Table of Contents >> Show >> Hide

- Does Car Insurance Cover the Car or the Driver?

- Who Is Usually Insured to Drive Your Car?

- Common Real-World Scenarios

- Who Is Usually Not Insured to Drive Your Car?

- What If You Are Driving Someone Else’s Car?

- How to Make Sure the Right People Are Insured to Drive Your Car

- Quick FAQ: Is That Driver Covered?

- Real Experiences and Lessons Learned About Who’s Insured to Drive Your Car

- The Bottom Line

You hand your keys to a friend and say, “Just be careful with her, okay?” Five minutes later, the only thing

you’re thinking about is not the car, but a much scarier question: “Is this even covered by my insurance?”

The good news is that in the United States, car insurance usually follows the car, not the driver. In many

situations, your policy will help cover another person who drives your vehicle with your permission. But there are

important exceptions, fine print, and a few landmines that can turn a casual favor into an expensive headache.

In this guide, we’ll break down in plain English who is typically insured to drive your car, when your coverage

might not apply, and what you can do right now to make sure the right people are covered before anyone touches

your keys again.

Does Car Insurance Cover the Car or the Driver?

Most U.S. auto policies are built around the idea that liability coverage follows the vehicle. That means:

- Your car is insured when you drive it.

- Your car is often insured when someone else drives it, if they’re allowed to and meet your insurer’s rules.

- In many cases, your policy is the primary coverage if your car is involved in a crash, even if someone

else was behind the wheel.

Many insurers describe this as “permissive use” coverage: you give a licensed driver permission to use your

car, and your policy typically extends to them for that one-time or occasional use, subject to all the usual

terms and exclusions.

However, some types of policies (like strict named driver policies) only cover specifically listed drivers,

and some states allow or even regulate “named driver” limitations. If your policy is one of these, then “car

insurance follows the car” is not always true.

Who Is Usually Insured to Drive Your Car?

1. You, the Named Insured

You’re the star of the show. The named insured is the person (or people) whose name is on the policy.

You’re automatically covered when you drive the cars listed on that policy, up to the limits and coverages

you purchased (liability, collision, comprehensive, etc.).

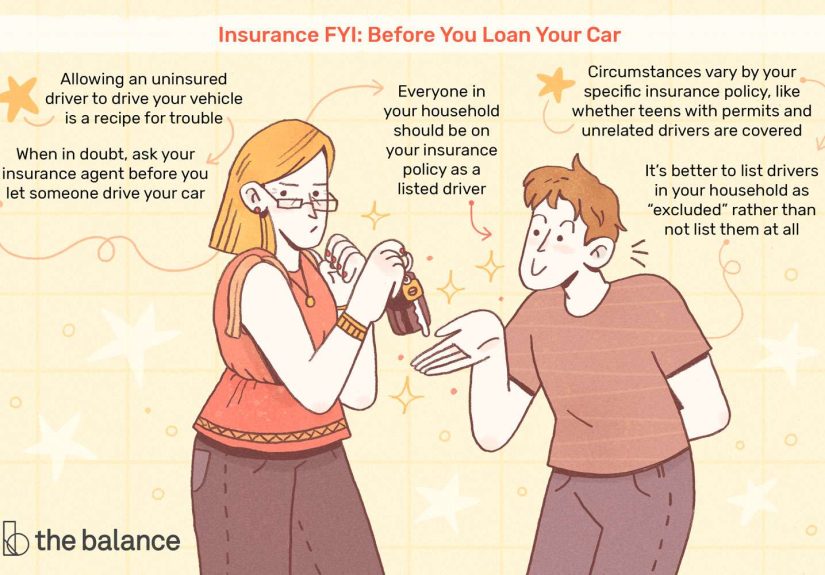

2. Your Spouse and Household Family Members

Most standard policies automatically cover your spouse and resident relatives in your household,

especially if they’re listed on the policy as drivers. In fact, insurers usually require you to disclose all

licensed household members because they assume those people have regular access to your cars.

