Table of Contents >> Show >> Hide

- The “destination” problem: why people get stuck on the “what”

- Step 1: Define your destination in plain English

- Step 2: Build the launchpad (cash flow + emergency fund)

- Step 3: Match investments to the trip (time horizon + risk tolerance)

- Step 4: Create the map (asset allocation, diversification, and rebalancing)

- Step 5: The “boring” essentials that protect your destination

- Step 6: Automate the journey (systems beat motivation)

- Step 7: Check the dashboard (review, adjust, repeat)

- Common detours (and how to stay on track)

- A quick “financial destination” worksheet

- Conclusion: You don’t need a perfect mapjust a real destination

- Experiences from the road: what “destination thinking” looks like in real life

Most money advice starts with the same question: “What should I invest in?” Stocks? Bonds? ETFs? That one fund

your friend swears is “basically guaranteed”? (Spoiler: if anything is “basically guaranteed,” it’s usually fees.)

But there’s a quieter question that matters moreone that sounds simple until you try to answer it in one sentence:

What are you investing for?

Because investing without a destination is like getting into a rideshare and saying, “Just drive.” You’ll go somewhere.

You just might not like where you end upor the bill.

The “destination” problem: why people get stuck on the “what”

It’s totally normal to focus on the “what.” Specific investments feel concrete. Goals feel… squishier. Goals make you

confront trade-offs. They force you to pick priorities. They require numbers and dates and grown-up words like “timeline.”

Yet the “what” depends on the “why.” A portfolio meant to cover next year’s rent should not be built like a portfolio

meant to fund a retirement that’s decades away. Even the smartest investment can be the wrong choice if it’s matched to

the wrong mission.

Knowing your financial destination does two powerful things:

- It gives your money a job. Every dollar is either feeding today, protecting tomorrow, or building the future.

- It reduces panic. When markets wobble (they will), a clear plan keeps you from treating every headline like a fire drill.

Step 1: Define your destination in plain English

A “destination” isn’t just a number. It’s a picture of what life looks like when money stops being the main character.

Some people want freedom (options). Some want security (stability). Some want generosity (giving). Most want a mix.

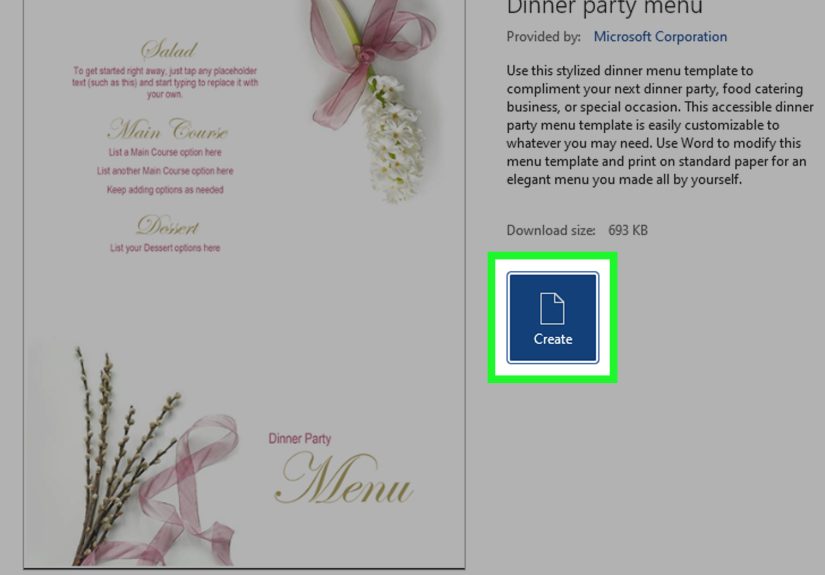

Use the GPS formula: goal, amount, date, priority

If you want goals that actually guide decisions, make them specific enough that your future self can’t wiggle out of them.

Try this simple format:

- Goal: What are you trying to do?

