Table of Contents >> Show >> Hide

- What “Overvalued” Actually Means (and What It Doesn’t)

- The Usual Clues People Use to Call Something “Pricey”

- Why It Can Feel Like Everything Is Overvalued at the Same Time

- The Bigger Risk: Planning Like the Future Owes You 10% a Year

- So… What Should You Do If You Think Everything Is Overvalued?

- Step 1: Separate “I’m nervous” from “I have a plan”

- Step 2: Diversify like you mean it

- Step 3: Rebalance (aka: stop your winners from hijacking the car)

- Step 4: Consider valuation-aware tweaks (without going full doomsday)

- Step 5: Use dollar-cost averaging if timing stress is taking over

- Step 6: Don’t underestimate behavior risk

- Stress-Test Your Plan Without Becoming a Financial Prepper

- Quick FAQs

- Conclusion: The World Where Prices Are High Is Still Investable

- Experiences: What the “Everything Is Overvalued” Feeling Looks Like in Real Life (and What People Learn)

Picture this: you open your favorite investing app, glance at headlines, and suddenly everything looks like it was priced by someone who just discovered the “round up” button. Stocks are expensive. Homes are expensive. Even “safe” bonds feel like they’re charging a cover fee. And somewhere, a vintage Pokémon card is quietly appreciating faster than your paycheck.

If you’ve ever thought, “What if everything is overvalued?” you’re not aloneand you’re not automatically wrong. But you might be mixing three different ideas: (1) assets are pricey relative to history, (2) future returns may be lower than what you’re used to, and (3) the next crash is scheduled for Tuesday at 2:00 p.m. (Spoiler: markets do not RSVP.)

This article untangles what “overvalued” really means, why it can feel like everything is expensive at once, and how to make smart money moves without turning your portfolio into an emotional support animal.

What “Overvalued” Actually Means (and What It Doesn’t)

Value is math… plus mood lighting

At a basic level, an asset’s value is tied to the cash it can generate in the futureprofits, rent, interest, or some other stream of benefitsadjusted for risk. The tricky part is that “adjusted for risk” is where humans get creative. When investors feel optimistic, they accept lower compensation for risk. Prices rise. When investors feel nervous, they demand a bigger cushion. Prices fall.

So “overvalued” usually means one of these:

- Prices are high relative to fundamentals (earnings, cash flow, rents, etc.).

- Prices are high relative to history (compared with past valuation ranges).

- Prices are high relative to alternatives (stocks vs. bonds, owning vs. renting, etc.).

Overvalued is not a countdown timer

Here’s the part that hurts: an asset can be “overvalued” for a long time. Valuation is better at hinting what long-term returns might look like than predicting what happens next week. Markets can stay expensive while earnings rise, investors stay enthusiastic, and the economy refuses to cooperate with your doom-scrolling schedule.

Think of valuation like a weather forecast for the next season, not a lightning detector. It can tell you to pack a jacket. It cannot tell you the exact moment a raindrop hits your forehead.

The Usual Clues People Use to Call Something “Pricey”

Stocks: P/E, CAPE, and the “Wait… how much?” effect

The most common stock valuation metric is the price-to-earnings (P/E) ratio: how much investors pay for a dollar of earnings. A higher P/E can mean investors expect faster growth, think the business is safer, or are simply feeling extra generous.

Then there’s the CAPE ratio (also called Shiller P/E), which smooths earnings over a longer period to reduce the impact of short-term booms and busts. It’s often used as a “big picture” gauge for broad markets. When people say “stocks are overvalued,” they’re frequently pointing at measures like CAPE or unusually high P/E levels.

One more concept worth knowing: earnings yield (roughly the inverse of P/E). It’s a simple way to compare stocks with bonds: “How much earnings do I get for the price I pay?” This isn’t perfectearnings aren’t couponsbut it helps explain why stocks can look expensive or attractive depending on interest rates.

Bonds: overvalued often means “low yield” (and high sensitivity)

With bonds, “overvalued” often shows up as low yields. When investors bid bond prices up, yields go down. That can be uncomfortable if you rely on bond income.