If you have a teen driver at home, or an adult child who still uses your car, they’re typically expected to be

added as a rated driver or listed driver on your policy. Failing to list a regular driver can cause

trouble if there’s a claim.

3. Listed or Rated Drivers

Insurance companies like clarity. Anyone who regularly drives your car (roommate, partner, long-term

houseguest) should usually be listed as a driver on your policy. When they are:

- They’re clearly covered when driving your vehicle.

- Their driving record is used to help calculate the premium.

- There’s less risk of coverage disputes after an accident.

If someone is driving your car every day to work, they’re not an occasional “borrower” anymore in your insurer’s

eyes. That’s a listed-driver situation.

4. Permissive Users (Occasional Borrowers)

This is the category most people worry about: friends, coworkers, or visiting relatives who borrow your car

once in a while. Under many U.S. policies, if your insurer allows permissive use:

- A licensed driver you give permission to is covered under your liability policy when driving your car.

- Your coverage may be the primary coverage for a crash involving your car.

- The borrower’s insurance (if they have a policy) might act as secondary backup in some situations.

Some insurers reduce coverage limits for permissive users, or exclude certain types of permissive use

(like business deliveries), so it’s wise to read the section of your policy that talks about “permissive use”

or “other drivers.”

Common Real-World Scenarios

Scenario 1: Your Friend Runs to the Store

You let your friend drive your car to pick up pizza. They rear-end another car at a stoplight. In many states and

under many standard policies:

- Your liability coverage is primary and helps pay for damage and injuries to others.

- Your collision coverage (if you purchased it) may help fix your car, minus your deductible.

- Your friend’s own insurance could act as secondary coverage if your limits are exhausted.

If your policy includes permissive use and your friend is properly licensed, this type of situation is usually

exactly what it’s designed for.

Scenario 2: Roommate Uses Your Car Every Day

Your roommate doesn’t own a car but drives yours to work daily. You never added them to the policy because it

seemed like a hassle. If they’re in a serious accident, your insurer might argue:

- This is regular use, not occasional borrowing.

- You should have listed them as a driver and paid a premium that reflects their risk.

- They were a material risk the insurer wasn’t told about, which can complicate or even jeopardize coverage.

That’s why insurers and consumer advocates continually stress: if someone drives your car frequently, get

them on the policy.

Scenario 3: Your Teen’s Friend Drives

Your teenager lets a friend drive your car without asking you. There’s an accident. Is it covered?

It depends on policy language, but many insurers treat “second-hand” permission (your driver giving

permission to someone else) differently than your direct permission. Sometimes coverage applies, sometimes it’s

limited, and sometimes it could be denied. In this gray area, your policy wording and state law matter a lot.

Who Is Usually Not Insured to Drive Your Car?

1. Excluded Drivers

A named excluded driver (or just “excluded driver”) is someone listed on your policy as not covered to

drive any car on that policy. They’re often excluded because:

- They have a poor driving record.

- They’ve had serious violations or multiple claims.

- Excluding them keeps premiums more affordable for the rest of the household.

If an excluded driver takes the wheel and crashes your car, the insurance company can legally refuse coverage

under that policy in many states. That can leave you personally responsible for injuries, damages, and potentially

legal judgments. If there’s one rule to tattoo on your steering wheel, it’s this:

Do not let an excluded driver use your car.

2. Unlicensed or Suspended Drivers

Insurance assumes legal, licensed drivers. If you knowingly allow someone with no license, a suspended license,

or a revoked license to drive your car, your insurer might:

- Deny coverage for the claim.

- Cancel or non-renew your policy.

- Argue you were negligent in entrusting the vehicle.

Bottom line: if they can’t legally drive, they shouldn’t be anywhere near your driver’s seat.