- Amount: Roughly how much will it take?

- Date: When do you need the money?

- Priority: Must-have, should-have, nice-to-have.

Example: three goals, three different “vehicles”

Let’s say you have these goals:

- Emergency buffer (ongoing): protect against surprises.

- House down payment (3–5 years): build a lump sum.

- Retirement (20+ years): grow long-term wealth.

Notice how the timelines change everything. Same person, same paycheck, same brain… different time horizons, different

risk levels, different strategies.

Step 2: Build the launchpad (cash flow + emergency fund)

Before you worry about optimizing investments, make sure your day-to-day finances aren’t sabotaging your plan. If your

monthly cash flow is unpredictable, every goal turns into a “maybe someday.” (Someday is not a date, sadly.)

Create a simple spending plan (no, it doesn’t have to be a spreadsheet masterpiece)

A budget doesn’t have to be restrictive. Think of it as a spending plan: you decide where money goes

before it disappears into the Bermuda Triangle of takeout, subscriptions, and “I deserved it” purchases.

Start with three buckets:

- Basics: housing, food, utilities, transportation, insurance

- Life: fun, hobbies, travel, gifts, the things that make you feel like a human

- Future: emergency savings, debt payoff, investing

The numbers will vary. The point is to make trade-offs intentional instead of accidental.

Emergency fund: the shock absorber for your financial life

An emergency fund is not an investment strategy. It’s a sleep strategy. It keeps a flat tire from

turning into a full-blown financial disaster.

A common target is 3–6 months of essential expenses in a liquid, boring place you can access quickly.

Boring is good here. Boring is the point.

Without this buffer, people often end up using high-interest debt or raiding long-term accounts when life throws a surprise

expense their way. Your destination gets delayed… because the car needed a new transmission.

Step 3: Match investments to the trip (time horizon + risk tolerance)

Once you know when you’ll need money and what it’s for, investment decisions become less mysterious.

Your timeline isn’t just a detailit’s the steering wheel.

Time horizon: when the money needs to show up

Money you need soon generally calls for lower volatility. Money you won’t touch for a long time can usually afford more

ups and downs because it has time to recover from them.

Risk tolerance: what you can handle (and what you’ll actually stick with)

Risk tolerance isn’t just “How brave are you?” It’s also:

- Capacity: could you afford a downturn without derailing your goals?

- Willingness: will you panic-sell if your account drops?

- Needs: do you need growth, stability, or income right now?

The best plan is the one you can follow in real life. If a portfolio is “optimal” on paper but causes you to make emotional

decisions, it’s not optimal. It’s a trap with a fancy font.

Try “goal buckets” to keep your brain from sabotaging you

Many people find it easier to manage money when it’s separated by purpose:

- Short-term bucket: near-term goals and reserves (stable, liquid)

- Mid-term bucket: goals 3–10 years away (balanced approach)

- Long-term bucket: retirement and far-off goals (growth-oriented)

Buckets aren’t magic. They’re psychology. They help you avoid stealing from “Future You” to pay for “Present You.”

(Present You is charming, but not always responsible.)

Step 4: Create the map (asset allocation, diversification, and rebalancing)

Once your destinations and timelines are clear, you can build a portfolio designed to support them. This is where

asset allocation and diversification do their quiet, boring, essential work.

Asset allocation: choosing your mix

Asset allocation is just the split between major asset typescommonly stocks, bonds, and cash-like holdings. The “right”

mix depends on your goals, time horizon, and risk profile. There’s no universal best allocation because people are not

universal.

Diversification: don’t put all your eggs in one chart

Diversification means spreading risk across different investments so one problem doesn’t wreck everything. It’s the

financial version of not balancing your entire dinner plan on a single avocado.

Diversification can happen across:

- Asset classes: stocks, bonds, cash

- Within stocks: different industries, company sizes, domestic/international exposure

- Within bonds: different maturities and issuers

Rebalancing: returning to the plan after markets move

Over time, market performance can shift your portfolio away from your original mix. Rebalancing is the process of bringing

it back in line. Think of it as a routine alignmentless exciting than new tires, but it keeps the ride smoother.