Also, bonds carry interest-rate risk: when rates rise, bond prices tend to fall. A key concept here is duration, which measures how sensitive a bond (or bond fund) may be to changes in interest rates. Longer-duration bonds typically swing more when rates move. If you’ve ever watched a bond fund wobble and thought, “I did not sign up for this kind of drama,” duration is probably the reason.

Housing: expensive can mean “unaffordable,” not just “up”

Real estate “overvaluation” debates usually revolve around affordability and comparisons to fundamentals like incomes and rents. Home prices can rise for years, but if incomes don’t keep upor if mortgage rates jumpmonthly payments can become the real villain.

Housing is also local. One city can be frothy while another is merely spicy. Broad indicators like home price indices help track trends, but whether a specific neighborhood is “overvalued” depends on supply, demand, job growth, zoning, and what buyers can actually pay without eating ramen forever.

Alternatives: the “story premium”

Crypto, collectibles, private deals, and “rare assets” can surge when narratives are strong. Sometimes the story turns out to be real innovation. Sometimes it turns out to be a group project where nobody read the instructions.

These assets can be the most “overvalued-feeling” because their fundamentals are harder to pin down. When valuation anchors are fuzzy, price swings can become… expressive.

Why It Can Feel Like Everything Is Overvalued at the Same Time

1) Discount rates changed (translation: interest rates matter)

When interest rates and required returns are low, the present value of future cash flows rises. That can push up prices across stocks, real estate, and even private assets. When the discount rate shifts, it’s like changing the zoom level on the entire financial universe.

2) Investors collectively decided risk felt… less risky

Sometimes markets reprice because investors are willing to take on more risk. That can compress risk premiums across asset classes. The result: valuations rise broadly, correlations creep up, and your diversified portfolio starts moving like a group chat that can’t stop agreeing.

3) “There is no alternative” becomes a lifestyle brand

When cash yields feel unexciting and bonds don’t offer much real return, investors often look to stocks and real assets. That demand can keep valuations elevated. Even if stocks look expensive, they can still look less expensive than the alternatives.

4) Concentration makes the market look pricier than it is

Broad indexes can become top-heavy, with a small number of large companies driving a big share of returns. If those leaders trade at higher multiples, the whole market’s valuation can look stretchedeven if many smaller or less popular areas are more reasonably priced.

5) The “wealth effect” and feedback loops

Rising asset prices can boost confidence and spending. That can support corporate earnings and keep the cycle goinguntil something interrupts it. Policymakers and financial stability watchers pay attention here because elevated valuation pressure can increase the risk of sharp price drops if sentiment flips.

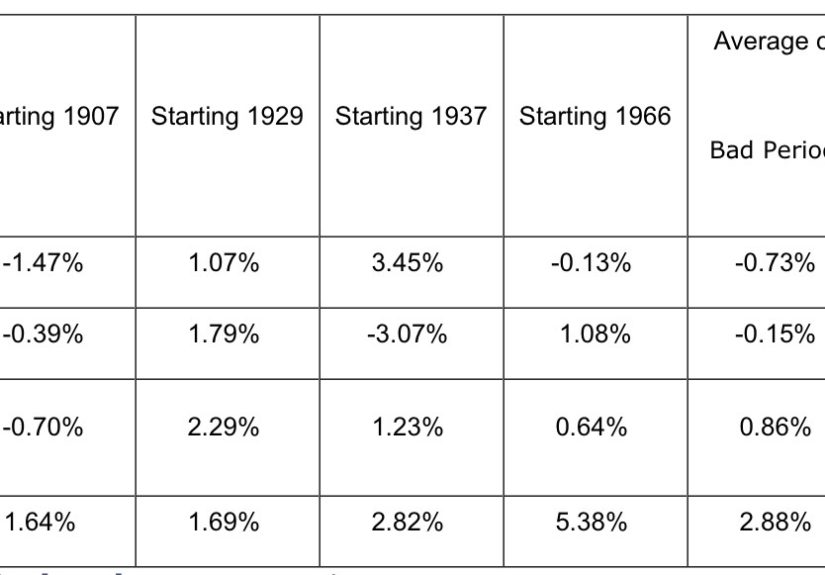

The Bigger Risk: Planning Like the Future Owes You 10% a Year

The most practical reason to care about overvaluation isn’t to predict the next correction. It’s to set expectations. High starting valuations have often been associated with lower long-term returns, even if short-term outcomes are unpredictable.