3. Regular Drivers You “Forgot” to List

If your policy requires you to list all household drivers (and most do) and you intentionally leave someone off

to keep your rate low, you’re playing “hide and seek” with your insurer. If that unlisted regular driver causes

an accident, the insurer might:

- Still cover the claim but adjust or surcharge your policy heavily later.

- Limit or deny coverage based on misrepresentation or non-disclosure (depending on state law).

Forgetfulness happens, but intentional non-disclosure can be a serious issue.

4. Commercial or Rideshare Use Without Proper Endorsements

Many standard personal auto policies exclude or limit coverage if your car is being used for:

- Rideshare (Uber, Lyft) without a rideshare endorsement.

- Delivery of goods (takeout, packages, etc.).

- Certain business uses beyond simple commuting.

If you let someone use your car to do DoorDash runs or ride-hailing and your policy excludes this, coverage may

not apply the way you expect. Always check that your policy allows the type of use before saying “Sure, take my car.”

What If You Are Driving Someone Else’s Car?

Flip the script. You’re borrowing a friend’s car instead. In many cases:

- The car owner’s policy is the primary coverage if you have permission to drive.

- Your own auto policy (if you have one) may act as secondary coverage if the damages exceed their limits.

There’s another product that’s useful here: non-owner car insurance. This is liability coverage for people

who don’t own a car but still drive occasionallyrental cars, car-sharing, or borrowing friends’ vehicles.

Non-owner policies:

- Typically provide liability coverage only (injury and property damage to others).

- Usually do not cover damage to the car you’re driving.

- Can help maintain continuous insurance history, which carriers like.

How to Make Sure the Right People Are Insured to Drive Your Car

-

List all household drivers.

If someone of driving age lives with you and might use the car, tell your insurer. Yes, even your 20-year-old

who “barely drives.” -

Clarify permissive use rules.

Ask your agent:- Does your policy allow permissive users?

- Are coverage limits reduced for them?

- Are there exclusions (business use, teen drivers, etc.)?

-

Know your exclusions.

Look carefully for “named excluded drivers” or “named driver” language. If someone is excluded, never hand

them the keys. -

Update your policy when life changes.

New roommate? New partner moved in? Teen just got a license? Time to call your agent and adjust drivers. -

Set ground rules for your car.

Tell your kids, spouse, and roommates:

“No one else gets to drive this car unless I say so.” This reduces surprise “second-hand permission” situations. -

Consider non-owner coverage if you don’t own a car.

If you’re always borrowing cars, non-owner insurance can add a layer of protection tied to you.

Quick FAQ: Is That Driver Covered?

Can my visiting relative drive my car while they’re in town?

Often yes, if:

- They’re properly licensed.

- Your policy allows permissive use.

- They’re only driving occasionally during the visit.

If they’ll be staying for months and using your car regularly, talk to your insurer about adding them as a driver.

Is the valet or mechanic covered?

Typically, the valet company or repair shop has its own business insurance that covers employees when

moving your car. Your policy may still be involved in certain scenarios, but you’re not usually expected to add

these drivers individually.

What if my friend doesn’t have insurance of their own?

If your policy allows permissive use, your coverage may still apply as primary coverage when they drive your car.

But if they’re a high-risk or unlicensed driver, that’s a huge red flag. You’re essentially “lending” them your

insurance record along with your keys.

What if I let someone drive who’s been drinking?

Beyond being dangerous and illegal, this can lead to serious coverage complications, potential policy

cancellation, and major legal liability. Never, ever hand your keys to someone who’s impaired.

Real Experiences and Lessons Learned About Who’s Insured to Drive Your Car

It’s one thing to read the definitions in an insurance booklet; it’s another to live through a claim. Here are

some common “I learned the hard way” situations people run into and what you can learn from them.

Experience 1: The “It’s Just Around the Corner” Accident

A common story goes like this: someone lends a car for a “two-minute” drive to the convenience store. The borrower

is licensed, careful, and completely sober. But on the way back, another driver runs a stop sign and there’s a

collision. Now the car owner is suddenly an expert in fault, medical bills, and the meaning of “primary coverage.”