A simple approach many investors use is checking on a set schedule (like once or twice a year) or when allocations drift

beyond a chosen range. The goal isn’t perfection. The goal is consistency.

Step 5: The “boring” essentials that protect your destination

Destinations get wrecked more often by ordinary problems than by dramatic market events. The basicsdebt management,

insurance coverage, and simple safeguardscan be the difference between staying on route and spinning out.

Debt: treat high-interest debt like a financial emergency

If you’re carrying high-interest debt, you’re trying to drive to the beach with the parking brake half on. Paying it down

can be one of the highest-impact moves you make because it frees up cash flow for savings and investing.

Insurance and protection: not fun, very useful

The goal of insurance isn’t to “win.” It’s to prevent one bad event from destroying years of progress. Health coverage,

disability considerations, and basic property coverage are often part of a resilient plan.

Simple paperwork: future-proofing your life

A basic estate plan (like naming beneficiaries and having key documents updated) is less about being fancy and more about

being kind to the people you care about. It’s a destination detail many people delayuntil it becomes urgent.

Step 6: Automate the journey (systems beat motivation)

Motivation is great, but it has the lifespan of a phone battery at 2% in an airport. Systems are what get results.

Consider automating:

- Emergency savings: a recurring transfer on payday

- Goal savings: separate accounts for separate goals

- Investing: consistent contributions, especially for long-term goals

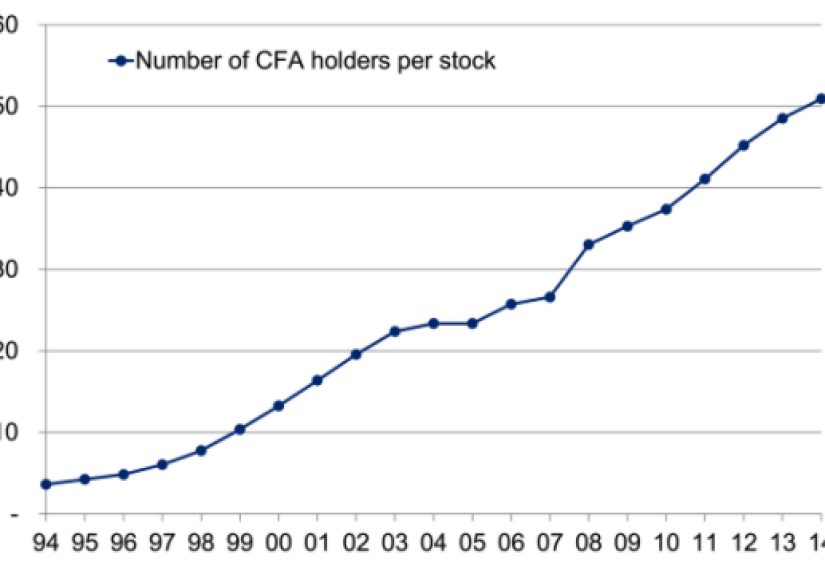

The big win isn’t predicting markets. It’s showing up consistentlyso compounding can do its slow, dramatic thing in the

background while you live your life.

Step 7: Check the dashboard (review, adjust, repeat)

A financial plan isn’t something you create once and frame on the wall like a diploma. It’s a living document that changes

when life changes.

When to review

- Regularly: a quick check-in monthly, a deeper review once or twice a year

- After big events: new job, move, marriage, new child, major expense, windfall, or loss of income

What to look for

- Are your goals still the sameor did “future you” get new priorities?

- Is your emergency fund still appropriate for your life?

- Has your risk level drifted away from what you can realistically tolerate?

- Are you making progress on the goals that matter most?

The point of review isn’t to nitpick. It’s to make sure you’re still headed where you actually want to go.

