanges,

making them relatively liquid compared to owning a building.

Why REITs can be a common-sense option

- Diversification: You can own exposure to many properties instead of one address.

- Liquidity: Shares can typically be bought/sold quickly (market hours apply).

- Lower hassle: No tenants, no repairs, no lease renewals (just market risk).

REIT risks to respect

- Market volatility: Public REIT prices can swing like other stocks.

- Interest-rate sensitivity: Rising rates can pressure some real estate sectors.

- Non-traded REIT complexity: These can be illiquid for long periods and may carry high feesread disclosures carefully.

A Wealth of Common Sense: 12 Rules That Travel Well

- Buy cash flow, not compliments. A pretty property isn’t automatically a profitable one.

- Leave room for error. Underwrite conservatively; profit loves a margin of safety.

- Reserves are part of the deal. If you can’t afford reserves, you can’t afford the property.

- Time is a cost. DIY everything is only “free” if your time is worth $0 (it isn’t).

- Tenant quality matters. Great tenants turn real estate into a business. Bad tenants turn it into a reality show.

- Don’t fight math. If the numbers don’t work, walk.

- Location isn’t a clichéit’s a lever. It drives rent demand, resale demand, and long-term stability.

- Small multifamily can be a cheat code. Multiple income streams reduce vacancy risk.

- Plan your exit before you enter. Sell, refi, rent long-term, or live thereknow the options.

- Respect legal basics. Fair housing and disclosures aren’t “tips,” they’re requirements.

- Taxes are a tool, not a strategy. Don’t buy a bad deal for a deduction.

- Play the long game. Most real estate fortunes are built slowly, then noticed suddenly.

Experiences From Real Investors: What Actually Happens After You Buy (500+ Words)

Since I don’t have personal lived experience, this section is based on patterns and lessons that landlords, homeowners,

and long-time investors commonly sharewhat tends to surprise people, what tends to go right, and what tends to go wrong.

Think of it as “field notes,” not a fairy tale.

Experience #1: The first repair always arrives faster than you expect.

Many first-time landlords say the property behaves perfectly during the inspection period, then immediately develops a personality.

A dishwasher leaks. A ceiling fan wobbles. A “minor drip” becomes a “major drip with ambition.” The lesson isn’t that rentals are cursed;

it’s that systems age on schedules you don’t control. The common-sense response is a maintenance reserve and a simple rule:

if the building has moving parts, it will eventually audition for your attention.

Experience #2: Vacancy feels like a speedrun of all your financial fears.

A vacant unit is a strange kind of stress because the expenses keep coming while income doesn’t. Investors who survive this phase

usually do two things well: they budget vacancy from day one, and they don’t procrastinate on leasing. They take better photos,

write clearer listings, respond quickly, and schedule showings like it’s their second jobbecause in that moment, it is.

A common quote from seasoned landlords: “You don’t make money when it’s rented; you make money when you keep it rented.”

Experience #3: Tenant screening is where the real business starts.

New landlords often focus on countertops and paint colors. Experienced landlords focus on screening criteria, documentation,

and consistency. The story you hear again and again is that one bad tenant can erase a year of profit through unpaid rent,

damages, and legal costs. The common-sense takeaway: set a clear standard (income, rental history, references),

apply it consistently, and don’t let urgency override judgment. “But they seemed nice” is not a screening method.

Experience #4: The best deals aren’t always the flashiestthey’re the calmest.

Many investors report that their most profitable properties weren’t dramatic flips or ultra-trendy areas.

They were boring rentals in steady neighborhoods with reliable demand. Think: close to jobs, schools, transit,

or major services. Over time, “boring” becomes “predictable,” and predictable becomes “profitable.”

The property that never makes you panic at 11 p.m. is often the one that quietly builds net worth.

Experience #5: The emotional cycle is realespecially in year one.

People often describe a pattern: excitement at closing, a small wave of regret during the first repair,

confidence when the unit rents, then a steady calm as routines form. The point is that discomfort is normal.

Real estate is a business with learning curves. Common sense says you should expect a few bumps, not interpret them

as proof you made a terrible decision. If the fundamentals are soundconservative numbers, adequate reserves,

and manageable leveragetime tends to turn early anxiety into experience.

The big “experience-based” insight is simple: most real estate success is operational excellence.

The spreadsheets matter, but so does responding to issues, maintaining the property, communicating clearly,

and running the business consistently. If you do the boring stuff well, the money-making part often becomes

a byproductnot a miracle.

Conclusion

Making money in real estate isn’t about finding a mythical “no-money-down, zero-risk, guaranteed” deal. It’s about stacking

sensible advantages: buying with a margin of safety, managing leverage, budgeting honestly, respecting legal requirements,

and choosing a strategy you can repeat. Real estate can build wealth through cash flow, appreciation, forced value creation,

and loan paydownbut only if you treat it like a business, not a lottery ticket with shingles.

![GEO, AEO, LLMO: Separating Fact from Fiction & How to Win AI Search [MozCon 2025 Speaker Series] - Moz](https://2quotes.net/wp-content/uploads/2026/02/geo-aeo-llmo-separating-fact-from-fiction-how-to-win-ai-search-mozcon-2025-speaker-series-moz-ebcxNHY8-thumb.jpg)