That matters because many financial plans quietly assume returns that were more common in friendlier valuation environments. If future returns are lower, you may need one (or more) of these:

- Higher savings rates

- More time

- Less spending

- A portfolio that matches your real risk tolerance (not your “I’m brave on the internet” risk tolerance)

This isn’t meant to be depressing. It’s meant to be empowering. Your plan should work even if markets are expensivenot only if they’re in a bargain bin.

So… What Should You Do If You Think Everything Is Overvalued?

Step 1: Separate “I’m nervous” from “I have a plan”

Start with your time horizon and cash needs. If you’ll need money soon (tuition, a down payment, emergency fund), that money shouldn’t be depending on the stock market’s mood swings. Boring cash reserves are not a failure. They’re shock absorbers.

Step 2: Diversify like you mean it

Diversification doesn’t prevent losses, but it can reduce the chance that one bad break wrecks everything. Spread risk across asset classes, regions, and styles. In an “everything is pricey” world, diversification is less about chasing the hottest thing and more about not betting your future on a single storyline.

Step 3: Rebalance (aka: stop your winners from hijacking the car)

When one part of your portfolio grows faster than others, your risk level quietly changes. Rebalancing means bringing your allocation back toward your targetsoften by trimming what grew and adding to what lagged.

It’s not flashy. It doesn’t make for thrilling social media content. But it’s one of the few disciplined ways investors can “sell high and buy low” without trying to predict the future every Tuesday.

Step 4: Consider valuation-aware tweaks (without going full doomsday)

If valuations feel stretched, you don’t have to choose between “all in” and “sell everything.” There’s a middle ground:

- Raise your quality bar: emphasize strong balance sheets, durable cash flows, and reasonable pricing.

- Broaden exposure: consider areas that aren’t the center of the hype cycle.

- Manage interest-rate risk: if bonds worry you, understand duration and align it with your time horizon.

- Build a cash buffer: not as a market-timing weapon, but as a life-stability tool.

The goal isn’t to “outsmart” markets. The goal is to avoid being forced into bad decisions when volatility shows up uninvited.

Step 5: Use dollar-cost averaging if timing stress is taking over

One reason “everything is overvalued” feels paralyzing is that it turns every purchase into a high-stakes moment. Dollar-cost averaging (investing set amounts at regular intervals) can reduce the emotional pressure to pick the perfect day. It doesn’t guarantee better returns, but it can help you stay consistentand consistency matters a lot more than most people want to admit.

Step 6: Don’t underestimate behavior risk

Overvaluation fear can push people into two expensive mistakes:

- Selling everything and waiting for “the dip,” which might not arrive on your schedule.

- Chasing safety in things that only look safe (or are illiquid), then panicking when the fine print shows up.

Missing a handful of strong recovery days can hurt long-term results. The problem isn’t that caution is bad. The problem is that panic is usually badly timed.

Stress-Test Your Plan Without Becoming a Financial Prepper

If you’re worried about lofty valuations, run a reality check:

- Can you handle a 30%–50% stock drawdown without selling at the bottom?

- What if bond prices drop because rates rise again?

- What if housing cools and it takes longer to sell?

- What if returns are just “okay” for a decade instead of spectacular?

Stress testing isn’t about predicting. It’s about preparing. If your plan collapses under a pretty normal market storm, it’s better to learn that nowwhen you can adjust calmlyrather than mid-storm while yelling at your screen like it personally betrayed you.

Quick FAQs

Is “everything overvalued” the same as “a crash is coming”?

No. High valuations can increase vulnerability to declines, but timing is uncertain. Markets can stay expensive longer than pessimists can stay patient.

Should I go to cash if I think valuations are extreme?