The lesson? Even the safest drivers can’t control everything on the road. If you’re going to lend your car, treat

it like you’re driving: would you be comfortable taking responsibility for whatever happens? Because under most

policies, you are.

Experience 2: The Hidden Regular Driver

Another frequent scenario: someone starts dating, and their partner essentially becomes the unofficial co-owner

of the car. They swap drivers on road trips, share commuting, and use the car interchangeably. But only one name

is on the policy. When the partner rear-ends someone in bad weather, the insurer notices they’ve been driving a

lot and asks, “How long has this been going on?”

In some cases, the claim gets paid but future premiums spike. In more extreme cases, depending on state law and

how the insurer views the non-disclosure, coverage can be limited or contested. The emotional stress of dealing

with a claim is bad enough; adding uncertainty about coverage makes it much worse.

The takeaway: as soon as someone becomes a “regular driver,” update your policy. It’s usually cheaper

and less stressful than trying to untangle things later.

Experience 3: The Excluded Driver Mistake

Stories involving excluded drivers are often the most painful. Imagine excluding a high-risk driver in your

household to keep your premiums affordable. You’ve signed paperwork confirming they will not drive the car.

Months later, they grab the keys “just this once,” perhaps without your knowledge, and get into a major crash.

In many states and policies, the insurer can legitimately deny coverage because the excluded driver was behind

the wheel. Now you’re facing not only repairs but potentially medical claims, lawsuits, and wage garnishment

all because the excluded driver took a risk with your car.

The lesson here is simple but strict: if someone is excluded on your policy, treat your keys like a locked

safe. This is not a gray area.

Experience 4: Borrowing Cars Without Owning One

Many city dwellers don’t own cars but still drive borrowed or rented vehicles. One day, someone with no car and

no policy borrows a friend’s vehicle for a weekend trip. The friend’s policy includes permissive use, so there’s

some coverage. But the borrower causes a multi-car accident. The damages exceed the friend’s liability limits, and

the injured parties go after the borrower personally.

A non-owner policy could have acted as an extra layer of liability protection in this kind of scenario.

It isn’t a magic shield, but it can help step in when the car owner’s coverage runs out, depending on how

the policies coordinate.

The practical takeaway: if you’re the “I don’t own a car, I just borrow everyone else’s” person in your friend

group, it may be worth talking to an agent about non-owner insurance. You may be carrying more personal risk than

you realize.

Experience 5: The Family Road Trip With Multiple Drivers

On a long road trip, drivers take turns to avoid fatigue. A cousin who’s visiting from another state hops in

to “help with the last stretch.” They’re licensed, experienced, and insured in their home state. In many standard

policies, your coverage extends to them as a permissive user, and their own policy could be secondary if needed.

Still, this is a great example of when it pays to know your policy ahead of time. Some people call their insurer

before a long trip and ask, “If I let my cousin/aunt/friend help with driving, are they covered the same way I am?”

That five-minute call can save a lot of anxiety if something goes wrong.

Across all of these experiences, one pattern stands out: the best time to learn who’s insured to drive your car

is before anyone borrows it, not after a claim is filed. A quick conversation with your agent and a habit of

only lending your car to responsible, licensed drivers can make a huge difference if life throws a curveball.

The Bottom Line

In many U.S. auto insurance policies, your coverage does extend to more than just you:

household members, listed drivers, and often occasional borrowers with your permission. But excluded drivers,

unlicensed drivers, and undisclosed regular users can create serious coverage problems.

The safest move? Read your policy’s “who is an insured” and “other drivers” sections, ask your agent to explain

anything that sounds fuzzy, and make sure anyone who regularly drives your vehicle is properly listed. You don’t

have to become an insurance lawyer you just have to know enough not to lend your car (and your financial

future) to the wrong person.

And the next time someone casually says, “Hey, can I just take your car real quick?” you’ll know exactly what

you’re really being asked.