Common detours (and how to stay on track)

Detour: market drops

Market volatility is normal. If your long-term goals and emergency fund are set up properly, you can avoid turning a

temporary drop into a permanent mistake.

Detour: income changes

If your income rises, consider increasing savings before lifestyle inflation claims it. If income falls, focus on the

essentials: cash flow, emergency reserves, and keeping long-term plans intact where possible.

Detour: windfalls

A bonus, inheritance, or big refund can speed up your journeyif you give it a job. A simple rule: pause before spending,

then allocate intentionally across debt, reserves, goals, and investing.

A quick “financial destination” worksheet

Use this as a starter template. You can refine it laterperfection is not required to make progress.

| Goal | Target Date | Priority | Monthly Contribution | Where It Lives | Next Action |

|---|---|---|---|---|---|

| Emergency Fund | Ongoing | Must-have | Automatic transfer on payday | Liquid savings account | Set transfer + pick a target amount |

| Short/Mid-Term Goal (e.g., down payment) | 3–5 years | Should-have | Scheduled savings | Separate goal account | Define amount + deadline |

| Retirement | 10+ years | Must-have | Consistent investing | Retirement account(s) | Increase contributions when possible |

Conclusion: You don’t need a perfect mapjust a real destination

Knowing where your financial destination is doesn’t mean every detail is figured out. It means you’ve stopped letting

circumstance do the driving.

Start with your “why.” Name your goals. Give them timelines. Build your launchpad with cash flow and an emergency fund.

Match your investments to your horizon and risk reality. Diversify. Rebalance. Automate. Review.

And when the next market headline tries to hijack your mood, you’ll have something better than vibes: a plan.

Experiences from the road: what “destination thinking” looks like in real life

Experience #1: The “I’m doing fine” wake-up call. A lot of people start with the assumption that they’re

okay because bills are paid and the account balance isn’t scary. Then they try to answer one question“What is this money

for?”and realize they’ve been saving and investing on autopilot without direction. Once they write down even two goals

(like “emergency buffer” and “retire with options”), the anxiety often drops. Not because they suddenly have more money,

but because the money finally has a purpose. Direction can feel like a raise.

Experience #2: The two-goal household that stopped arguing. In many families, money conflict isn’t about

mathit’s about mismatched destinations. One person wants security; the other wants freedom; both assume the other is

“bad with money.” A simple goal list can translate values into shared language: “We want stability and we want

experiences.” Once the household decides which goals are must-haves and which are nice-to-haves, decisions get easier.

The budget becomes less of a fight and more of a plan: “Yes to the tripafter we finish the emergency fund milestone.”

Experience #3: The over-optimizer who finally simplified. Some people treat investing like a video game:

endless research, constant tweaks, and a deep belief that the next adjustment will unlock “maximum efficiency.” The plot

twist is that this often increases stress and decreases consistency. When they shift to destination-based thinking, the

focus moves from “best fund” to “best behavior.” A simpler, diversified approach plus regular contributions beats

perfectionism that never actually gets implemented. The relief is realbecause the plan becomes something they can live

with for years, not weeks.

Experience #4: The mid-course correction that saved a goal. Life changesjobs, kids, caregiving, housing,

health. People who review their plan periodically notice problems earlier, when fixes are smaller. They might reduce risk

on a near-term goal, rebuild emergency savings after a big expense, or rebalance after markets move. The key experience is

this: planning doesn’t eliminate surprises; it reduces how expensive surprises become. A small adjustment today can

prevent a painful decision later.

Experience #5: The “destination” that isn’t a number. Some of the best outcomes come when people define

goals as lifestyle outcomes, not just account balances: “I want to be able to leave a bad job,” “I want to help my family

without harming my future,” “I want to sleep at night even when the news is loud.” These destinations still require

numbers eventually, but they start with clarity. And clarity tends to create consistencybecause it’s easier to say no to

impulse spending when you can picture what you’re saying yes to.