Going to cash is a major timing decision. A more practical approach is aligning risk with your time horizon, rebalancing, and keeping adequate reserves for near-term needs.

What’s a reasonable expectation if valuations are high?

Often, it’s wise to assume more muted long-term returns and build your plan around what you can control: saving, fees, taxes, diversification, and discipline.

How do I invest if I’m scared of buying the top?

Consistency helps. Dollar-cost averaging, broad diversification, and a long time horizon can reduce the pressure to “get the entry perfect.”

Can overvalued assets still be worth owning?

Yesespecially if the alternative is not investing at all. The key is sizing your risk appropriately and avoiding leverage that forces you to sell at the worst time.

Conclusion: The World Where Prices Are High Is Still Investable

If everything feels overvalued, you don’t need a crystal ballyou need a process. Valuations can inform expectations, but they’re not an alarm clock for the next downturn. The better response is to build a portfolio that can survive disappointment: diversify, rebalance, understand your risks, and keep investing in a way you can actually stick with.

Because the ultimate goal isn’t to be the person who perfectly predicted the peak. The goal is to be the person who didn’t sabotage their future while trying.

Experiences: What the “Everything Is Overvalued” Feeling Looks Like in Real Life (and What People Learn)

When people say, “Everything is overvalued,” they’re rarely talking about a spreadsheet alone. They’re talking about a life momentthe uneasy gap between prices and what feels normal. Here are a few common experiences investors and homebuyers describe, and the lessons they tend to carry forward.

1) The new investor who keeps waiting for “a better entry”

A lot of people start investing after watching markets rise and hearing success stories that sound suspiciously like fairy tales with brokerage accounts. Then they look at valuations and freeze. They don’t want to be “the person who bought the top,” so they wait. Weeks turn into months. The market dips a littlethen rallies. They wait again. Eventually they realize the hidden cost of waiting isn’t just missed returns; it’s the slow erosion of confidence. The lesson they often land on is simple: make investing smaller and more routine. Instead of trying to time a perfect lump sum purchase, they set up automatic contributions. They still care about valuations, but they stop treating every buy as a referendum on their intelligence.

2) The homebuyer who learns that “overvalued” can be personal

Home prices can be objectively high and still be the right move for someone’s life. Many buyers describe running rent-vs-buy math, looking at mortgage rates, and feeling like the numbers are daring them to blink first. Some decide to rent longer and invest the difference, valuing flexibility. Others buy anyway because stability, schools, commute, or family needs matter more than perfect timing. The experience teaches an important point: housing is both an asset and a lifestyle choice. If you buy a home thinking it’s a guaranteed winning trade, high valuations can be terrifying. If you buy a home you can afford and plan to keep, price swings become less like a cliff and more like background noise.

3) The long-term investor who discovers their “risk tolerance” was theoretical

When markets feel expensive, people say they’re ready for a correctionuntil the correction arrives and their portfolio drops hard. That’s when “I’m fine with volatility” collides with a very real stomach sensation that can only be described as “financial gravity.” The investors who come out stronger usually don’t become fearless; they become better designed. They adjust their mix of stocks and bonds, build a cash buffer, and create rules for rebalancing so decisions aren’t made in the heat of the moment. They also stop measuring success by whether they avoided every drop and start measuring success by whether they stayed on track.

4) The person who hoards cashand then realizes inflation is also a price

Another common story: someone sells or stops investing because valuations feel stretched, then sits in cash “until things make sense again.” At first, the calm feels great. But after a while, they notice two things: inflation quietly reduces purchasing power, and it’s surprisingly hard to pick the moment to get back in. Cash is usefulessential, evenfor emergencies and near-term goals. But as a long-term plan, it can become its own kind of risk. The lesson here is balance: use cash intentionally (emergency fund, upcoming expenses, sleep-at-night money), and invest the rest according to a plan you can live with.

In the end, the “everything is overvalued” experience often becomes a turning point. People stop looking for the perfect prediction and start building a portfolio that doesn’t require perfection. That’s not just smarter. It’s kinderto your future self and to your blood pressure.